Residential DSCR loans focus on a property’s income potential, making them ideal for investors, self-employed individuals, and those with non-traditional jobs. These loans offer flexible income requirements, faster approval processes, and the potential for multiple property investments. Learn how to calculate DSCR, maximize rental income, and navigate these game-changing loans to grow your real estate portfolio.

Residential DSCR Loans: Your Key to Rental Property Investing

Unlock the power of Residential DSCR Loans and revolutionize your real estate investing strategy. These innovative financing options focus on your property’s income potential, not your personal earnings. Perfect for savvy investors, self-employed individuals, and anyone looking to build a robust rental portfolio.

Discover how DSCR loans can help you:

- Bypass traditional income verification hurdles

- Expand your real estate empire faster

- Enjoy a streamlined approval process

With lower barriers to entry and the potential for multiple property investments, DSCR loans are your ticket to real estate success. Learn how to calculate DSCR, maximize your rental income, and navigate the unique aspects of these game-changing loans.

Whether you’re a seasoned landlord or a newcomer to property investing, our comprehensive guide will equip you with the knowledge to leverage DSCR loans effectively. Don’t let conventional financing hold you back – explore the world of Residential DSCR Loans and take your real estate investments to new heights!

What’s a Residential DSCR Loan?

A Residential DSCR (Debt Service Coverage Ratio) loan is a new way to finance rental properties. Unlike regular mortgages that look at your income, DSCR loans focus on how much money the property can make. This opens doors for many people who want to invest in real estate.

Understanding the DSCR Formula

The key to these loans is the Debt Service Coverage Ratio. Here’s how it works:

DSCR = Money the property makes / Money needed for the loanLenders usually want this number to be 1.25 or higher. This means the property should make 25% more money than it needs to pay for the loan.

Why Choose a DSCR Loan?

| Reason | Description |

|---|---|

| 1. Flexible Income Requirements | DSCR loans focus on the income generated by the property rather than the borrower’s personal income, making it easier for investors with varying income sources to qualify. |

| 2. Grow Your Real Estate Portfolio | By using the property’s income to qualify, investors can expand their portfolios more easily, leveraging the income from existing properties to acquire new ones. |

| 3. Faster and Easier Process | The qualification process for DSCR loans can be quicker and more straightforward, as it relies primarily on the property’s cash flow rather than extensive personal financial documentation. |

1. Flexible Income Requirements

DSCR loans don’t care as much about your personal income. This is great for:

- People who work for themselves

- Investors with complicated income

- Those with non-traditional jobs

2. Grow Your Real Estate Portfolio

With DSCR loans, you can often buy more properties than with regular loans. As long as each property makes enough money, you can keep expanding your real estate business.

3. Faster and Easier Process

Compared to regular mortgages, DSCR loans usually have:

- Less paperwork

- Quicker approvals

- Faster closings

How to Figure Out if a Property Qualifies

To see if a property can get a DSCR loan, follow these steps:

- Estimate how much rent you can charge each month

- Subtract costs like taxes, insurance, and repairs

- Divide that number by the monthly loan payment

For example:

- Monthly rent: $2,000

- Costs: $500

- Money left: $1,500

- Monthly loan payment: $1,200

- DSCR = $1,500 / $1,200 = 1.25

Who Should Get a DSCR Loan?

Experienced Real Estate Investors

If you already own rental properties and want more, DSCR loans can help you grow.

New Investors with Good Property Skills

Even if you’re new to real estate, DSCR loans can work if you:

- Understand how to manage properties

- Can find properties that will make good money

- Plan to invest for the long term

Self-Employed People

If you own your own business, DSCR loans make it easier to buy property without showing years of tax returns.

How to Get a DSCR Loan: Step by Step

- Find a Good Property: Look for a place that can bring in good rent.

- Get Your Papers Ready: You’ll need info about the property, its cost, and how much rent you think you can get.

- Find a Lender: Not all banks offer DSCR loans. You might need to look around or ask a mortgage broker for help.

- Apply: Send in your application and be ready to talk about your plans.

- Property Check: The lender will have someone look at the property.

- Loan Review: The lender will decide if they’ll give you the loan.

- Closing: If approved, you’ll sign the papers and get the money to buy the property.

Tips for Success with DSCR Loans

Make More Rent Money

To get a better loan:

- Improve the property so you can charge more rent

- Offer things renters want

- Advertise well to keep the property rented

Keep Costs Down

Your DSCR is better when you spend less on the property. Try:

- Using energy-saving appliances

- Fixing small problems quickly

- Finding good deals on insurance

Know Your Market

Stay informed about real estate in your area:

- Watch how rent prices change

- Keep an eye on property values

- Be aware of new developments that could affect your property

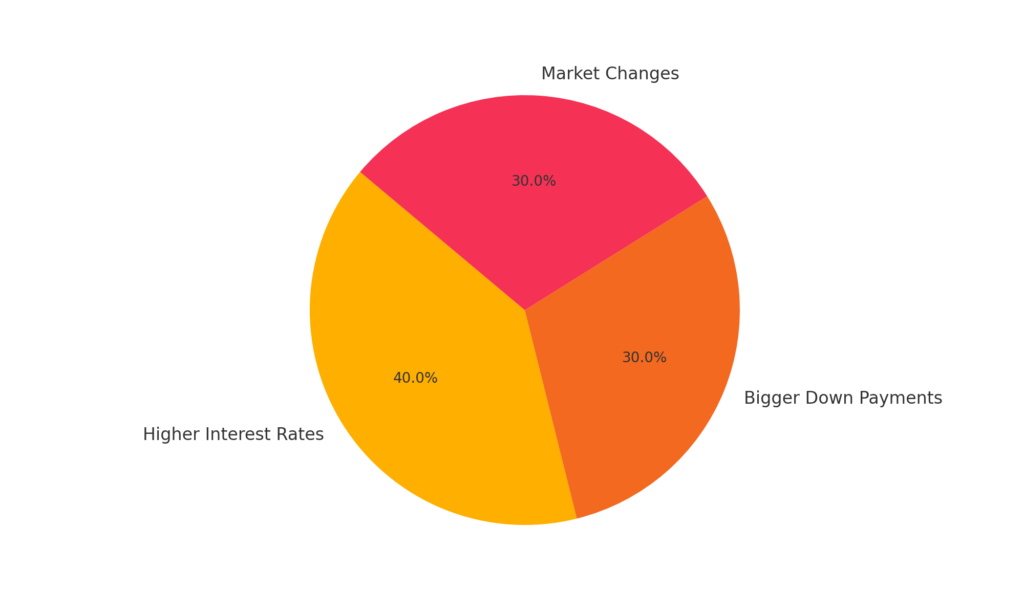

Watch Out for These Challenges

Higher Interest Rates

DSCR loans often have higher rates. To help with this:

- Keep your credit score high

- Look for the best rates

- Consider paying extra upfront to lower your rate

Bigger Down Payments

Be ready to put down 20-25% of the property’s price. To manage this:

- Save up over time

- Use money from other investments

- Consider partnering with other investors

Market Changes

Rental markets can go up and down. Protect yourself by:

- Buying properties in different areas

- Keeping extra money saved for when you don’t have renters

- Being flexible with your rental plans

The Future of DSCR Loans

As more people look to build wealth through real estate, DSCR loans are likely to become more popular. They work well for many investors, both new and experienced.

Conclusion: Is a DSCR Loan Right for You?

Residential DSCR loans are a powerful tool for building a real estate business. They focus on how well a property can perform, not just your personal income. This opens up new chances for all kinds of investors.

Whether you’re just starting or want to grow your existing investments, DSCR loans could be the key to your success in real estate.

Remember, doing well in real estate takes careful planning and research. With a good strategy and DSCR loans, you’re ready to build a successful real estate business. Why wait? Start looking into DSCR loans today and take your first step towards owning more properties!

Also Read: Commercial DSCR Loans: What is it, Expert Advice & How to Apply

Frequently Asked Questions

What credit score do I need for a DSCR loan?

Most lenders want to see a credit score of at least 640-680. A higher score could help you get better loan terms.

Can I use a DSCR loan for the house I live in?

No, DSCR loans are only for properties you plan to rent out. You can’t use them for your own home or a vacation house.

How is a DSCR loan different from a regular mortgage?

Regular mortgages look at your personal income. DSCR loans care more about how much money the property can make from rent.

Is there a limit on how many properties I can buy with DSCR loans?

Usually, there’s no limit. As long as each property makes enough money, you can keep buying more.

Can I use a DSCR loan to refinance a rental property I already own?

Yes, many investors use DSCR loans to refinance their existing rental properties. This can be helpful if your property is making more money now than when you first bought it.