A DSCR of 1.25 means a borrower has $1.25 in income for every $1 of debt payments. This ratio is crucial for lenders assessing loan risk. A 1.25 DSCR indicates good financial health, often leading to better loan terms. Businesses can improve DSCR by increasing income, reducing expenses, or managing debt effectively.

What Does a DSCR of 1.25 Mean?

Have you ever wondered what those mysterious financial acronyms really mean? Today, we’re diving deep into one such term that’s crucial in the world of finance and real estate: DSCR. More specifically, we’ll unravel the mystery behind a DSCR of 1.25. Buckle up, because we’re about to embark on a journey through the fascinating realm of debt service coverage ratios!

Understanding DSCR: The Basics

What is DSCR?

DSCR stands for Debt Service Coverage Ratio. It’s a financial metric used by lenders to assess a borrower’s ability to repay a loan. But what does that really mean for you and me?

Imagine you’re trying to convince your friend to lend you money. They’d probably want to know if you can pay them back, right? That’s essentially what DSCR does for banks and other lenders. It gives them a snapshot of how well a business or individual can cover their debt payments.

The DSCR Formula

Let’s break it down into simple terms. The DSCR formula looks like this:

DSCR = Net Operating Income / Total Debt Service

Don’t worry if that sounds like financial gibberish – we’ll explain each part:

- Net Operating Income (NOI): This is the money left over after you’ve paid all your operating expenses, but before you pay your debts.

- Total Debt Service: This is the total amount you need to pay towards your debts, including principal and interest.

Decoding a DSCR of 1.25

What Does 1.25 Actually Mean?

Now that we understand the basics, let’s focus on our magic number: 1.25. When a lender says they require a DSCR of 1.25, what are they really asking for?

In simple terms, a DSCR of 1.25 means that for every dollar of debt you need to pay, you should have $1.25 in income available to cover it. It’s like having a 25% buffer on top of what you owe.

The Importance of the 1.25 Threshold

Why is 1.25 such a popular number in the world of DSCR? Well, it’s all about balance. Lenders want to see that you have enough income to comfortably cover your debt payments, with a little extra left over for unexpected expenses or fluctuations in income.

A DSCR of 1.0 would mean you’re just scraping by, with exactly enough income to cover your debt. That’s cutting it too close for comfort in most lenders’ eyes. The extra 0.25 provides a safety net that makes lenders feel more secure about your ability to repay the loan.

DSCR in Action: Real-World Examples

Example 1: The Thriving Business

Let’s say you own a small bakery. Your annual net operating income is $100,000, and your total annual debt payments (for your business loan and equipment leases) amount to $80,000.

DSCR = $100,000 / $80,000 = 1.25

Congratulations! Your bakery has exactly hit the 1.25 DSCR threshold. This means you’re generating enough income to cover your debt payments with a 25% cushion.

Example 2: The Struggling Restaurant

Now, imagine you’re running a restaurant that’s having a tough year. Your annual net operating income is $90,000, but your debt payments total $100,000.

DSCR = $90,000 / $100,000 = 0.9

Uh-oh. A DSCR below 1.0 means you’re not generating enough income to cover your debt payments. This could be a red flag for lenders and might indicate that your business needs to make some changes to improve its financial health.

Why DSCR Matters: Implications for Borrowers and Lenders

For Borrowers: Your Financial Report Card

If you’re seeking a loan, your DSCR is like a financial report card. A DSCR of 1.25 or higher tells lenders that you’re a responsible borrower who can comfortably manage your debt. This can lead to:

- Better loan terms

- Lower interest rates

- Higher loan amounts

- Increased likelihood of loan approval

On the flip side, a lower DSCR might make lenders nervous. They might offer less favorable terms or even decline your loan application altogether.

For Lenders: A Risk Assessment Tool

From a lender’s perspective, DSCR is a crucial tool for assessing risk. A DSCR of 1.25 provides a comfort zone:

- It indicates the borrower has a buffer against financial setbacks

- It suggests the loan is less likely to default

- It helps lenders maintain a healthy loan portfolio

Lenders use DSCR alongside other metrics to make informed decisions about who to lend to and on what terms.

The Impact of DSCR on Lending Decisions

How Lenders Use DSCR

| DSCR Range | Lender’s Perspective | Likely Outcome for Borrower |

|---|---|---|

| < 1.0 | High Risk | Loan denial or very unfavorable terms |

| 1.0 -1.24 | Moderate Risk | Possible approval with stringent terms |

| 1.25 – 1.5 | Acceptable Risk | Loan approval with standard terms |

| 1.5 – 2.0 | Low Risk | Favorable loan terms, higher loan amounts |

| > 2.0 | Very Low Risk | Best available terms, preferred borrower status |

Lenders rely heavily on DSCR when making financing decisions. Here’s how they typically use this crucial metric:

- Risk Assessment: A DSCR of 1.25 or higher indicates lower risk to lenders.

- Loan Terms: Higher DSCRs often lead to more favorable interest rates and loan terms.

- Loan Amounts: The DSCR helps determine the maximum loan amount a borrower can qualify for.

- Ongoing Monitoring: Lenders may require borrowers to maintain a minimum DSCR throughout the loan term.

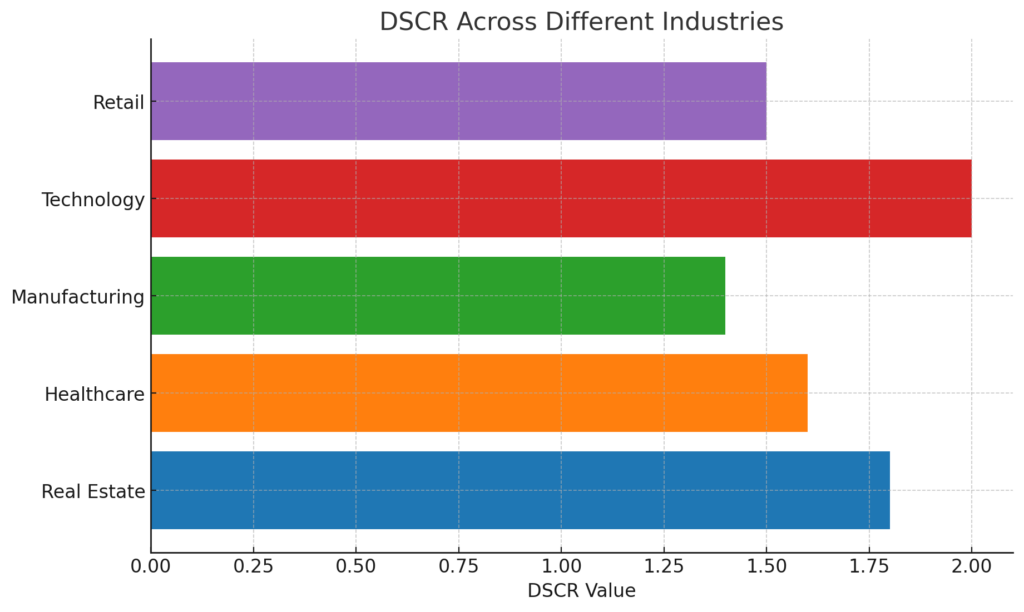

DSCR Thresholds in Different Industries

| Industry | Typical Minimum DSCR Requirement |

|---|---|

| Multifamily Real Estate | 1.20–1.25 |

| Commercial Real Estate | 1.25–1.35 |

| Hotels | 1.40+ |

| Service Industries | 1.15+ |

| Manufacturing | 1.25+ |

| Investment-Grade Companies | 1.5+ |

| Non-investment-grade companies | 2.0+ |

Different sectors have varying DSCR expectations:

Real Estate

- Multifamily properties: Typically require a DSCR of 1.20 to 1.25

- Commercial properties: Often demand a higher DSCR, around 1.25 to 1.35

- Hotels: Due to their volatility, may require DSCRs of 1.40 or higher

Small Businesses

- Service industries: May accept DSCRs as low as 1.15

- Manufacturing: Often requires DSCRs of 1.25 or higher due to capital-intensive nature

Large Corporations

- Investment-grade companies: May be acceptable with DSCRs around 1.5

- Non-investment grade: Might need DSCRs of 2.0 or higher to attract investors

Calculating DSCR: A Closer Look

Components of the DSCR Formula

Let’s break down the DSCR formula further:

DSCR = Net Operating Income (NOI) / Total Debt Service

Net Operating Income (NOI)

NOI includes:

- Gross income

- Minus operating expenses

- Excluding debt payments, income taxes, capital expenditures, and depreciation

Total Debt Service

This encompasses:

- Principal payments

- Interest payments

- Lease payments

- Any other debt obligations

Step-by-Step DSCR Calculation

- Calculate your Net Operating Income

- Sum up all your debt payments for the period

- Divide NOI by the total Service

- The result is your DSCR

Common DSCR Calculation Mistakes

Avoid these pitfalls when calculating your DSCR:

- Inconsistent Time Periods: Ensure your NOI and debt service cover the same timeframe.

- Overlooking Expenses: Include all relevant operating expenses in your NOI calculation.

- Ignoring Seasonality: For businesses with seasonal fluctuations, consider calculating DSCR on an annual basis.

- Forgetting About Taxes: While income taxes aren’t included in NOI, property taxes often are for real estate calculations.

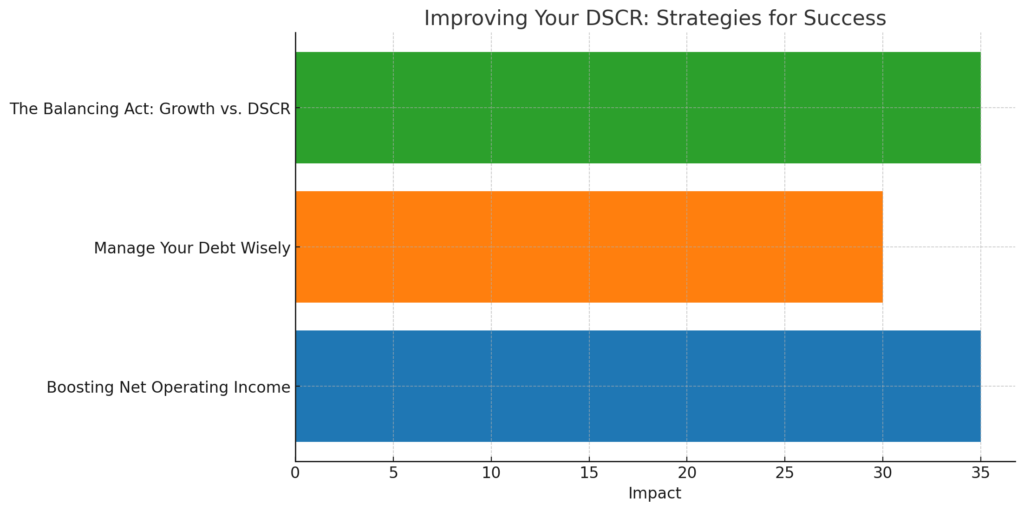

Improving Your DSCR: Strategies for Success

Boosting Net Operating Income

- Increase Revenue:

- Implement strategic price increases

- Expand your customer base

- Introduce new products or services

- Reduce Operating Expenses:

- Negotiate better rates with suppliers

- Improve energy efficiency

- Streamline operations to cut labor costs

Manage Your Debt Wisely

- Refinance of Existing Debt:

- Take advantage of lower interest rates

- Extend loan terms to reduce monthly payments

- Consolidate Debt:

- Combine multiple loans into one with better terms

- Pay Down High-Interest Debt:

- Prioritize paying off debts with the highest interest rates

The Balancing Act: Growth vs. DSCR

While maintaining a strong DSCR is important, it shouldn’t come at the expense of growth opportunities. Consider these strategies:

- Phased Expansion: Gradually increase debt to fund growth, allowing NOI to catch up

- Alternative Financing: Explore options like equity financing that don’t impact DSCR

- Cash Flow Projections: Use detailed projections to demonstrate future DSCR improvements to lenders

By implementing these strategies, businesses and investors can work towards achieving and maintaining a healthy DSCR of 1.25 or higher, improving their financial stability and access to favorable financing options.

DSCR Across Different Industries

Real Estate: The DSCR Superstar

In the world of real estate, DSCR is practically royalty. It’s used extensively in commercial real estate lending and investment property financing. Why? Rental properties generate income that can be easily compared to debt payments.

For example, if you’re buying a rental property:

- Annual rental income (after expenses): $50,000

- Annual mortgage payments: $40,000

- DSCR = $50,000 / $40,000 = 1.25

This DSCR of 1.25 would likely make lenders smile, as it shows the property generates enough income to cover its debt with a comfortable margin.

Small Businesses: Navigating DSCR Challenges

For small businesses, maintaining a DSCR of 1.25 can be trickier. Income can be more volatile, and expenses can be more unpredictable. However, demonstrating a consistent DSCR of 1.25 or higher can open doors to better financing options and business growth opportunities.

Corporate Finance: DSCR in the Big Leagues

Even large corporations pay attention to DSCR. While they might use more complex financial metrics as well, DSCR remains a quick and effective way to assess a company’s ability to service its debt. Investors and analysts often look at a company’s DSCR when evaluating its financial health.

Beyond 1.25: Other DSCR Benchmarks

When 1.25 Isn’t Enough

While a DSCR of 1.25 is a common benchmark, some situations call for higher ratios:

- High-risk industries: Lenders might require DSCRs of 1.5 or higher for businesses in volatile sectors.

- Start-ups: New businesses with limited track records might need to show higher DSCRs to offset their perceived risk.

- Economic uncertainty: During times of economic instability, lenders might raise their DSCR requirements across the board.

When a Lower DSCR Might Be Acceptable

Conversely, there are situations where a DSCR below 1.25 might still be acceptable:

- Established businesses with strong track records

- Industries with predictable, stable cash flows

- Borrowers with significant liquid assets or alternative income sources

The Limitations of DSCR

Not the Whole Picture

While DSCR is a useful metric, it’s important to remember that it’s just one piece of the financial puzzle. Lenders and investors typically consider other factors as well, such as:

- Credit score

- Business history

- Market conditions

- Collateral

Potential for Manipulation

Like any financial metric, DSCR can potentially be manipulated. For example, a business might delay necessary expenses to artificially boost their NOI for a short period of time. This is why lenders often look at DSCR over time and in conjunction with other financial indicators.

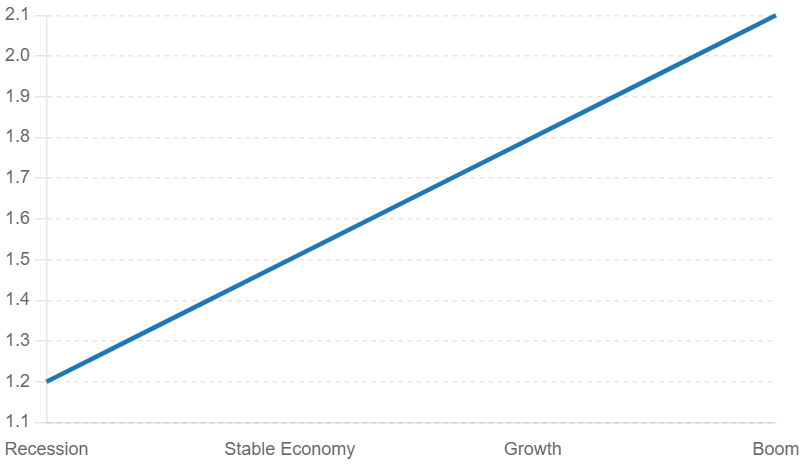

DSCR in a Changing Economy

The Impact of Interest Rates

Interest rates play a crucial role in DSCR calculations. When interest rates rise, debt service costs increase, potentially lowering DSCR. This is why many businesses and investors pay close attention to Federal Reserve policies and economic indicators that might signal interest rate changes.

DSCR in Times of Crisis

Economic crises, like the 2008 financial crash or the recent COVID-19 pandemic, can have a significant impact on DSCR across various industries. During these times, maintaining a DSCR of 1.25 can become challenging for many businesses, leading to increased scrutiny from lenders and potential difficulties in obtaining financing.

The Future of DSCR: Trends and Predictions

Technology and DSCR Calculations

As we move further into the digital age, technology is changing how DSCR is calculated and used. Advanced analytics and artificial intelligence are making it easier for lenders to assess DSCR in real-time, potentially leading to more dynamic lending decisions.

Environmental, Social, and Governance (ESG) Factors

There’s a growing trend towards considering ESG factors in financial decisions. In the future, we might see DSCR calculations that incorporate sustainability metrics or social responsibility indicators. For example, a business with strong environmental practices might be viewed more favorably, even with a slightly lower DSCR.

DSCR: A Global Perspective

DSCR Around the World

While a DSCR of 1.25 is a common benchmark in many countries, it’s not universal. Different regions may have different standards based on their economic conditions and lending practices. For instance:

- In some developing economies, lenders might require higher DSCRs due to increased economic volatility.

- In countries with very stable economies, a slightly lower DSCR might be acceptable.

Understanding these global differences is crucial for international businesses and investors.

Read Also: DSCR vs ICR: Master These Key Ratios to Unlock Financial Success

Conclusion

So, what does a DSCR of 1.25 mean? In essence, it represents a financial sweet spot – a point where a borrower is generating enough income to comfortably cover their debt obligations with a 25% cushion. This ratio provides lenders with confidence and borrowers with financial stability.

Whether you’re a small business owner seeking a loan, a real estate investor evaluating a property, or simply someone trying to understand financial jargon, grasping the concept of DSCR is valuable. It’s a powerful tool that bridges the gap between income and debt, offering insights into financial health and lending decisions.

Remember, while a 1.25 DSCR is often seen as a benchmark, it’s not a one-size-fits-all solution. Your ideal DSCR may vary depending on your industry, economic conditions, and individual circumstances. The key is to understand what DSCR means for you and how you can use this knowledge to make informed financial decisions.

As we navigate an ever-changing economic landscape, keeping an eye on your DSCR can help you stay financially healthy and prepared for whatever challenges or opportunities may come your way. After all, in the world of finance, knowledge truly is power.

FAQs

How often should I calculate my DSCR?

It’s a good practice to calculate your DSCR at least quarterly. However, if you’re in a volatile industry or considering taking on new debt, you might want to monitor it more frequently. Regular calculations can help you spot trends and address potential issues before they become serious problems.

Can a high DSCR be a bad thing?

While a high DSCR generally indicates strong financial health, an extremely high DSCR might suggest that a business isn’t leveraging its assets effectively. It could mean you’re missing out on growth opportunities by not utilizing available credit. The ideal DSCR balances financial security with growth potential.

How does DSCR affect personal loans?

While DSCR is more commonly used for business and real estate loans, a similar concept applies to personal loans. Lenders look at your debt-to-income ratio, which is comparable to the DSCR. A lower debt-to-income ratio (similar to a higher DSCR) can help you secure better personal loan terms.

What’s the difference between DSCR and debt-to-income ratio?

DSCR and debt-to-income ratio are similar concepts, but they’re used in different contexts. DSCR is typically used for businesses and income-producing real estate, while the debt-to-income ratio is used for personal loans and mortgages. Both measure the relationship between income and debt obligations.

Can I improve my DSCR without increasing income or reducing debt?

While increasing income or reducing debt are the most direct ways to improve DSCR, there are other strategies. You might be able to refinance your debt to lower your payments, improve your operational efficiency to increase your net operating income, or negotiate better terms with suppliers or landlords to reduce expenses.