DSCR loans in Texas are investment property mortgages based on property income, not personal income. Key features:

- 20-25% down payment typically required

- Minimum 1.25 DSCR ratio

- Credit score 620+ often needed

- Easier qualification for investors

- Higher interest rates than traditional loans Learn more about DSCR loan options in Texas.

The Ultimate Guide to DSCR Loans in Texas: Requirements, Pros, and Cons

Understanding the financial landscape of property investments can be challenging, but Debt Service Coverage Ratio (DSCR) loans in Texas offer a viable option for investors. This comprehensive guide will walk you through everything you need to know about DSCR loans in Texas, from requirements and rates to the pros and cons. Let’s dive in!

Why Choose a DSCR Loan in Texas?

Texas, with its robust real estate market and favorable investment climate, is an ideal location for DSCR loans. Here are some reasons why investors opt for DSCR loans in Texas:

- Strong Rental Market: Texas cities like Houston, Dallas, and Austin have strong rental markets, making it easier to generate income from rental properties.

- Favorable Regulations: Texas has investor-friendly property laws and regulations.

- Economic Growth: The state’s economic growth ensures a stable investment environment.

DSCR Loan Requirements in Texas

Before applying for a DSCR loan in Texas, it’s crucial to understand the specific requirements. These generally include:

- Minimum DSCR: Most lenders require a minimum DSCR of 1.25, meaning the property’s net operating income must be 1.25 times the total debt service.

- Credit Score: A good credit score, typically 680 or higher, is essential.

- Down Payment: Usually, a 20-25% down payment is required.

- Property Appraisal: An independent appraisal to determine the property’s value and income potential.

- Income Proof: Proof of rental income or potential rental income.

How to Calculate DSCR

Calculating DSCR is straightforward: DSCR=Net Operating Income (NOI)Total Debt Service\text{DSCR} = \frac{\text{Net Operating Income (NOI)}}{\text{Total Debt Service}}DSCR=Total Debt ServiceNet Operating Income (NOI)

For example, if a property generates $150,000 in NOI and the annual debt service is $120,000: DSCR=150,000120,000=1.25\text{DSCR} = \frac{150,000}{120,000} = 1.25DSCR=120,000150,000=1.25

Pros and Cons of DSCR Loans in Texas

Pros

- Higher Loan Amounts: Due to the reliance on property income, borrowers can often qualify for larger loans.

- Flexible Income Verification: Unlike traditional loans, DSCR loans focus on the property’s income rather than the borrower’s personal income.

- Investment Focus: Ideal for investors looking to expand their portfolio.

Cons

- Higher Interest Rates: DSCR loans typically come with higher interest rates compared to conventional loans.

- Stricter Property Criteria: The property must meet specific income requirements, which can limit the type of properties you can invest in.

- Larger Down Payment: A significant down payment is often required, which can be a barrier for some investors.

DSCR Loan Rates in Texas

Interest rates for DSCR loans in Texas can vary based on several factors, including the borrower’s credit score, loan amount, and property type. Generally, you can expect rates to be higher than conventional loans, often ranging from 5% to 8%.

Factors Affecting DSCR Loan Rates in Texas

- DSCR Ratio: A higher DSCR ratio often results in better interest rates.

- Credit Score: While not as crucial as with traditional loans, your credit score still impacts your rate.

- Loan-to-Value Ratio: The amount you’re borrowing compared to the property’s value can affect your rate.

- Property Type: Different property types (single-family, multi-family, etc.) may have different rate structures.

Typical DSCR Loan Terms in Texas

DSCR loans in Texas often come with the following terms:

- Loan periods of 15, 20, or 30 years

- Fixed or adjustable rate options

- Interest-only payment options in some cases

It’s crucial to shop around and compare offers from different lenders to find the best terms for your specific situation.

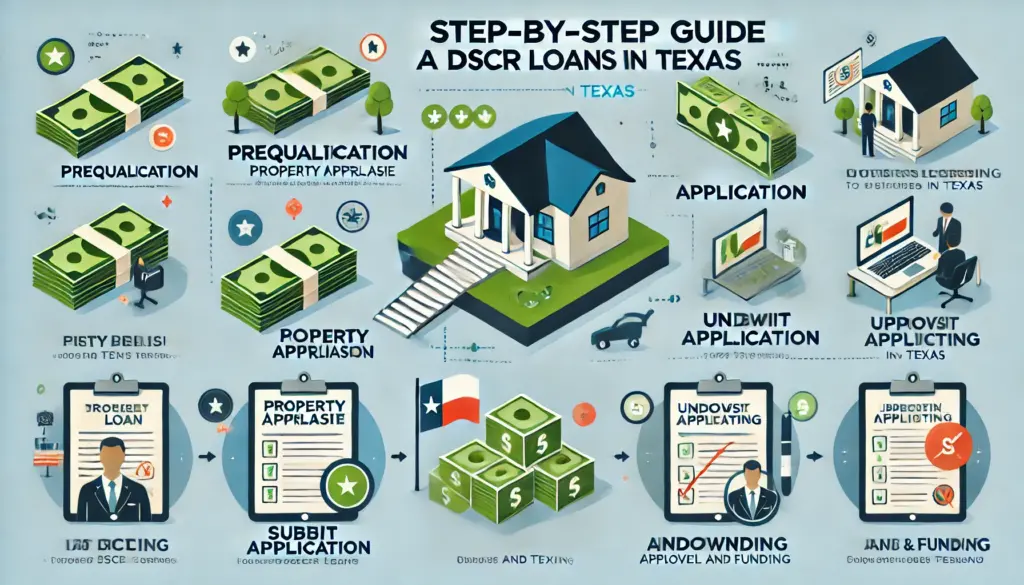

DSCR Loan Application Process

- Prequalification: Determine your eligibility and gather necessary documents.

- Property Appraisal: Get an independent appraisal to establish the property’s value.

- Submit Application: Complete the loan application with all required documentation.

- Underwriting: The lender reviews your application, credit score, and property appraisal.

- Approval and Funding: Upon approval, the loan is funded, and you can proceed with the property purchase.

Best DSCR Loan Lenders in Texas

When looking for DSCR loan lenders in Texas, consider the following top-rated lenders known for their favorable terms and customer service:

- Lender A: Specializes in investment properties with competitive rates.

- Lender B: Offers flexible terms and quick approval processes.

- Lender C: Known for excellent customer service and comprehensive loan options.

How to Apply for a DSCR Loan in Texas

Ready to apply for a DSCR loan in Texas? Here’s a step-by-step guide to help you through the process:

- Research Lenders: Look for banks and mortgage companies that offer DSCR loans in Texas. Compare their terms and rates.

- Gather Documentation: While less extensive than traditional loans, you’ll still need to provide property details, financial statements, and sometimes personal financial information.

- Calculate Your DSCR: Use the formula we discussed earlier to determine your property’s DSCR.

- Submit Your Application: Once you’ve chosen a lender, submit your application along with all required documentation.

- Property Appraisal: The lender will typically require an appraisal of the investment property.

- Underwriting: The lender will review your application and make a decision.

- Closing: If approved, you’ll proceed to closing, where you’ll sign the final documents and receive your loan.

Tips for Getting Approved for a DSCR Loan

- Maintain a Good Credit Score: Ensure your credit score is 680 or higher.

- Prepare Detailed Income Documentation: Provide clear proof of current or potential rental income.

- Choose the Right Property: Select properties with strong income potential to meet DSCR requirements.

- Work with Experienced Lenders: Choose lenders experienced in DSCR loans for smoother approval.

DSCR Loan Programs in Texas

Texas offers various DSCR loan programs tailored to different types of investors and properties. These programs include:

- New Construction Loans: For building new rental properties.

- Rehabilitation Loans: For renovating existing properties to increase income potential.

- Portfolio Loans: For investors with multiple properties looking to refinance or expand.

DSCR Loan Calculator

Using a DSCR loan calculator can help you estimate your loan eligibility and payments. Input your property’s net operating income and total debt service to get an estimate.

Read Also: Get Low-Rate DSCR Loans for Florida Investment Properties

Conclusion

DSCR loans in Texas present a valuable opportunity for real estate investors to finance income-generating properties. By understanding the requirements, benefits, and application process, you can leverage these loans to grow your investment portfolio. Remember to work with experienced lenders and choose properties with strong income potential to ensure success.

Common FAQs About DSCR Loans

What is a DSCR loan in Texas?

A DSCR loan in Texas is a type of financing for investment properties, based on the property’s ability to generate sufficient income to cover its debt obligations.

What is the minimum DSCR required for a loan in Texas?

The minimum DSCR required is typically 1.25, meaning the property’s income must be 1.25 times the debt service.

Can I get a DSCR loan with a low credit score?

A good credit score is essential for DSCR loans. Most lenders require a minimum score of 680.

Are DSCR loans available for new construction?

Yes, DSCR loans are available for new construction projects, provided the property can generate adequate income post-construction.

What is the typical interest rate for DSCR loans in Texas?

Interest rates for DSCR loans in Texas generally range from 5% to 8%, depending on various factors such as credit score and loan amount.