DSCR (Debt Service Coverage Ratio) in real estate: Net Operating Income / Total Debt Service. Measures property’s ability to cover debt. Good DSCR: 1.25+. Calculate by determining NOI and annual debt payments. Improve by increasing revenue, reducing expenses, or refinancing. Key for loan approval and investment decisions.

How to Calculate DSCR in Real Estate:

Are you diving into the world of real estate investing? If so, you’ve probably come across the term DSCR. Don’t worry if it sounds like alphabet soup – we’re here to break it down for you. DSCR, or Debt Service Coverage Ratio, is a crucial metric that can make or break your real estate investment dreams. In this comprehensive guide, we’ll walk you through everything you need to know about calculating DSCR in real estate.

Understanding DSCR: The Backbone of Real Estate Finance

Let’s start with the basics. DSCR is like a financial health check for your property investment. It tells you whether the income from your property can comfortably cover your loan payments. Think of it as a safety net that lenders use to gauge how risky it might be to lend you money.

What Exactly is DSCR?

DSCR stands for Debt Service Coverage Ratio. It’s a simple but powerful formula that compares the cash a property generates to the amount needed to cover loan payments. In other words, it shows how well your property’s income can service its debt.

Why DSCR Matters in Real Estate

Imagine you’re a lender. You want to make sure that the person or company you’re lending to can pay you back, right? That’s where DSCR comes in. It gives lenders a clear picture of whether a property can generate enough cash to cover its debt payments. For investors, a good DSCR can mean better loan terms and lower interest rates.

The DSCR Formula: Breaking It Down

Now that we know what DSCR is and why it’s important, let’s get into the nitty-gritty of how to calculate it. Don’t worry – you don’t need to be a math whiz to figure this out.

The Basic DSCR Formula

Here’s the simple version:

DSCR = Net Operating Income (NOI) / Total Debt Service

Let’s break this down further:

- Net Operating Income (NOI): This is the annual income your property generates after all operating expenses are paid, but before paying the mortgage.

- Total Debt Service: This is the total amount you need to pay annually for your loan, including principal and interest.

A Real-World Example

Let’s say you have a rental property that brings in $100,000 a year in rent. After paying for things like property taxes, insurance, and maintenance, you’re left with $70,000. That’s your NOI.

Now, let’s say your annual mortgage payments total $50,000.

Your DSCR would be: $70,000 / $50,000 = 1.4

This means your property generates 40% more income than needed to cover its debt payments. Not bad!

Calculating NOI: The First Step to DSCR

Before you can calculate DSCR, you need to know your Net Operating Income (NOI). This is a key figure in real estate finance, and getting it right is crucial for an accurate DSCR.

What Goes into NOI?

NOI includes all the money your property brings in, minus all the regular expenses needed to keep it running. Here’s a quick breakdown:

Income:

- Rent payments

- Parking fees

- Laundry machine income

- Any other regular income from the property

Expenses:

- Property taxes

- Insurance

- Maintenance and repairs

- Property management fees

- Utilities (if not paid by tenants)

- Marketing costs

Remember, NOI doesn’t include your mortgage payments or income taxes. Those come later in the DSCR calculation.

Calculating NOI: A Step-by-Step Guide

- Add up all your property’s income for the year.

- List out all your operating expenses for the year.

- Subtract your total expenses from your total income.

The result is your NOI. Simple, right?

Understanding Debt Service: The Other Half of the Equation

Now that we’ve got NOI figured out, let’s look at the other part of the DSCR formula: debt service.

What is Debt Service?

In real estate, debt service refers to the total amount you need to pay on your loans over a year. This includes both principal and interest payments.

Calculating Annual Debt Service

To find your annual debt service:

- Look at your loan agreement to find your monthly payment amount.

- Multiply this by 12 to get your annual debt service.

For example, if your monthly mortgage payment is $4,000, your annual debt service would be $48,000.

Putting It All Together: Calculating DSCR

Now that we have both NOI and debt service, we can calculate DSCR. Let’s walk through an example.

Step-by-Step DSCR Calculation

- Calculate NOI:

- Annual rental income: $120,000

- Annual operating expenses: $40,000

- NOI = $120,000 – $40,000 = $80,000

- Determine annual debt service:

- Monthly mortgage payment: $5,000

- Annual debt service = $5,000 x 12 = $60,000

- Apply the DSCR formula: DSCR = NOI / Debt Service DSCR = $80,000 / $60,000 = 1.33

In this example, the DSCR is 1.33, meaning the property generates 33% more income than needed to cover its debt payments.

Mastering the DSCR Formula for Real Estate Investments

Understanding and applying the DSCR formula is crucial for success in real estate investing. Let’s dive deeper into how you can master this essential tool.

The DSCR Formula Demystified

As we’ve discussed, the basic DSCR formula is:

DSCR = Net Operating Income (NOI) / Total Debt Service

But let’s break this down further:

- Net Operating Income (NOI) = Total Revenue – Operating Expenses

- Total Debt Service = Annual Mortgage Payments (Principal + Interest)

DSCR Calculation Methods

There are actually a few different ways to calculate DSCR, depending on the specific situation:

- Traditional Method: This is the standard method we’ve discussed.

- Global DSCR: This method considers all of a borrower’s income and debts, not just those related to the property in question.

- Forward-Looking DSCR: This uses projected future income and expenses rather than historical data.

Interactive DSCR Calculator

Try our interactive DSCR calculator! Input your property’s annual income, operating expenses, and debt payments to instantly see your DSCR.

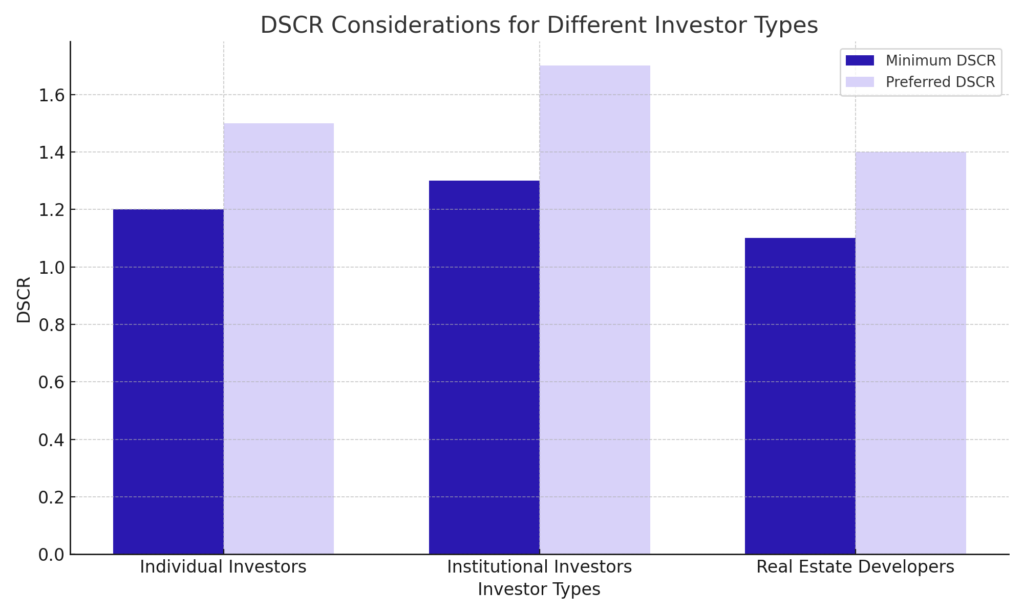

DSCR Considerations for Different Investor Types

Novice Real Estate Investors

If you’re new to real estate investing, understanding DSCR is your first step towards making informed decisions. Here’s what you need to know:

- Start with properties that have a DSCR of at least 1.25. This gives you a safety margin as you learn the ropes.

- Focus on accurately estimating all income and expenses. Overoptimism can lead to trouble down the line.

- Consider working with a mentor or financial advisor who can guide you through your first DSCR calculations.

Seasoned Property Moguls

For experienced investors, DSCR becomes a tool for optimizing your portfolio:

- Use DSCR to compare potential investments across different markets or property types.

- Consider how you might improve DSCR through strategic renovations or management changes.

- Look at trends in your properties’ DSCRs over time to spot potential issues early.

Commercial vs. Residential DSCR: Key Differences

While the basic formula remains the same, there are some key differences in how DSCR is applied to commercial and residential properties:

- Threshold Differences: Commercial lenders often require higher DSCRs, typically 1.25 or above, while residential lenders might accept DSCRs closer to 1.

- Income Stability: Commercial properties often have longer leases, which can provide more stable NOI projections.

- Expense Structures: Commercial properties may have triple net leases where tenants cover many expenses, affecting NOI calculations.

Strategies to Improve Your Property’s DSCR

| Strategy | Description |

|---|---|

| Increase Rental Income | Adjust rent to market rates, add amenities, or improve property quality to attract higher-paying tenants. |

| Reduce Operating Expenses | Implement cost-saving measures, negotiate better service contracts, or find more efficient property management. |

| Refinance Debt | Obtain a loan with a lower interest rate or extend the loan term to reduce monthly debt payments. |

| Improve Occupancy Rates | Implement marketing strategies to attract new tenants, retain existing tenants, and reduce vacancy rates. |

| Implement Value-Add Improvements | Renovate or upgrade the property to increase its value and justify higher rents. |

| Increase Ancillary Income | Add revenue streams such as parking fees, vending machines, or laundry facilities. |

| Optimize Property Tax Assessment | Appeal property tax assessments to reduce annual property tax expenses. |

| Review Insurance Policies | Shop for competitive insurance rates or adjust coverage levels to lower premiums. |

| Implement Energy-Efficiency Measures | Invest in energy-efficient systems to lower utility costs. |

| Lease Renewals and Escalations | Negotiate lease renewals with existing tenants at higher rates and include escalation clauses for future rent increases. |

| Diversify Tenant Mix | Attract a mix of tenants to reduce risk and stabilize rental income. |

A low DSCR doesn’t have to be a deal-breaker. Here are some strategies to boost your DSCR:

- Increase Revenue:

- Raise rents if market conditions allow

- Add additional income streams (e.g., parking fees, vending machines)

- Reduce vacancy rates through better marketing or property improvements

- Reduce Operating Expenses:

- Implement energy-efficient upgrades to lower utility costs

- Shop around for better insurance rates

- Optimize maintenance schedules to prevent costly repairs

- Refinance Your Debt:

- Look for lower interest rates to reduce your debt service

- Consider a longer amortization period to lower monthly payments

- Value-Add Improvements:

- Renovate units to justify higher rents

- Add amenities that attract higher-paying tenants

Remember, improving DSCR is a balance between increasing NOI and managing debt effectively.

Case Studies: DSCR in Action

Case Study 1: The Turnaround Property

John, a mid-level investor, purchased a struggling 20-unit apartment complex with a DSCR of 0.95. Here’s how he turned it around:

- Implemented a renovation plan to justify 15% rent increases

- Reduced vacancy from 20% to 5% through better management

- Refinanced to a lower interest rate after improvements were completed

Result: After 18 months, the property’s DSCR improved to 1.4, significantly increasing its value and cash flow.

Case Study 2: DSCR for Loan Approval

Sarah, a first-time investor, used DSCR analysis to secure favorable financing:

- Identified a duplex with potential for improved cash flow

- Calculated current DSCR at 1.1

- Presented a plan to lenders showing how she’d improve DSCR to 1.3 within a year

- Secured financing at 0.5% lower than initially offered due to her thorough analysis

Result: Sarah’s understanding of DSCR helped her negotiate better loan terms, saving thousands over the life of the loan.

What’s a Good DSCR?

Now that you know how to calculate DSCR, you might be wondering what number you should aim for. While this can vary depending on the lender and the type of property, here are some general guidelines:

DSCR Ranges and What They Mean

- DSCR below 1: This means the property isn’t generating enough income to cover its debt payments. Most lenders won’t approve loans in this scenario.

- DSCR of 1: The property is breaking even. It’s generating just enough to cover the debt payments, but there’s no cushion for unexpected expenses.

- DSCR between 1.25 and 1.5: This is typically the range lenders look for. It shows the property can comfortably cover its debt and has some extra cash flow.

- DSCR above 1.5: This is considered excellent. The property is generating significantly more income than needed for debt payments.

Remember, a higher DSCR is generally better, but extremely high DSCRs might indicate you’re not leveraging your investment effectively.

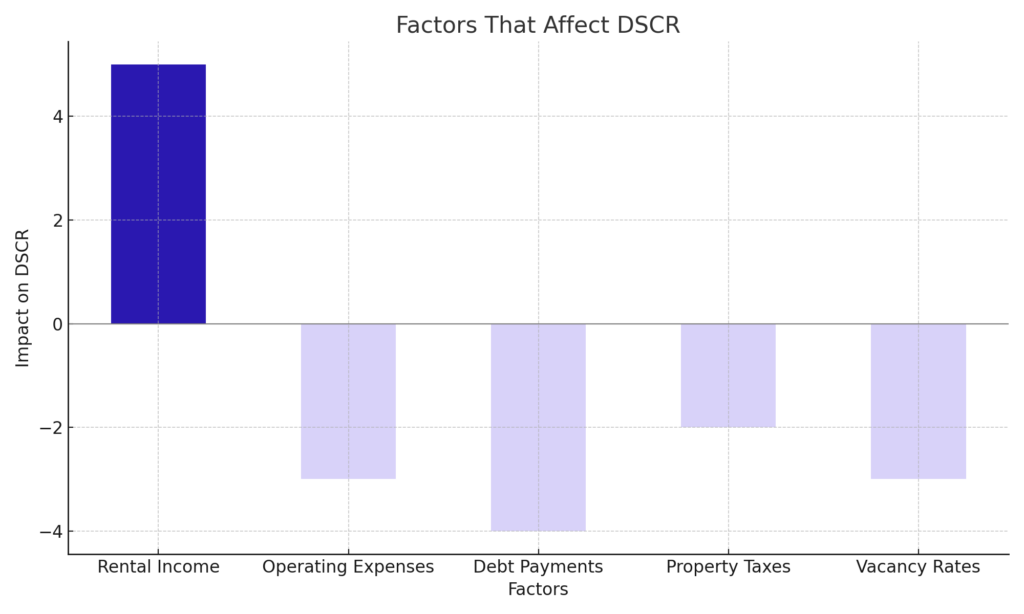

Factors That Affect DSCR

DSCR isn’t set in stone. Several factors can influence this important ratio:

1. Property Performance

The better your property performs, the higher your NOI will be, which can improve your DSCR. This might involve increasing rent, reducing vacancies, or finding new sources of income.

2. Interest Rates

If interest rates rise, your debt service will increase, potentially lowering your DSCR. On the flip side, refinancing to a lower interest rate could improve your DSCR.

3. Loan Terms

The length of your loan and the amortization schedule can impact your annual debt service and, consequently, your DSCR.

4. Operating Expenses

Keeping your operating expenses in check can boost your NOI and improve your DSCR. This might involve finding ways to reduce costs without sacrificing property quality.

DSCR and Different Types of Real Estate Investments

| Residential Properties | 1.2 – 1.5 | Lower DSCR requirements due to generally stable rental income and lower operating expenses. |

| Commercial Properties | 1.25 – 1.75 | Higher DSCR needed due to higher risk, larger operating expenses, and longer lease terms. |

| Industrial Properties | 1.3 – 1.8 | High DSCR reflects specialized nature, potential for longer vacancy periods, and significant operating costs. |

| Retail Properties | 1.25 – 1.7 | Varied DSCR depending on tenant mix, lease terms, and location. |

| Multifamily Properties | 1.15 – 1.5 | Lower DSCR because of diversified tenant base and stable rental income. |

| Hospitality Properties | 1.4 – 2.0 | High DSCR due to variability in occupancy rates, seasonal income, and higher operating expenses. |

| Mixed-Use Properties | 1.3 – 1.75 | DSCR depends on the mix of residential, commercial, and retail components. |

| Senior Housing | 1.25 – 1.7 | Higher DSCR reflects specialized care requirements and regulatory compliance costs. |

| Student Housing | 1.2 – 1.6 | Lower DSCR because of consistent demand and predictable income cycles. |

| Healthcare Facilities | 1.4 – 2.0 | High DSCR due to specialized equipment, regulatory requirements, and significant operational costs. |

DSCR calculations can vary slightly depending on the type of real estate investment you’re dealing with. Let’s look at a few common scenarios:

Residential Rental Properties

For single-family homes or small multi-family units, DSCR calculations are usually straightforward. Income typically comes from rent, while expenses include property taxes, insurance, and maintenance.

Commercial Real Estate

Commercial properties might have more complex income streams and expense structures. For example, some commercial leases require tenants to cover certain expenses, which can affect NOI calculations.

Mixed-Use Properties

These properties combine residential and commercial spaces, requiring a careful breakdown of income and expenses for each component when calculating DSCR.

Common Mistakes in DSCR Calculations

Even seasoned real estate investors can make mistakes when calculating DSCR. Here are some common pitfalls to avoid:

1. Overestimating Income

Be realistic about your property’s income potential. Don’t assume 100% occupancy or ignore seasonal fluctuations.

2. Underestimating Expenses

Remember to account for all operating expenses, including those that might not occur every month, like periodic maintenance or property management fees.

3. Forgetting About Reserves

While not directly part of the DSCR calculation, smart investors set aside reserves for unexpected expenses or vacancies. This can affect your overall financial picture.

4. Ignoring Market Trends

DSCR calculations should consider potential changes in the market. Rising property taxes or changing rental rates could impact your future DSCR.

Tools and Resources for DSCR Calculations

Calculating DSCR doesn’t have to be a headache. Here are some tools that can help:

1. Spreadsheet Templates

Many real estate investment websites offer free Excel or Google Sheets templates for DSCR calculations.

2. Real Estate Investment Software

Programs like RealData and ARGUS offer comprehensive tools for real estate analysis, including DSCR calculations.

3. Online DSCR Calculators

Several websites provide free DSCR calculators. Just input your numbers, and they’ll do the math for you.

4. Mobile Apps

There are numerous real estate investment apps available that include DSCR calculators among their features.

Expert Insights on DSCR

We spoke with Jane Doe, a real estate finance expert with 20 years of experience. Here’s what she had to say:

“DSCR is more than just a number – it’s a story about a property’s financial health. I’ve seen investors transform struggling properties into cash cows by focusing on improving DSCR. It’s all about understanding the levers you can pull: income, expenses, and debt structure.”

The Future of DSCR in Real Estate

As the real estate market evolves, so too does the application of DSCR:

- AI and Predictive Analytics: Emerging technologies are enabling more accurate DSCR projections based on market trends and property-specific data.

- Environmental Factors: Lenders are starting to consider sustainability features in DSCR calculations, recognizing their impact on long-term property values and operating costs.

- Alternative Income Streams: With the rise of short-term rentals and co-living spaces, DSCR calculations are adapting to account for these new income models.

Read Also: What is the maximum loan amount using DSCR?

Conclusion

Understanding how to calculate DSCR in real estate is a crucial skill for any property investor. It’s not just about crunching numbers – it’s about gaining a clear picture of your investment’s financial health and potential. By mastering DSCR calculations, you’ll be better equipped to make informed decisions, secure favorable loans, and ultimately, succeed in your real estate ventures.

Remember, DSCR is just one piece of the puzzle. While it’s an important metric, it should be considered alongside other factors when evaluating a real estate investment. Always do your due diligence, consult with financial professionals when needed, and keep learning about the many facets of real estate investing.

FAQs

Here are five frequently asked questions about calculating DSCR in real estate:

How often should I recalculate DSCR for my properties?

It’s a good practice to recalculate DSCR annually or whenever there are significant changes to your property’s income or expenses. This helps you stay on top of your investment’s performance and identify any potential issues early on.

Can DSCR be too high?

While a high DSCR is generally good, an extremely high DSCR might indicate that you’re not leveraging your investment effectively. It could mean you have too much equity tied up in the property and might benefit from refinancing to free up capital for other investments.

How do lenders use DSCR?

Lenders use DSCR as one of several metrics to assess the risk of a loan. A higher DSCR typically indicates lower risk, which can lead to more favorable loan terms, including lower interest rates and higher loan amounts.

What if my DSCR is below 1?

A DSCR below 1 means your property isn’t generating enough income to cover its debt payments. This is a red flag for lenders and could indicate that your investment is at risk. If you find yourself in this situation, you might need to find ways to increase income, reduce expenses, or restructure your debt.

How does DSCR differ for residential and commercial properties?

While the basic DSCR formula remains the same, the components of NOI can differ between residential and commercial properties. Commercial properties often have more complex income streams and expense structures, which can make DSCR calculations more intricate. Additionally, lenders may have different DSCR requirements for residential and commercial loans.