DSCR loans in Maryland offer real estate investors financing based on property income, not personal finances. Benefits include larger loan amounts, portfolio expansion, and flexibility across property types. Requirements typically include a 1.25 DSCR, 640+ credit score, and property-specific criteria. Rates range from 5.5% to 8.5%.

DSCR Loans in Maryland: The Ultimate Guide for Real Estate Investors

Are you a real estate investor looking to expand your portfolio in the beautiful state of Maryland? If so, you’ve likely heard about DSCR loans. But what exactly are DSCR loans in Maryland, and how can they benefit your investment strategy? In this comprehensive guide, we’ll explore everything you need to know about Maryland DSCR loans, from the basics to advanced strategies.

Understanding DSCR Loans Maryland: The Basics

DSCR, or Debt Service Coverage Ratio, is a crucial metric in real estate financing. DSCR loans in Maryland are becoming increasingly popular among savvy investors. But what sets them apart?

What Are DSCR Loans Maryland?

DSCR loans in Maryland are a type of financing that focuses on the property’s income potential rather than the borrower’s personal income. This unique approach makes them an attractive option for many investors.

Types of DSCR Loans Maryland: Finding the Right Fit

| DSCR Loan Maryland | Standard DSCR loans available in Maryland for various purposes. |

| DSCR Loans Maryland | Multiple DSCR loan options tailored for Maryland borrowers. |

| DSCR Loan Maryland Requirements | Specific requirements and qualifications for obtaining a DSCR loan in Maryland. |

| DSCR Loan 10 Down Payment | DSCR loans requiring a 10% down payment. |

| DSCR Loan Cash Out Refinance | DSCR loans allowing for cash-out refinancing options. |

| Can You Refinance a DSCR Loan | Information about refinancing existing DSCR loans. |

| Best DSCR Lenders 2023 | Top-rated DSCR lenders for the year 2023. |

| Who Offers DSCR Loans | List of lenders offering DSCR loans. |

| 10 Down DSCR Loan | DSCR loans with a 10% down payment option. |

| DSCR Loan Rates Today | Current interest rates for DSCR loans. |

| Best DSCR Loan Rates | Information on the best available rates for DSCR loans. |

| Best DSCR Loan Companies | Leading companies providing DSCR loans. |

| DSCR Loan Companies | Various companies that offer DSCR loans. |

| Best DSCR Loan Lenders | Top lenders specializing in DSCR loans. |

DSCR loans in Maryland come in various forms to suit different investment strategies and property types. Let’s explore some common options:

DSCR Loan for Investment Property: Residential Focus

Many investors in Maryland use DSCR loans for residential investment properties. These can include:

- Single-family homes

- Duplexes

- Triplexes

- Quadplexes

The DSCR loan requirements for Maryland residential properties are often more lenient than those for commercial properties, making them an excellent starting point for new investors.

DSCR Loan for Multi-Family Property: Scaling Up

For those looking to scale their investments, DSCR loans for multi-family properties in Maryland can be an excellent option. Benefits include:

- Higher potential income

- Economies of scale in management

- Reduced risk through diversification of tenants

Multi-family DSCR loans in Maryland often require a slightly lower DSCR ratio, typically around 1.20, due to the stability of income from multiple units.

DSCR Loan for Commercial Property: Expanding Horizons

Maryland’s diverse economy offers numerous opportunities for commercial real estate investment. DSCR loans for commercial properties can help you capitalize on these opportunities. Consider:

- Office spaces in Baltimore or Bethesda

- Retail locations in Columbia or Annapolis

- Industrial properties near major transportation hubs

Keep in mind that DSCR loan requirements for commercial properties in Maryland are often stricter, with many lenders requiring a DSCR of 1.30 or higher.

DSCR Loan Requirements Maryland: What You Need to Know

| Requirement | Description |

|---|---|

| Minimum DSCR Ratio | The minimum Debt Service Coverage Ratio required to qualify for a DSCR loan in Maryland. |

| Credit Score | The minimum credit score required for applicants. |

| Down Payment | The minimum down payment percentage required. |

| Property Type | Types of properties eligible for DSCR loans (e.g., residential, commercial, mixed-use). |

| Loan Amount | The minimum and maximum loan amounts available. |

| Income Documentation | Required documentation for verifying income and financial stability. |

| Employment History | Minimum length of employment history required for applicants. |

| Reserve Requirements | The amount of reserves or savings required to qualify for a DSCR loan. |

| Debt-to-Income Ratio (DTI) | Acceptable debt-to-income ratio for applicants. |

| Property Appraisal | Requirement for property appraisal to determine its market value. |

| Loan-to-Value Ratio (LTV) | Maximum allowable loan-to-value ratio. |

| Mortgage Insurance | Requirement for mortgage insurance, if applicable. |

| Closing Costs | Estimated closing costs and fees associated with obtaining the loan. |

| Prepayment Penalties | Information on any prepayment penalties that may apply. |

| Documentation Requirements | List of necessary documents, such as tax returns, bank statements, and identification. |

Before diving into DSCR loans, it’s essential to understand the requirements:

- Property Type: Typically residential properties with 1-4 units

- Minimum DSCR: Usually 1.25, though some lenders may accept lower

- Credit Score: Often 640+, but less critical than in traditional loans

- Down Payment: Can vary, with some lenders offering options as low as 10%

- Loan-to-Value Ratio: Typically ranges from 75% to 80%.

- Reserves: Many lenders require 6-12 months of loan payments in reserves.

Benefits of DSCR Loans for Maryland Investors

DSCR loans offer several advantages for investors in the Maryland real estate market:

- Simplified Approval Process: With less focus on personal income, the approval process can be quicker and more straightforward.

- Higher Loan Amounts: Investors can often secure larger loans based on the property’s income potential.

- Scalability: It’s easier to grow your portfolio as you’re not limited by your personal income.

- Flexibility: Some lenders offer interest-only options, allowing for lower monthly payments.

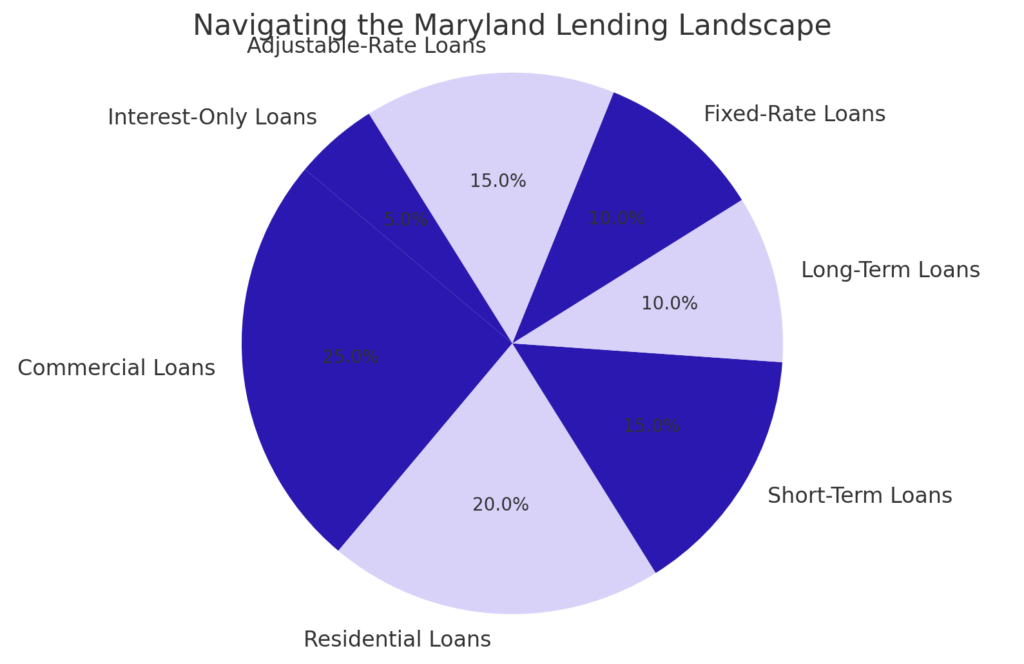

Navigating the Maryland Lending Landscape

When it comes to securing a DSCR loan in Maryland, you have several options. From traditional banks to specialized lenders, the choices can seem overwhelming. Let’s break it down:

Top DSCR Lenders in Maryland

While we can’t endorse specific lenders, it’s worth noting that many national and local institutions offer DSCR loans in Maryland. Some of the best DSCR loan companies have a strong presence in the state, offering competitive rates and terms.

Maryland Hard Money Lenders: An Alternative Option

For investors looking for quick financing or those dealing with properties that don’t meet traditional lending criteria, Maryland hard money lenders can be a viable option. These lenders typically offer short-term, high-interest loans based primarily on the property’s value.

Loan Companies in Maryland: Exploring Your Options

Beyond DSCR and hard money lenders, Maryland boasts a diverse array of loan companies. From large national banks to local credit unions, you’ll find a wide range of options to suit your investment needs.

DSCR Loan Calculator: A Valuable Tool for Investors

Using a DSCR loan calculator is essential when evaluating potential investments in Maryland. Here’s how to make the most of this tool:

- Input accurate property income and expense data

- Use realistic interest rate estimates

- Account for vacancy rates typical in your target Maryland market

- Consider different down payment scenarios

By using a DSCR loan calculator, you can quickly assess whether a Maryland property meets the minimum DSCR requirements and estimate your potential return on investment.

DSCR Loan for Investment Property: Maximizing Your Portfolio

One of the key advantages of DSCR loans in Maryland is their suitability for investment properties. Whether you’re looking at single-family homes in Baltimore or multi-family units in Annapolis, DSCR loans can help you expand your portfolio.

DSCR Loan for Multi-Family Property

Multi-family properties are often favored for DSCR loans due to their stable income potential.

- Pros: Higher potential income, economies of scale in management

- Cons: Larger initial investment, more complex management

DSCR requirements may be slightly lower for multi-family properties, often around 1.20.

DSCR Loan for Commercial Property

DSCR loans for commercial properties in Maryland can be an excellent option for investors looking to diversify their portfolio.

- Pros: Potentially higher returns, longer lease terms

- Cons: More significant market fluctuations, specialized management needs

Lenders typically require a higher DSCR for commercial properties, often 1.30 or above.

DSCR Loan for Industrial Property

Industrial real estate can offer unique opportunities for DSCR loan investors in Maryland.

- Pros: Long-term leases, lower maintenance costs

- Cons: Higher vacancy risk, market-dependent performance

DSCR requirements for industrial properties are often similar to commercial properties, around 1.25 to 1.35.

DSCR Loan Refinance: Optimizing Your Existing Investments

Already have investment properties in Maryland? A DSCR loan refinance might help you optimize your portfolio. Benefits of refinancing with a DSCR loan include:

- Potentially lower interest rates

- Improved cash flow

- Access to equity for further investments

DSCR Loan Cash Out: Leveraging Equity

A DSCR loan cash out refinance allows Maryland investors to tap into their property’s equity. This can be particularly beneficial in areas with strong appreciation, such as parts of Montgomery County or Howard County. Use the funds for:

- Property improvements

- Down payments on additional investments

- Diversification into other Maryland markets

Tax Implications of DSCR Loans

Understanding the tax implications of DSCR loans is crucial for maximizing your investment returns in Maryland.

Potential Tax Benefits

- Interest Deductions: The interest paid on DSCR loans is typically tax-deductible as a business expense.

- Depreciation: You can depreciate the property over time, providing significant tax benefits.

- Operating Expenses: Costs associated with managing and maintaining the property are generally deductible.

Tax Considerations

- Capital Gains: Profits from property sales may be subject to capital gains tax.

- Passive Activity Rules: Rental income is generally considered passive, which may limit your ability to deduct losses against other income.

- State-Specific Rules: Maryland has its own tax laws that may affect your investment strategy.

Always consult with a tax professional familiar with Maryland real estate investment to optimize your tax strategy.

DSCR Loan Tax Benefits: Maximizing Your Returns

Understanding the tax implications of your DSCR loan can significantly impact your bottom line. In Maryland, investors should be aware of:

- State-specific tax deductions and credits

- How rental income is taxed at the state level

- Maryland’s property tax rates, which can vary significantly by county

Always consult with a tax professional familiar with Maryland real estate investment to ensure you’re maximizing your tax benefits.nsult with a tax professional familiar with Maryland real estate investment to optimize your tax strategy.

DSCR Loan Rates Maryland: Understanding the Numbers

DSCR Loan Rates in Maryland:

| Rate Type | Description |

|---|---|

| Fixed DSCR Loan Rates | Interest rates that remain constant throughout the loan term. |

| Variable DSCR Loan Rates | Interest rates that can fluctuate based on market conditions. |

| Current DSCR Loan Rates | The most up-to-date interest rates available for DSCR loans. |

| Best DSCR Loan Rates | The lowest available interest rates offered by lenders. |

| Average DSCR Loan Rates | The average interest rates typically offered to borrowers. |

| Promotional DSCR Loan Rates | Special interest rates offered during promotional periods. |

| Long-Term DSCR Loan Rates | Interest rates for loans with longer terms, typically over 10 years. |

| Short-Term DSCR Loan Rates | Interest rates for loans with shorter terms, typically under 10 years. |

| Jumbo DSCR Loan Rates | Interest rates for larger loan amounts that exceed conventional limits. |

| Conforming DSCR Loan Rates | Interest rates for loan amounts that meet conventional loan limits. |

| Refinance DSCR Loan Rates | Interest rates for refinancing existing DSCR loans. |

| Cash-Out Refinance DSCR Rates | Interest rates for cash-out refinancing options. |

| Interest-Only DSCR Loan Rates | Rates for DSCR loans that initially require interest-only payments. |

| Adjustable-Rate DSCR Loans | DSCR loans with interest rates that adjust periodically based on an index. |

| Discounted DSCR Loan Rates | Lower interest rates offered through discount points or other incentives. |

While DSCR loan rates in Maryland are generally higher than traditional mortgage rates, they offer more flexibility and potential for investors. Factors affecting your rate include:

- Property type and location

- Loan-to-value ratio

- DSCR

- Credit score

- Loan term

To get the best DSCR loan rates in Maryland, it’s crucial to shop around and compare offers from multiple lenders.

DSCR Loan Rates Maryland: What to Expect

While DSCR loan rates in Maryland may be slightly higher than traditional mortgages, they often come with more flexible terms. Current rates typically range from 5.5% to 8.5%, depending on various factors.

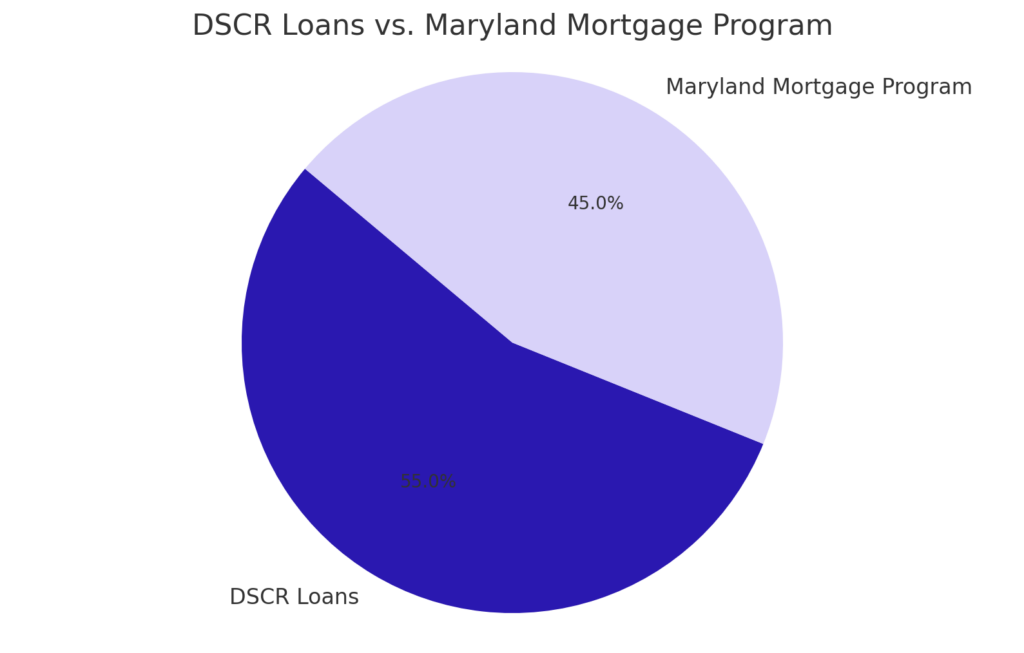

Maryland Mortgage Program Interest Rates: A Comparison

While DSCR loans are excellent for investment properties, it’s worth comparing them to other options like the Maryland Mortgage Program. This state-run initiative offers competitive interest rates for primary residences.

DSCR Loans vs. Maryland Mortgage Program

- Purpose: DSCR loans are for investment properties, while the Maryland Mortgage Program is for primary residences.

- Eligibility: The Maryland Mortgage Program has income and purchase price limits, while DSCR loans focus on the property’s income potential.

- Interest Rates: Maryland Mortgage Program rates are often lower but come with more stringent requirements.

DSCR Loan Property Management: Keys to Success in Maryland

Effective property management is crucial for maintaining a healthy DSCR and ensuring long-term investment success in Maryland. Consider:

- Familiarizing yourself with Maryland’s landlord-tenant laws

- Understanding local market trends in different Maryland regions

- Implementing efficient systems for rent collection and maintenance requests

- Regularly reviewing and adjusting rental rates to stay competitive

Whether you self-manage or hire a professional property management company, staying informed about Maryland’s real estate market is essential for success with DSCR loans.

The Importance of Professional Management

- Maintaining DSCR: Good management ensures consistent rental income, helping you maintain a favorable DSCR.

- Regulatory Compliance: Professional managers stay updated on Maryland’s landlord-tenant laws and local regulations.

- Efficient Operations: Skilled managers can often reduce operating costs, improving your net operating income.

DIY vs. Professional Management

While managing properties yourself can save money, it’s essential to consider the time commitment and expertise required. For many investors, especially those with multiple properties, professional management is well worth the cost.

Maryland-Specific Management Considerations

- Seasonal Rentals: In coastal areas like Ocean City, managing seasonal rentals requires specialized knowledge.

- Urban vs. Rural Properties: Management needs can vary significantly between Baltimore’s urban landscape and Maryland’s rural areas.

- Student Housing: Areas near universities may require managers experienced in dealing with student tenants.

By understanding these aspects of DSCR loans, you’ll be better equipped to make informed decisions and maximize your real estate investment success in Maryland.

DSCR Loan Alternatives for Maryland Investors

While DSCR loans offer many advantages, they’re not the only option for real estate investors in Maryland. Consider these alternatives:

- Hard Money Loans: Ideal for short-term financing or properties that need significant renovation.

- Private Money Lenders: Can offer more flexible terms but often at higher interest rates.

- Conventional Mortgages: May be suitable for investors with strong personal income and credit.

- FHA Loans: For owner-occupied multi-unit properties (up to 4 units).

Each option has its pros and cons, so it’s essential to evaluate which best suits your investment strategy and financial situation.

Read Also: 10 Best DSCR Loan Illinois: Skyrocket Your Chicago & Peoria Real Estate Profits (2024 Guide)

Conclusion: Harnessing the Power of DSCR Loans in Maryland

As we’ve explored throughout this comprehensive guide, DSCR loans offer a powerful financing tool for real estate investors in Maryland. From Baltimore’s urban landscape to the serene Chesapeake Bay area, these loans can help you unlock the potential of various property types across the state.

Let’s recap the key benefits of DSCR loans for Maryland investors:

- Focus on property income rather than personal finances

- Potential for larger loan amounts and portfolio expansion

- Flexibility across residential, multi-family, and commercial properties

- Options for low down payments, increasing accessibility

- Opportunities for refinancing and cash-out to optimize investments

While DSCR loans in Maryland offer numerous advantages, it’s crucial to approach them with careful consideration. Factors such as slightly higher interest rates and the importance of maintaining a healthy debt service coverage ratio require diligent planning and management.

As you contemplate your real estate investment journey in Maryland, we encourage you to take the next step. Consult with a mortgage professional specializing in DSCR loans in Maryland. They can provide personalized advice based on your unique financial situation and investment goals, helping you navigate the diverse opportunities in Maryland’s real estate market.

Armed with the knowledge from this guide and professional advice, you’ll be well-equipped to leverage DSCR loans for success in Maryland’s dynamic property market. Here’s to your prosperous investing future in the Old Line State!

FAQs: DSCR Loans in Maryland

To address common questions about DSCR loans in Maryland, we’ve compiled this FAQ section:

What is the minimum DSCR required for a loan in Maryland?

Most lenders in Maryland typically require a minimum DSCR of 1.25. This means the property’s income should be at least 25% higher than the debt payments. However, requirements can vary based on property type and lender policies.

Can I use a DSCR loan for a vacation rental property in Maryland?

Yes, many lenders offer DSCR loans for vacation rental properties in Maryland, including popular areas like Ocean City or Deep Creek Lake. Be prepared to demonstrate consistent rental income, as lenders may scrutinize seasonal properties more closely.

Are DSCR loans available for first-time investors in Maryland?

Absolutely! While some experience can be beneficial, many lenders offer DSCR loans to first-time investors in Maryland. The key is having a property with strong income potential that meets the lender’s DSCR requirements.

How do DSCR loan rates in Maryland compare to conventional mortgage rates?

DSCR loan rates in Maryland are typically slightly higher than conventional mortgage rates. This reflects the increased risk for lenders. However, the trade-off often includes more flexible terms and the ability to qualify based on property income rather than personal income.

Can I refinance my existing Maryland investment property with a DSCR loan?

Yes, many investors use DSCR loans to refinance their existing Maryland investment properties. This can potentially lower your interest rate, improve cash flow, or allow you to access equity for further investments.