The minimum DSCR for bank loans varies by loan type.

- Commercial real estate: typically 1.25

- Small business: 1.15-1.35

- Corporate: 1.5-2.0 DSCR measures a borrower’s ability to repay loans.

To improve DSCR:

- Increase income

- Reduce debt

- Improve cash flow management Banks also consider credit score, LTV, and overall financial health.

Minimum DSCR for Bank Loans: Requirements, Calculation, and Improvement Strategies:

In the complex world of finance and lending, understanding key metrics is crucial for both borrowers and lenders. One such critical metric is the Debt Service Coverage Ratio (DSCR). If you’re considering applying for a bank loan, you’ve likely encountered this term and may be wondering about the minimum DSCR required. In this comprehensive guide, we’ll dive deep into the concept of DSCR, its importance in the loan approval process, and explore the minimum DSCR typically required for bank loans.

Understanding DSCR: The Key to Loan Approval

What is DSCR and Why Does It Matter for Bank Loans?

DSCR, or Debt Service Coverage Ratio, is a financial metric used by lenders to assess a borrower’s ability to repay a loan. It’s a crucial tool in evaluating the risk associated with lending money, especially for business and commercial real estate loans.

But what does this ratio actually measure? In simple terms, DSCR compares a company’s or property’s net operating income (NOI) to its total debt service obligations. It provides a clear picture of whether the borrower generates sufficient cash flow to cover their debt payments.

How to Calculate DSCR: Breaking Down the Formula

To truly grasp the concept of DSCR, let’s look at its formula:

DSCR = Net Operating Income / Total Debt Service

Here’s what each component means:

- Net Operating Income (NOI): This is the annual income generated by a business or property after deducting operating expenses but before accounting for taxes and debt payments.

- Total Debt Service: This includes all debt obligations due within a year, including principal and interest payments on loans, leases, and other debts.

A DSCR of 1.0 indicates that a company’s income exactly matches its debt obligations. Anything above 1.0 suggests a surplus, while a ratio below 1.0 implies a deficit.

The Importance of DSCR in Bank Loan Approval

Why Banks Prioritize DSCR in Loan Evaluations

Banks and other lenders use DSCR as a key indicator of a borrower’s financial health and ability to repay a loan. It’s not just a number—it’s a reflection of the borrower’s cash flow management and overall financial stability.

When you apply for a bank loan, the lender wants to ensure that you’ll be able to make your payments consistently. A strong DSCR gives them confidence that you have a buffer between your income and your debt obligations, reducing the risk of default.

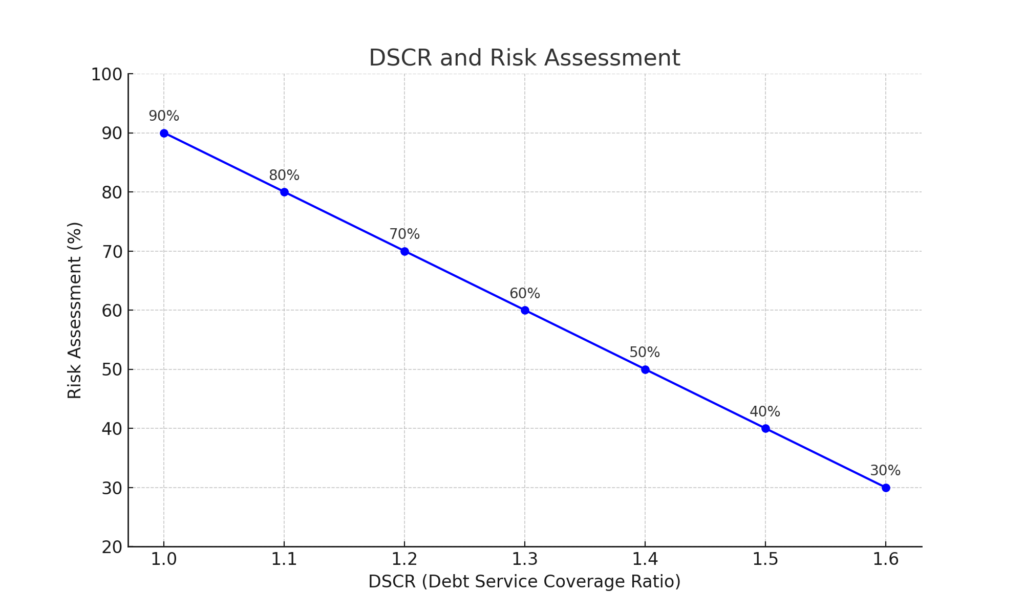

DSCR and Risk Assessment: What Your Ratio Tells Lenders

From a lender’s perspective, DSCR is a powerful tool for risk assessment. Here’s how different DSCR levels are typically interpreted:

- DSCR > 1.0: This indicates positive cash flow, suggesting the borrower can cover their debt payments.

- DSCR = 1.0: This shows that the borrower’s income exactly matches their debt obligations, leaving no margin for error.

- DSCR < 1.0: This implies negative cash flow, signaling that the borrower may struggle to meet their debt obligations.

The higher the DSCR, the lower the perceived risk for the lender. This often translates to more favorable loan terms for the borrower, including lower interest rates and higher loan amounts.

Minimum DSCR Requirements for Different Types of Bank Loans

| Type of Bank Loan | Minimum DSCR Requirement |

|---|---|

| Commercial Real Estate Loan | 1.25 |

| Small Business Loan | 1.20 |

| Multi-Family Property Loan | 1.20 |

| SBA Loan (Small Business Administration) | 1.15 |

| Equipment Financing | 1.15 |

| Construction Loan | 1.30 |

| Bridge Loan | 1.10 |

| Term Loan | 1.20 |

| Agricultural Loan | 1.20 |

| Franchise Loan | 1.25 |

Is There a Universal Minimum DSCR for All Bank Loans?

One of the most common questions borrowers ask is, “What’s the minimum DSCR required for a bank loan?” The truth is, there’s no one-size-fits-all answer. The minimum acceptable DSCR can vary based on several factors:

- Type of loan

- Industry standards

- Economic conditions

- Individual lender policies

- Borrower’s overall financial profile

DSCR Requirements by Loan Type: What You Need to Know

While there’s no universal standard, let’s explore some common DSCR requirements for different types of bank loans:

1. Commercial Real Estate Loans: Minimum DSCR Requirements

For commercial real estate loans, lenders typically look for a minimum DSCR of 1.25. This means the property’s net operating income should be at least 25% higher than its debt service obligations.

However, in some cases, particularly for strong borrowers or prime properties, lenders might accept a DSCR as low as 1.20. On the other hand, for riskier properties or in uncertain market conditions, they might require a DSCR of 1.30 or higher.

2. Small Business Loans: DSCR Expectations for Entrepreneurs

For small business loans, the minimum DSCR requirements can be more varied. Some lenders might accept a DSCR of 1.15 for established businesses with a strong track record. However, for newer or riskier businesses, they might require a DSCR of 1.35 or even higher.

The Small Business Administration (SBA), which guarantees certain business loans, typically requires a minimum DSCR of 1.15 for most of its loan programs.

3. Corporate Loans: DSCR Standards for Large Businesses

For large corporate loans, the DSCR requirements can be more stringent. Many lenders look for a minimum DSCR of 1.5 or even 2.0, depending on the industry and the company’s financial stability.

Factors Influencing Minimum DSCR Requirements for Bank Loans

| Factor | Description |

|---|---|

| Loan Type | Different loans (e.g., commercial real estate, small business, construction) have varying DSCR requirements based on the risk and collateral involved. |

| Creditworthiness of Borrower | Borrowers with higher credit scores and strong financial histories may qualify for lower DSCR requirements. |

| Loan Amount | Larger loan amounts may necessitate higher DSCR requirements to mitigate risk for the lender. |

| Economic Conditions | In a stable or growing economy, banks may lower DSCR requirements, whereas in a recession, they may raise them to reduce risk. |

| Collateral Value | Loans secured with high-value collateral may have lower DSCR requirements due to reduced risk for the lender. |

| Industry Risk | High-risk industries (e.g., startups and volatile sectors) often have higher DSCR requirements compared to stable industries. |

| Interest Rates | Higher interest rates increase debt servicing costs, potentially raising DSCR requirements to ensure loan repayment capability. |

| Loan Term | Shorter-term loans might have higher DSCR requirements as they have less time for revenue generation to cover debt. |

| Lender Policies | Each lender has specific underwriting policies and risk tolerance levels that influence DSCR requirements. |

| Regulatory Environment | Changes in banking regulations and policies can impact DSCR requirements, with stricter regulations often leading to higher ratios. |

| Historical Financial Performance | Borrowers with strong and consistent past financial performance may benefit from lower DSCR requirements. |

| Revenue Stability | Businesses with stable and predictable revenue streams might be subject to lower DSCR requirements than those with fluctuating incomes. |

Understanding why DSCR requirements can vary is crucial for borrowers. Several factors influence a lender’s minimum DSCR threshold, including:

- Industry Norms: Some industries naturally have higher cash flow volatility, leading to higher DSCR requirements.

- Economic Climate: During economic downturns, lenders might increase their minimum DSCR requirements to mitigate risk.

- Loan-to-Value (LTV) Ratio: A lower LTV ratio might allow for a slightly lower DSCR, as the loan is better secured by the asset’s value.

- Borrower’s Credit History: A strong credit history might lead to more flexible DSCR requirements.

- Loan Term and Size: Longer-term loans or larger loan amounts might necessitate higher DSCR requirements.

How to Improve Your DSCR for Better Loan Terms

Strategies to Boost Your DSCR and Qualify for Bank Loans

If you’re aiming to secure a bank loan but your DSCR falls short of the lender’s requirements, don’t despair. There are several strategies you can employ to improve your DSCR:

- Increase Net Operating Income:

- Boost revenue through marketing efforts or expansion

- Implement cost-cutting measures to reduce operating expenses

- Improve operational efficiency

- Reduce Debt Service:

- Refinance existing debts at lower interest rates

- Extend loan terms to lower monthly payments

- Pay off smaller debts to reduce overall debt service

- Improve Cash Flow Management:

- Implement stricter accounts receivable policies

- Negotiate better terms with suppliers

- Optimize inventory management

- Consider a Larger Down Payment:

- If you are applying for a new loan, a larger down payment can reduce the loan amount and improve your DSCR

- Demonstrate Strong Financial management:

- Maintain detailed and accurate financial records

- Show a history of consistent debt repayment

- Present a solid business plan and financial projections

Remember, improving your DSCR is not just about meeting a lender’s requirements—it’s about strengthening your overall financial health.

Beyond DSCR: Other Factors Banks Consider in Loan Approval

The Comprehensive Loan Evaluation Process

While DSCR is a crucial metric, it’s important to remember that banks consider various other factors when evaluating a loan application:

- Credit Score: Your personal or business credit score plays a significant role in loan approval and terms.

- Loan-to-Value Ratio: For secured loans, the LTV ratio is another key consideration.

- Industry and Market Conditions: Banks assess the overall health and stability of your industry.

- Business Plan and Projections: For business loans, a solid business plan and realistic financial projections are essential.

- Management Experience: The experience and track record of the business management team can influence the loan decision.

- Collateral: The value and quality of any collateral offered can impact loan terms and approval.

- Overall Financial Health: Banks will review your complete financial statements, not just the DSCR.

By focusing on improving these areas alongside your DSCR, you can significantly enhance your chances of loan approval and secure more favorable terms.

The Future of DSCR in Banking: Emerging Trends

How DSCR Evaluation is Evolving in the Lending Industry

As the financial landscape continues to evolve, so too does the role of DSCR in bank loan evaluations. Here are some trends to watch:

- AI and Big Data: Banks are increasingly using artificial intelligence and big data analytics to assess loan applications, potentially leading to more nuanced DSCR evaluations.

- Alternative Data Sources: Some lenders are beginning to consider non-traditional data sources to supplement DSCR calculations, especially for small businesses and startups.

- Industry-Specific Benchmarks: There’s a growing trend towards developing more refined, industry-specific DSCR benchmarks.

- Stress Testing: Banks are placing greater emphasis on stress testing DSCR under various economic scenarios.

- Sustainability Factors: Some lenders are starting to incorporate sustainability metrics into their DSCR calculations, particularly for real estate and industrial loans.

Staying informed about these trends can help borrowers better prepare for future loan applications and negotiations.

Read Also: What does a DSCR of 1.25 mean?

Conclusion: Mastering DSCR for Successful Loan Applications

Understanding the minimum DSCR for bank loans is crucial for anyone seeking financing. While there’s no universal minimum, most lenders look for a DSCR of at least 1.25, with variations depending on the loan type, industry, and other factors.

Remember, DSCR is more than just a number—it’s a reflection of your financial health and ability to manage debt. By focusing on improving your DSCR and overall financial position, you can increase your chances of loan approval and secure more favorable terms.

Whether you’re a small business owner, a real estate investor, or a corporate finance professional, understanding and optimizing your DSCR can be a game-changer in your financial journey. Keep in mind that while DSCR is important, it’s just one piece of the puzzle. Banks consider a holistic view of your financial situation when making lending decisions.

As you navigate the world of bank loans, stay informed, be proactive in managing your finances, and don’t hesitate to seek professional advice when needed. With the right approach, you can position yourself as a strong, low-risk borrower, opening doors to the financing you need to achieve your goals.

FAQs About DSCR and Bank Loans

Here are five unique frequently asked questions about the minimum DSCR for bank loans:

How often do banks recalculate the DSCR for existing loans?

Most banks recalculate DSCR annually for existing loans, typically when financial statements are updated. However, some loan agreements may require more frequent calculations, especially for higher-risk loans or during periods of economic uncertainty.

Can a high DSCR compensate for a low credit score when applying for a bank loan?

While a high DSCR can certainly help, it usually can’t completely offset a low credit score. Banks typically consider both factors independently. A high DSCR might make a lender more willing to work with a borrower who has a less-than-perfect credit score, but it’s unlikely to completely negate credit concerns.

Are DSCR requirements different for startups compared to established businesses?

Yes, DSCR requirements often differ for startups. Since new businesses may not have a track record of consistent income, some lenders might place less emphasis on DSCR and more on other factors like the business plan, market potential, and the entrepreneur’s experience. Some lenders might use projected DSCR based on financial forecasts for startups.

How do seasonal fluctuations in income affect DSCR calculations for bank loans?

For businesses with seasonal income fluctuations, banks often calculate DSCR based on annual figures to smooth out these variations. Some lenders might also look at the monthly or quarterly DSCR to ensure the business can meet its obligations during low seasons. In some cases, lenders might require a higher overall DSCR to account for these fluctuations.

Can personal income be included in DSCR calculations for small business loans?

In some cases, especially for small businesses or sole proprietorships, lenders might consider including the owner’s personal income in DSCR calculations. This is more common with SBA loans or loans to very small businesses. However, traditional commercial lenders typically focus solely on the business’s income when calculating DSCR.