DSCR loans in Illinois finance investment properties based on property income, not personal income. Qualify with a 620+ credit score, 20-25% down payment, and 1.25+ DSCR. Ideal for Chicago, Peoria, and Springfield investors seeking higher loan amounts and faster approvals.

DSCR Loan Illinois: Unlocking Real Estate Investment Opportunities

Are you a real estate investor looking to expand your portfolio in the Land of Lincoln? Or perhaps you’re a first-time investor eyeing the lucrative Illinois property market? Either way, you’ve likely come across the term “DSCR loan” in your research. Discover how DSCR loans in Illinois can boost your real estate success. We cover benefits, requirements, and tips for investing in Chicago, Peoria, and Springfield.

Understanding DSCR Loans: The Gateway to Illinois Real Estate Investment

Let’s start by explaining DSCR loans and how they work for Illinois real estate investing. This info will help you understand why they’re important.

What is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio. DSCR loans care about how much money a property can make, not how much you earn. They’re for buying investment properties. Illinois real estate investors like DSCR loans. They help if you can’t get traditional mortgages because your income is tricky or you own many properties.

How Does a DSCR Loan Work in Illinois?

The DSCR is calculated by dividing the property’s net operating income by its annual debt obligations. Lenders check if the property makes enough money to pay its mortgage and other costs. Most Illinois lenders like a DSCR of 1.25 or higher. This applies whether you’re buying in busy Chicago or smaller cities like Peoria or Springfield.

DSCR Loan Illinois: A Game-Changer for Investors

Let’s see why DSCR loans are getting popular in Illinois. We’ll look at how they help investors in different parts of the state.

The Illinois Real Estate Market: Prime Opportunities Across the State

Illinois has many places to invest. You can buy in big city Chicago or growing towns like Peoria and Springfield. Each city presents unique advantages for real estate investors:

- Chicago: Known for its strong rental market and diverse neighborhoods, Chicago offers opportunities in both residential and commercial real estate.

- Peoria: This central Illinois city boasts a stable economy and affordable real estate prices, making it attractive for long-term investments.

- Springfield: As the state capital, Springfield offers a mix of government-related housing needs and a growing private sector, creating diverse investment opportunities.

DSCR Loan Illinois Requirements

| Requirement | Details |

|---|---|

| Minimum DSCR Ratio | Typically 1.25 or higher (varies by lender). |

| Credit Score | Usually 620 or higher; however, higher scores are preferred for better terms. |

| Income Documentation | Recent tax returns, pay stubs, or financial statements to prove income. |

| Property Type | Residential or commercial property, depending on the lender’s guidelines. |

| Down Payment | Varies, but generally 20% or more of the property’s purchase price. |

| Employment Verification | Proof of stable employment or business income, including recent pay stubs or tax returns. |

| Loan Purpose | Purchase, refinance, or cash-out refinance (must meet specific requirements for each purpose). |

| Debt-to-Income Ratio | Typically, the total debt-to-income ratio should not exceed 43%, but requirements can vary. |

| Property Appraisal | A current appraisal of the property is usually required to determine value. |

| Loan Term | Commonly 15, 20, or 30 years, depending on the lender’s offerings. |

| Reserve Requirements | Lenders may require reserves equivalent to a certain number of months of mortgage payments. |

| Documentation of Assets | Bank statements, investment accounts, and other proof of assets. |

It provides a general overview. Specific requirements can vary based on the lender and the borrower’s financial situation.

Understanding the requirements for DSCR loans in Illinois is crucial for investors. While these may vary slightly between lenders, common DSCR loan Illinois requirements include:

- A minimum credit score (typically 620-640)

- A down payment of 20-25% of the property value

- A DSCR of at least 1.25

- The property must be an investment property (not owner-occupied)

- Cash reserves to cover several months of mortgage payments

DSCR loans have easier rules than conventional loans. This makes them good for Illinois investors in Chicago, Peoria, and Springfield.

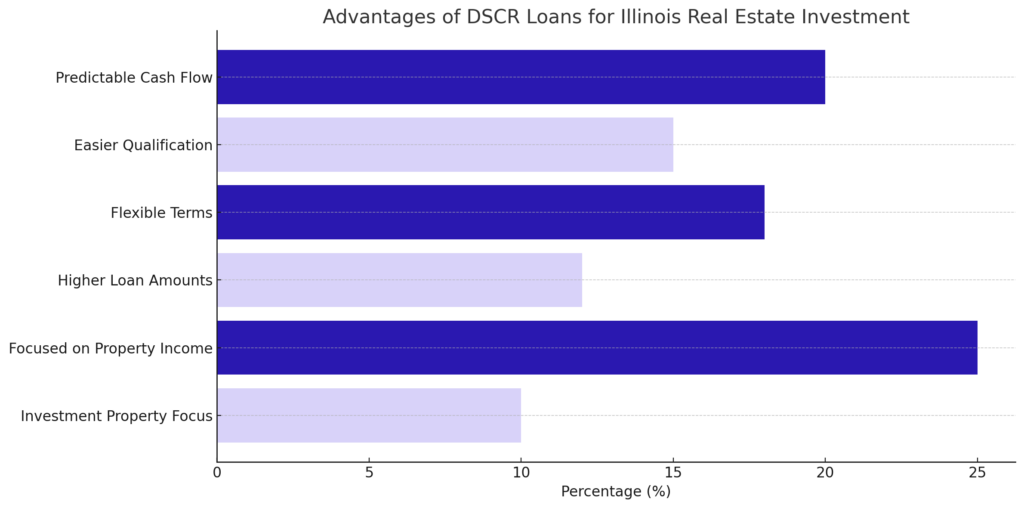

Advantages of DSCR Loans for Illinois Real Estate Investment

DSCR loans have many good points for Illinois real estate investors. Let’s look at why they’re so popular:

1. Easier Qualification Process

Unlike traditional mortgages, DSCR loans don’t require extensive documentation of personal income. This helps people who work for themselves or have tricky incomes. It works for expensive Chicago homes or cheaper ones in Peoria and Springfield.

2. Higher Loan Amounts

DSCR loans often let you borrow more money than conventional investment loans. This helps when buying expensive homes in Chicago or big business buildings in Peoria and Springfield.

3. Faster Approval and Closing

The streamlined qualification process often leads to quicker approval and closing times, allowing investors to move fast in competitive markets across Illinois.

4. Scalability for Portfolio Growth

For investors looking to grow their portfolios across multiple Illinois cities, DSCR loans can be easier to scale than traditional mortgages, as they’re based on each property’s individual performance rather than the investor’s overall debt-to-income ratio.

DSCR Loan Chicago: Spotlight on the Windy City

Let’s focus on Chicago for DSCR loans. It’s big and has a strong housing market. Chicago has many different areas. People want to rent there, and house prices may go up. This makes it great for buying property.

Why Choose a DSCR Loan in Chicago?

- High rental demand across various neighborhoods

- Potential for strong cash flow from multi-unit properties

- Opportunity to invest in both residential and commercial real estate

- Ability to leverage property value appreciation

Want to buy a big building in Lakeview or a business place in the Loop? A DSCR loan can help you get started or grow in Chicago’s housing market.

DSCR Loans in Peoria and Springfield: Exploring Opportunities Beyond Chicago

While Chicago often steals the spotlight, savvy investors are increasingly turning their attention to other Illinois cities like Peoria and Springfield. DSCR loans can be particularly advantageous in these markets:

DSCR Loans in Peoria

Peoria’s real estate market offers:

- More affordable property prices compared to Chicago

- A stable local economy anchored by healthcare and manufacturing sectors

- Growing demand for rental properties, especially near Bradley University

DSCR Loans in Springfield

As the state capital, Springfield presents unique investment opportunities:

- Steady demand for housing from government employees

- A growing private sector, creating diverse investment options

- Historical properties that can be renovated for higher returns

DSCR loans in these cities can help you buy cheaper properties and still make money from rent.

Beyond DSCR: Other Lending Options in Illinois

While DSCR loans offer numerous advantages, they’re not the only option for real estate investors in Illinois. Let’s explore some alternatives:

Hard Money Loans Illinois

Hard money loans are short-term lending options typically used for fix-and-flip projects or as bridge loans. They’re known for quick approval times and flexible terms, but often come with higher interest rates. Hard money loans help you fix up houses fast in growing Illinois areas. This is good for investors who want to buy and sell quickly.

Hard Money Lenders Illinois

Illinois has a robust network of hard money lenders, particularly in and around Chicago, Peoria, and Springfield. These lenders give quick money to property buyers. They often help with deals that big banks say no to.

Illinois Lending Loans

Many local and regional banks offer specialized lending programs for real estate investors. These Illinois loans come in different types. They’re made to fit what property buyers in Illinois need. Some examples are portfolio loans and blanket mortgages.

Cash Loans in Illinois

For investors with significant liquid assets, cash loans can be an option. You need a lot of money to start, but it can help you buy in busy areas. Sellers like cash offers in hot Chicago spots or growing parts of Peoria and Springfield.

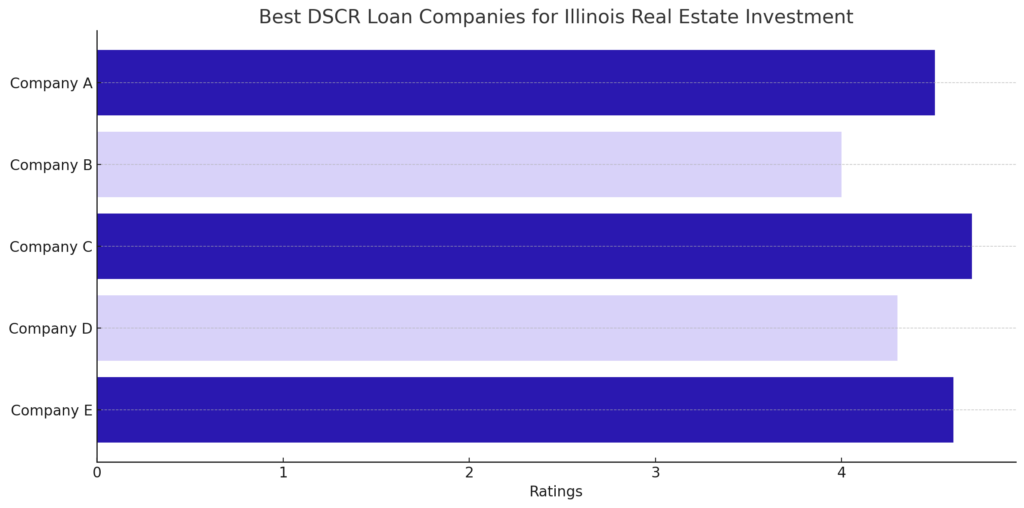

Choosing the Best DSCR Loan Companies for Illinois Real Estate Investment

With the growing popularity of DSCR loans, many lenders now offer these products across Illinois. But how do you choose the best DSCR loan companies for your Illinois real estate investment? Here are some factors to consider:

- Experience with DSCR loans and investment properties in Illinois

- Competitive interest rates and terms

- Flexible qualification requirements

- Strong customer service and support

- Positive reviews from other Illinois investors

The best DSCR loan for you depends on three things: how you plan to invest, what property you’re buying, and your future goals in Illinois real estate.

DSCR Loan Lenders: What to Look For in Illinois

When evaluating DSCR loan lenders in Illinois, pay attention to:

- Minimum DSCR requirements (may vary between Chicago and smaller cities)

- Interest rates and loan terms

- Prepayment penalties

- Closing costs and fees

- Geographic restrictions (some lenders may only operate in certain areas of Illinois)

Look at loans from many lenders. Compare them to find the best one for your Illinois property plans

Navigating the Illinois Lending Landscape

The world of real estate investing can be complex, especially when it comes to financing. Here are some tips to help you navigate the Illinois lending landscape:

- Do Your Research: Understand the different loan options available, including DSCR loans, hard money loans, and traditional mortgages in the context of Illinois real estate.

- Network with Other Investors: Join local real estate investing groups in Chicago, Peoria, and Springfield to learn from experienced investors in your area.

- Build Relationships with Lenders: Establishing good relationships with lenders can be beneficial for future deals across Illinois.

- Understand Local Markets: Illinois is diverse, and real estate markets can vary significantly between cities like Chicago, Peoria, and Springfield. Familiarize yourself with the nuances of each market.

- Stay Informed: Keep up with changes in lending regulations and market conditions that could affect your investments in Illinois.

The Future of DSCR Loans in Illinois Real Estate Investment

The housing market keeps changing. DSCR loans will likely become more important for Illinois investors. DSCR loans are flexible and care about how well a property does. This fits what today’s investors need in different cities like Chicago, Peoria, and Springfield.

Potential Changes and Trends in Illinois

- Increased adoption by traditional lenders across the state

- More competitive rates as the product becomes more mainstream in Illinois markets

- Potential for new variations of DSCR loans tailored to specific types of properties or investment strategies in different Illinois cities

Read Also: DSCR Loan Maryland: Uncover 10 Secrets to Maximize Real Estate Wealth

Conclusion: Empowering Your Illinois Real Estate Investment Journey

DSCR loans offer a powerful financing tool for real estate investors in Illinois. Want to buy property in Illinois? DSCR loans can help you a lot. This works for busy Chicago, steady Peoria, or diverse Springfield.

Remember, successful real estate investing in Illinois is about more than just securing financing. It requires careful market analysis, smart property selection, and effective management. But with the right financing tool, like a DSCR loan, you can build a robust and profitable real estate portfolio across the Land of Lincoln.

When looking at Illinois property options, talk to money experts and experienced real estate pros who know Illinois. They can give you good advice for your plans in Chicago, Peoria, Springfield, or other good spots in Illinois.

FAQs

What credit score do I need for a DSCR loan in Illinois?

Most DSCR loan lenders in Illinois require a minimum credit score of 620 to 640. However, some lenders may have higher or lower requirements, so it’s best to shop around, especially if you’re investing outside of major cities like Chicago.

Can I use a DSCR loan for fix-and-flip properties in Illinois?

While DSCR loans are typically used for long-term rental properties, some lenders may offer DSCR loan products for fix-and-flip projects in Illinois. However, hard money loans are more commonly used for these types of investments, especially in markets like Chicago with high property turnover.

Are DSCR loans available for commercial properties in Illinois?

Yes, many lenders offer DSCR loans for commercial properties across Illinois. These can be particularly useful for multi-unit residential buildings in Chicago, office spaces in Springfield, or retail properties in Peoria.

How does the Illinois real estate market compare to other states for investors?

Illinois, particularly the Chicago area, offers a strong rental market and potential for appreciation. However, it’s important to research specific local markets within the state, as conditions can vary significantly between urban areas like Chicago, mid-sized cities like Peoria and Springfield, and rural areas.

Can I refinance my existing investment property with a DSCR loan in Illinois?

Yes, many investors use DSCR loans to refinance existing investment properties in Illinois. This can be a good strategy to lower your interest rate, cash out equity, or consolidate multiple loans, whether you’re investing in Chicago’s high-value properties or more affordable options in Peoria or Springfield.