DSCR loans in New York offer investors flexible financing based on property income. Requirements include 1.25+ DSCR ratio, 75-80% LTV, and 640+ credit score. Popular for residential and commercial properties. Rates range from 5.5-8.5%. Benefits: easier qualification, larger loan amounts, and focus on property performance over personal income.

DSCR Loan New York: Unlocking Real Estate Investment Opportunities

Are you a real estate investor looking to expand your portfolio in the bustling New York market? If so, you’ve probably heard about DSCR loans. These unique financing options have been gaining popularity among savvy investors, and for good reason. In this comprehensive guide, we’ll dive deep into the world of DSCR loans in New York, exploring everything from the basics to the nitty-gritty details that could make or break your investment strategy.

What is a DSCR Loan?

Before we delve into the specifics of DSCR loans in New York, let’s start with the basics. DSCR stands for Debt Service Coverage Ratio, a crucial metric used by lenders to assess the financial health of a property investment. In simple terms, a DSCR loan is a type of financing where the property’s ability to generate income is the primary factor in loan approval, rather than the borrower’s personal income.

The DSCR Formula Explained

The DSCR is calculated by dividing the property’s net operating income by its total debt service:

DSCR = Net Operating Income / Total Debt Service

A DSCR of 1.0 or higher indicates that the property generates enough income to cover its debt obligations, making it an attractive prospect for lenders.

Why Choose a DSCR Loan in New York?

New York’s real estate market is known for its high property values and competitive investment landscape. DSCR loans offer several advantages that make them particularly appealing in this market:

- Focus on property performance: Unlike traditional loans, DSCR loans prioritize the property’s income potential over the borrower’s personal finances.

- Easier qualification: Investors with multiple properties or complex income structures may find it easier to qualify for DSCR loans.

- Potential for larger loan amounts: Since the property’s income is the key factor, investors may be able to secure larger loans compared to conventional financing options.

- Flexibility: DSCR loans can be used for various property types, from residential rentals to commercial real estate.

DSCR Loan Requirements in New York

| Requirement | Details |

|---|---|

| Minimum DSCR | Typically 1.25 or higher (varies by lender) |

| Loan-to-Value (LTV) Ratio | Up to 75-80% |

| Credit Score | Minimum 620 (varies by lender) |

| Property Types Eligible | Residential, commercial, and mixed-use properties |

| Minimum Loan Amount | Usually $100,000 or more |

| Maximum Loan Amount | Depends on lender, but often up to $5 million or more |

| Interest Rates | Generally higher than conventional loans; varies based on risk factors |

| Prepayment Penalties | May apply depending on lender’s terms |

| Amortization Period | Typically 25-30 years |

| Documentation Required | Income statements, property valuation, rent rolls, and business financials |

| Reserves Requirement | May require 6-12 months of reserves for loan approval |

| Occupancy Requirement | Investment properties typically require non-owner occupancy |

| Property Condition | Property must meet certain condition standards (e.g., no major repairs needed) |

| Closing Time | Usually takes 30-60 days from application to funding |

While DSCR loans offer more flexibility than traditional mortgages, there are still specific requirements you’ll need to meet when applying in New York:

Minimum DSCR Ratio

Most lenders in New York require a minimum DSCR of 1.25, meaning the property’s income should be at least 25% higher than its debt obligations. However, some lenders may offer more competitive rates for higher DSCR ratios.

Property Types

DSCR loans in New York are available for various property types, including:

- Single-family rentals

- Multi-family properties

- Apartment buildings

- Commercial properties

Loan-to-Value (LTV) Ratio

The maximum LTV ratio for DSCR loans in New York typically ranges from 75% to 80%. However, some lenders may offer DSCR loans with up to 90% LTV for well-qualified borrowers and high-performing properties.

Credit Score Requirements

While DSCR loans focus primarily on the property’s performance, your personal credit score still plays a role. Most New York lenders require a minimum credit score of 640, with better terms offered to borrowers with scores of 700 or higher.

DSCR Loan Interest Rates in New York

| Lender Name | Loan Type | Interest Rate (%) | Loan Term (Years) | Minimum DSCR | Max LTV | Comments |

|---|---|---|---|---|---|---|

| New York Finance Bank | Fixed Rate | 5.25 | 30 | 1.25 | 75% | No prepayment penalty |

| Empire State Lending | Adjustable Rate (ARM) | 4.75 | 5/1 ARM | 1.20 | 80% | Rate adjusts every 5 years |

| Metro NY Mortgage | Fixed Rate | 5.50 | 15 | 1.30 | 70% | Suitable for investment properties |

| Big Apple Lending | Fixed Rate | 5.15 | 20 | 1.25 | 75% | Special rates for multi-family units |

| Gotham City Loans | Adjustable Rate (ARM) | 4.85 | 7/1 ARM | 1.20 | 80% | Rate adjusts every 7 years |

| Hudson Valley Mortgage | Fixed Rate | 5.35 | 30 | 1.25 | 75% | Discount for first-time investors |

| Bronx Borough Banking | Fixed Rate | 5.45 | 25 | 1.30 | 70% | Focus on commercial properties |

Interest rates for DSCR loans in New York can vary widely depending on several factors:

- Property type and condition

- Loan amount and term

- DSCR ratio

- Borrower’s credit score and experience

As of 2024, DSCR loan interest rates in New York typically range from 5.5% to 8.5%. It’s important to note that these rates are generally higher than those for conventional mortgages due to the increased risk associated with investment properties.

Fixed vs. Adjustable Rates

When considering a DSCR loan in New York, you’ll have the option of choosing between fixed and adjustable rates:

- Fixed-rate DSCR loans offer stability and predictability, with interest rates remaining constant throughout the loan term.

- Adjustable-rate DSCR loans may start with lower initial rates but can fluctuate over time based on market conditions.

Best DSCR Lenders in New York

Finding the right lender is crucial to securing the best terms for your DSCR loan. Here are some of the top DSCR lenders operating in New York:

- Finger Lending Corp: A local lender with extensive experience in the New York market.

- National DSCR Lenders: Many nationwide lenders offer competitive DSCR loan products in New York.

- Online DSCR Loan Providers: Digital lenders often provide quick approvals and competitive rates.

When choosing a lender, consider factors such as:

- Interest rates and fees

- Loan terms and flexibility

- Customer service and reputation

- Experience with New York real estate market

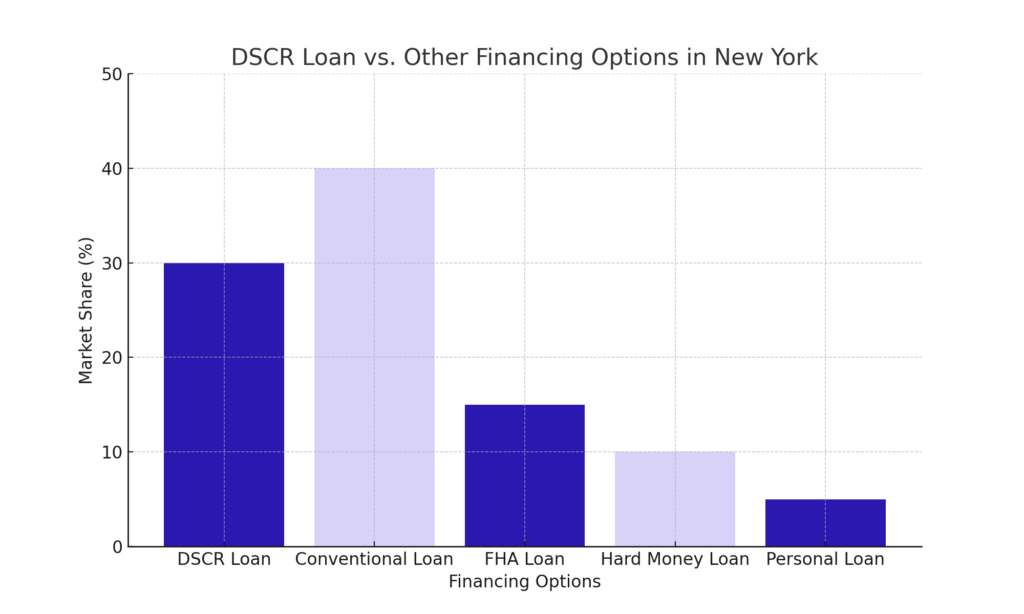

DSCR Loan vs Other Financing Options in New York

To help you make an informed decision, let’s compare DSCR loans to other popular financing options available in New York:

DSCR Loans vs. FHA Loans

While FHA loans are popular for first-time homebuyers, they’re not typically used for investment properties. DSCR loans offer more flexibility for investors, but FHA loans may provide lower down payment options for owner-occupied properties.

DSCR Loans vs. Conventional Mortgages

Conventional mortgages often have stricter income and credit requirements compared to DSCR loans. However, they may offer lower interest rates for highly qualified borrowers.

DSCR Loans vs. Hard Money Loans

Hard money loans, often provided by private lenders, can be easier to obtain but typically come with higher interest rates and shorter terms compared to DSCR loans.

Maximizing Your DSCR Loan in New York

To make the most of your DSCR loan and increase your chances of approval, consider these strategies:

- Boost your property’s income: Implement strategies to increase rental income, such as renovations or adding amenities.

- Reduce operating expenses: Find ways to lower costs without compromising property quality or tenant satisfaction.

- Improve your credit score: While not the primary factor, a higher credit score can help you secure better loan terms.

- Build a strong investment track record: Lenders favor experienced investors with a history of successful property management.

DSCR Loan Application Process in New York

Ready to apply for a DSCR loan in New York? Here’s a step-by-step guide to help you navigate the process:

- Gather necessary documents: Prepare property financial statements, rent rolls, and personal financial information.

- Research and compare lenders: Shop around to find the best rates and terms for your specific situation.

- Submit your application: Provide all required information and documentation to your chosen lender.

- Property appraisal: The lender will order an appraisal to determine the property’s value and income potential.

- Underwriting: The lender reviews your application and makes a decision.

- Closing: If approved, you’ll sign the final loan documents and receive funding.

DSCR Loans for Different Property Types in New York

Let’s take a deeper dive into how DSCR loans can be applied to various property types in the New York market, exploring the unique challenges and opportunities each presents:

Residential Rental Properties

DSCR loans are particularly popular for single-family and multi-family rental properties in New York’s competitive housing market. They allow investors to capitalize on the city’s high rental demand without being constrained by traditional income requirements.

Single-Family Rentals

- Opportunities: Lower entry costs, easier management, potential for higher appreciation in desirable neighborhoods.

- Challenges: Higher per-unit maintenance costs, more vulnerability to vacancies.

- DSCR Considerations: Lenders typically require higher DSCR ratios (1.25 or above) due to the reliance on a single tenant.

Multi-Family Properties

- Opportunities: Economies of scale, diversified income streams, potential for value-add improvements.

- Challenges: More complex management, stricter regulations (especially in NYC).

- DSCR Considerations: Some lenders may accept lower DSCR ratios (1.15-1.20) due to the reduced vacancy risk.

Commercial DSCR Loans

For those looking to invest in New York’s commercial real estate sector, DSCR loans offer a viable financing option. These loans can be used for office buildings, retail spaces, and mixed-use properties, allowing investors to tap into the city’s diverse commercial landscape.

Office Buildings

- Opportunities: Long-term leases, potential for high-quality tenants.

- Challenges: Changing work patterns post-COVID, higher fit-out costs.

- DSCR Considerations: Lenders may require higher DSCR ratios (1.30+) and more substantial reserves due to market volatility.

Retail Spaces

- Opportunities: High foot traffic in urban areas, potential for percentage rent clauses.

- Challenges: E-commerce competition, cyclical nature of retail.

- DSCR Considerations: Some lenders may require DSCR ratios of 1.35 or higher, especially for properties with single tenants.

Mixed-Use Properties

- Opportunities: Diversified income streams, potential for rezoning and value-add.

- Challenges: Complex management, varying regulations for different use types.

- DSCR Considerations: Lenders often view these favorably due to diversification, potentially accepting DSCR ratios around 1.25.

DSCR Loans for Manufactured Homes

While less common, some lenders in New York do offer DSCR loans for manufactured homes. These properties can provide an affordable investment option in certain areas of the state.

- Opportunities: Lower purchase prices, potential for higher yields.

- Challenges: Depreciation concerns, limited appreciation potential.

- DSCR Considerations: Lenders may require higher down payments and DSCR ratios (1.35+) due to perceived higher risk.

Case Studies: Successful DSCR Loan Investments in New York

To illustrate the real-world application of DSCR loans in New York, let’s examine three case studies of successful investments:

Case Study 1: Brooklyn Multi-Family Renovation

- Property: 4-unit brownstone in Bedford-Stuyvesant

- Purchase Price: $1.2 million

- Renovation Budget: $300,000

- DSCR Loan Details:

- Loan Amount: $1.125 million (75% LTV)

- Interest Rate: 6.25% (30-year fixed)

- DSCR Ratio: 1.30

The investor used the DSCR loan to purchase and renovate the property, updating units and common areas. Post-renovation, the increased rents boosted the DSCR to 1.45, allowing for a cash-out refinance to fund their next investment.

Case Study 2: Manhattan Mixed-Use Property

- Property: 3-story building with ground-floor retail and two residential units above

- Purchase Price: $3.5 million

- DSCR Loan Details:

- Loan Amount: $2.45 million (70% LTV)

- Interest Rate: 5.75% (5-year ARM)

- DSCR Ratio: 1.25

The investor leveraged the property’s prime location and diverse income streams to secure favorable loan terms. The stable retail tenant and high-demand residential units provided consistent cash flow, exceeding initial DSCR projections.

Case Study 3: Albany Single-Family Rental Portfolio

- Property: Portfolio of 10 single-family homes

- Total Purchase Price: $1.5 million

- DSCR Loan Details:

- Loan Amount: $1.125 million (75% LTV)

- Interest Rate: 6.5% (30-year fixed)

- DSCR Ratio: 1.35

The investor used a blanket DSCR loan to finance the entire portfolio, benefiting from economies of scale. The diverse locations within Albany helped mitigate vacancy risks, and the strong local rental market supported a healthy DSCR.

Detailed Comparison of DSCR Lenders in New York

To help you navigate the DSCR lending landscape in New York, here’s a more detailed comparison of some prominent lenders:

1. Finger Lending Corp

- Loan Amounts: $100,000 – $5 million

- DSCR Requirement: 1.20+

- LTV: Up to 80%

- Rates: Starting at 5.5%

- Unique Offering: Specializes in NYC borough properties

2. CoreVest

- Loan Amounts: $250,000 – $25 million

- DSCR Requirement: 1.25+

- LTV: Up to 75%

- Rates: Starting at 5.75%

- Unique Offering: Bridge-to-DSCR loan options

3. Lima One Capital

- Loan Amounts: $75,000 – $3 million

- DSCR Requirement: 1.20+

- LTV: Up to 80%

- Rates: Starting at 6%

- Unique Offering: 30-year fixed rate options

4. Visio Lending

- Loan Amounts: $100,000 – $2 million

- DSCR Requirement: 1.15+

- LTV: Up to 80%

- Rates: Starting at 6.25%

- Unique Offering: Loans for short-term rental properties

5. Arbor Realty Trust

- Loan Amounts: $1 million – $7.5 million

- DSCR Requirement: 1.25+

- LTV: Up to 80%

- Rates: Starting at 5.5%

- Unique Offering: Specializes in multi-family and commercial properties

When choosing a lender, consider factors beyond just rates and terms. Look at their experience with your property type, their understanding of the New York market, and their reputation for customer service and closing efficiency.

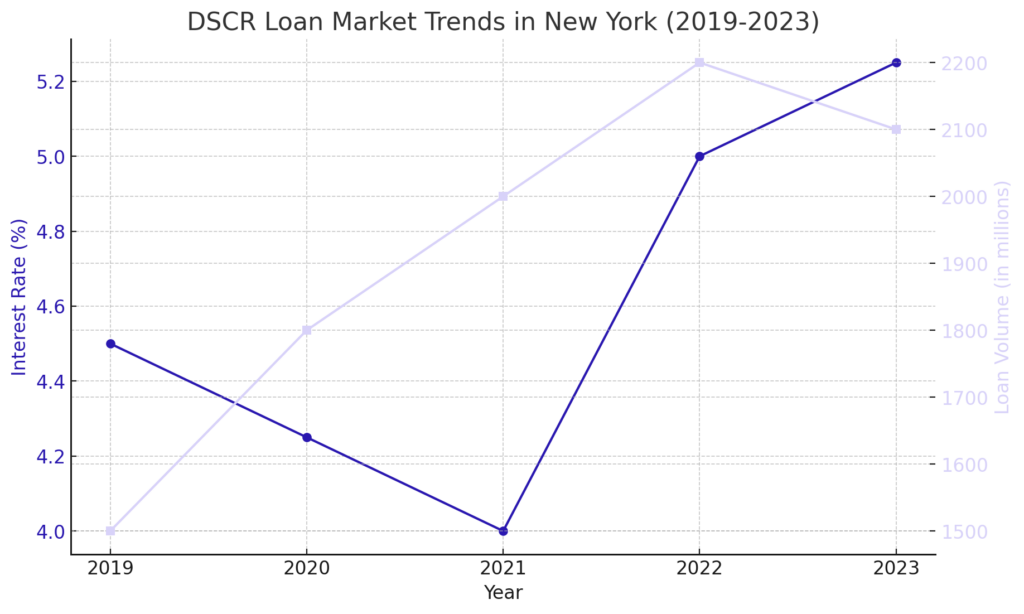

DSCR Loan Market Trends in New York

As the New York real estate market continues to evolve, several trends are shaping the DSCR loan landscape:

- Increased competition among lenders, potentially leading to more favorable terms for borrowers

- Growing popularity of DSCR loans for short-term rental properties, especially in tourist-heavy areas

- Rise of fintech lenders offering streamlined application processes and quicker approvals

- Increased focus on eco-friendly and energy-efficient properties, with some lenders offering better terms for “green” investments

- Adaptation to post-COVID market realities, including more flexible terms for office and retail properties

Staying informed about these trends can help you make strategic decisions about when and how to leverage DSCR loans for your New York real estate investments.

The Future of DSCR Loans in New York

As the New York real estate market continues to evolve, DSCR loans are likely to play an increasingly important role in investment strategies. Here are some trends to watch:

- Increased competition among lenders, potentially leading to more favorable terms for borrowers

- Integration of technology to streamline the application and approval process

- Growing popularity of DSCR loans for short-term rental properties, such as Airbnb investments

- Potential regulatory changes that could impact DSCR loan availability and terms

Read Also: How to Calculate DSCR for Rental Property: A Beginner’s Guide

Conclusion

DSCR loans offer a unique and powerful financing tool for real estate investors in New York. By focusing on property performance rather than personal income, these loans open up new possibilities for expanding your investment portfolio in one of the world’s most dynamic real estate markets. Whether you’re a seasoned investor or just starting out, understanding the ins and outs of DSCR loans can give you a significant advantage in New York’s competitive landscape.

Remember to carefully consider your investment goals, research potential lenders, and consult with financial professionals before committing to a DSCR loan. With the right approach and a solid understanding of the market, DSCR loans can be the key to unlocking lucrative real estate opportunities in the Empire State.

Frequently Asked Questions

What is the minimum loan amount for DSCR loans in New York?

The minimum loan amount for DSCR loans in New York can vary by lender, but it typically ranges from $100,000 to $150,000. Some lenders may have higher minimums, especially for commercial properties or larger multi-family investments.

Can I get a DSCR loan with bad credit in New York?

While it’s possible to obtain a DSCR loan with less-than-perfect credit, most lenders in New York prefer borrowers with credit scores of 640 or higher. If your credit score is lower, you may face higher interest rates or need to demonstrate stronger property performance to qualify.

Are there 40-year DSCR loans available in New York?

Yes, some lenders in New York offer 40-year DSCR loans. These longer-term loans can provide lower monthly payments, potentially improving your DSCR. However, they may come with slightly higher interest rates compared to shorter-term options.

How does a DSCR loan differ from a USDA loan in NYC?

DSCR loans and USDA loans serve different purposes and borrowers. DSCR loans are primarily for investment properties and focus on the property’s income potential. USDA loans, on the other hand, are designed for owner-occupied homes in rural areas and offer low or no down payment options. USDA loans are not typically available in New York City due to population density requirements.

Can I use a DSCR loan for a property I plan to live in part-time?

Generally, DSCR loans are intended for investment properties rather than primary residences or vacation homes. However, some lenders may offer flexibility for mixed-use properties or situations where you occupy a portion of a multi-unit property. It’s best to discuss your specific situation with potential lenders to understand your options.