DSCR loans in Akron allow real estate investors to qualify based on property income, not personal finances. Benefits include easier qualification, flexibility for multiple properties, and higher loan amounts. Key areas like Highland Square offer strong rental demand. Research properties carefully to ensure a favorable DSCR ratio. Explore DSCR opportunities today!

DSCR Loans Akron: The Ultimate Guide for Real Estate Investors

Do you want to buy property in Akron, Ohio? Are you new to real estate or do you already own some? Are you looking for new ways to buy buildings in Akron? You may have seen the term ‘DSCR loan’ while searching. But what exactly is a DSCR loan, and how can it benefit real estate investors in Akron? Let’s explore real estate money in Akron. We’ll find exciting chances in the Rubber City.

Understanding DSCR Loans: A Game-Changer for Akron Real Estate Investors

What is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio. A DSCR loan is a type of mortgage specifically designed for real estate investors. DSCR loans are different from regular mortgages. Regular mortgages look at your personal income. DSCR loans look at the money made by the property you are investing in. This special way of lending creates many chances for people who want to buy property in Akron.

How Does a DSCR Loan Work in Akron?

The core principle behind DSCR loans is simple yet powerful. Lenders evaluate the property’s ability to generate income relative to its debt obligations. They use the Debt Service Coverage Ratio to do this. This ratio compares how much money a property makes to how much it owes each year.

Let’s look at an example. Say an Akron rental property earns $2,000 each month. It costs $1,500 to run, including the mortgage. We divide $2,000 by $1,500 to get 1.33. This number is the DSCR. Lenders want to see a DSCR of 1.25 or more. This shows the property makes enough money to pay its bills and have some left over.

Why Akron is Prime for DSCR Loan Opportunities

Akron’s Real Estate Renaissance

People call Akron the ‘Rubber Capital of the World.’ The city has changed a lot lately. Akron is in a good spot and costs less to live in. The city is fixing up old areas. This makes people want to live and buy property here.

Diverse Property Options in Akron

Akron offers many investment choices. You can buy cozy houses in Highland Square or apartments near the University of Akron. This variety makes Akron perfect for investors. They can use DSCR loans to grow their real estate holdings.

- Single-family homes in established neighborhoods

- Multi-unit properties near educational institutions

- Commercial properties in revitalized downtown areas

Strong Rental Market in Akron

More young workers and students are moving to Akron. This makes the city’s rental market strong. Many people want to rent in Akron. This matches well with DSCR loans, which focus on income. Investors who want to buy in Akron can use these loans.

Benefits of DSCR Loans for Akron Real Estate Investors

| Benefit | Description |

|---|---|

| Easier Qualification Process | DSCR loans focus on property cash flow rather than personal income, simplifying the qualification. |

| Flexibility for Multiple Properties | Investors can finance multiple properties, increasing their investment opportunities. |

| Potential for Higher Loan Amounts | higher DSCR can lead to larger loan amounts, facilitating more significant investments. |

| Tax Benefits for Akron Investors | Akron investors can enjoy potential tax deductions on interest payments and property expenses. |

Now we discuss in detail:

1. Easier Qualification Process

One of the most significant advantages of DSCR loans is the simplified qualification process. These loans look at how much money a building can make, not how much money you have. This can make it easier for buyers to get these loans than traditional mortgages.

2. Flexibility for Multiple Properties

DSCR loans are particularly beneficial for investors looking to expand their portfolios. Conventional loans often limit how many properties you can finance.

DSCR loans in Akron are different. DSCR loans let you finance many Akron properties. For DSCR loans, each Akron property just needs to make enough money on its own. Akron investors can use DSCR loans to grow their property portfolio.

3. Potential for Higher Loan Amounts

DSCR loans in Akron can offer bigger loan amounts than traditional financing. This depends on how much money the Akron property can make and the lender’s rules.

Akron investors may get more funds with DSCR loans for their property investments. This can really help Akron investors buy bigger or pricier properties. DSCR loans make it easier to invest in Akron’s best locations. With DSCR loans, Akron real estate investors can grow their portfolios faster.

4. Tax Benefits for Akron Investors

While it’s always advisable to consult with a tax professional, DSCR loans may offer certain tax advantages. The interest you pay on DSCR loans is often tax-deductible. This can lower your total tax bill. DSCR loans in Akron may help investors save money on taxes

Navigating the DSCR Loan Process in Akron

| Step | Description |

|---|---|

| Step 1: Akron Property Research | Conduct thorough research on potential investment properties in Akron to ensure they meet your criteria. |

| Step 2: Calculate Your DSCR for Akron Properties | Determine the debt service coverage ratio (DSCR) for the properties to assess their profitability. |

| Step 3: Find DSCR Loan Lenders in Akron | Identify and contact lenders in Akron who specialize in DSCR loans to find the best terms and rates. |

| Step 4: Prepare Your Documentation | Gather necessary documents such as financial statements, property details, and DSCR calculations. |

| Step 5: Loan Application and Approval | Submit your loan application and work with the lender through the approval process to secure financing. |

Now we discuss in detail:

Step 1: Akron Property Research

Before diving into the loan application process, it’s crucial to thoroughly research potential investment properties in Akron. Consider factors such as location, property condition, potential rental income, and local market trends.

Step 2: Calculate Your DSCR for Akron Properties

Once you’ve identified a potential property, calculate its projected DSCR. Remember, most lenders look for a DSCR of 1.25 or higher. Be conservative in your income estimates and thorough in your expense calculations to ensure accuracy.

Step 3: Find DSCR Loan Lenders in Akron

While many national lenders offer DSCR loans, consider working with local Akron lenders who understand the nuances of the local real estate market. They may be able to offer more tailored solutions and valuable insights into the local investment landscape.

Step 4: Prepare Your Documentation

While DSCR loans typically require less personal financial documentation than traditional mortgages, you’ll still need to provide some paperwork. This may include:

- Property details and photos of Akron real estate

- Rent roll (for existing rental properties)

- Lease agreements (if applicable)

- Property management agreements (if using a management company)

- Proof of insurance

- Entity documentation (if purchasing through an LLC or corporation)

Step 5: Loan Application and Approval

Once you’ve gathered all the necessary documentation, submit your loan application. The lender will review your application, order an appraisal of the Akron property, and make a decision based on the property’s income potential and your overall investment strategy.

DSCR Loan Strategies for Success in Akron’s Real Estate Market

Strategy Categories

| Strategy | Description | Benefits | Challenges |

|---|---|---|---|

| 1. Optimize Property Cash Flow | Ensure properties generate high rental income relative to expenses. | Increases DSCR ratio and improves loan approval chances. | There is a higher risk if rental market fluctuates. |

| 2. Target High-Yield Areas | Invest in neighborhoods with high rental yields and strong demand. | Better returns on investment; more stable cash flow. | Limited availability of high-yield properties. |

| 3. Diversify Property Types | Invest in various types of properties (e.g., single-family, multi-family). | Spreads risk across different property types. | Requires diverse management strategies. |

| 4. Improve Property Management | Enhance property management to reduce vacancies and increase rental income. | Increased revenue and property value. | May require investment in management services. |

| 5. Use Conservative Financing | Opt for conservative loan terms and avoid over-leveraging. | Lower risk of default; easier to manage cash flow. | May limit the number of properties you can invest in. |

| 6. Leverage Tax Benefits | Take advantage of tax deductions related to property ownership and expenses. | Reduces overall tax liability, increasing cash flow. | Requires careful tax planning and advice. |

| 7. Monitor Market Trends | Stay informed about Akron’s real estate trends and adjust strategies accordingly. | Helps make informed investment decisions. | Requires ongoing research and analysis. |

Key Metrics to Track

| Metric | Description | Importance |

|---|---|---|

| DSCR Ratio | Measure of property income relative to debt service. | Essential for loan approval and financial stability. |

| Rental Yield | Income generated from property as a percentage of its value. | Indicates potential return on investment. |

| Vacancy Rates | Percentage of rental properties that are unoccupied. | Affects cash flow and property performance. |

| Property Appreciation | Increase in property value over time. | Impacts long-term investment value and returns. |

Action Plan

- Evaluate Current Portfolio: Assess the cash flow and DSCR of existing properties.

- Research Akron Market: Identify high-yield areas and emerging trends.

- Adjust Investment Strategy: Based on research, adjust property types and management practices.

- Optimize Financing: Seek conservative loan options and explore tax benefits.

- Regular Monitoring: Continuously track key metrics and market trends for ongoing success.

Focus on High-Demand Akron Areas

Renters love Akron areas like Highland Square, Merriman Valley, and Wallhaven. These spots have great stuff nearby and are close to important places. Investing in properties in these locations can help ensure a strong DSCR.

Consider Multi-Family Properties in Akron

Duplexes and small apartment buildings often make more money than single homes. You can buy these for less and rent out more units. This can lead to a more favorable DSCR and potentially better loan terms.

Plan for Vacancies and Maintenance in Akron Real Estate

When figuring out your DSCR, remember to count empty units and repair costs. This helps you know your true income. Money experts suggest saving more than you think you need. This smart plan helps you pay your bills, even when times get tough

Leverage Akron’s Economic Development Initiatives

Stay informed about Akron’s various economic development projects and initiatives. Growing areas offer chances for higher property values and more renters. Look for places getting new businesses or being fixed up

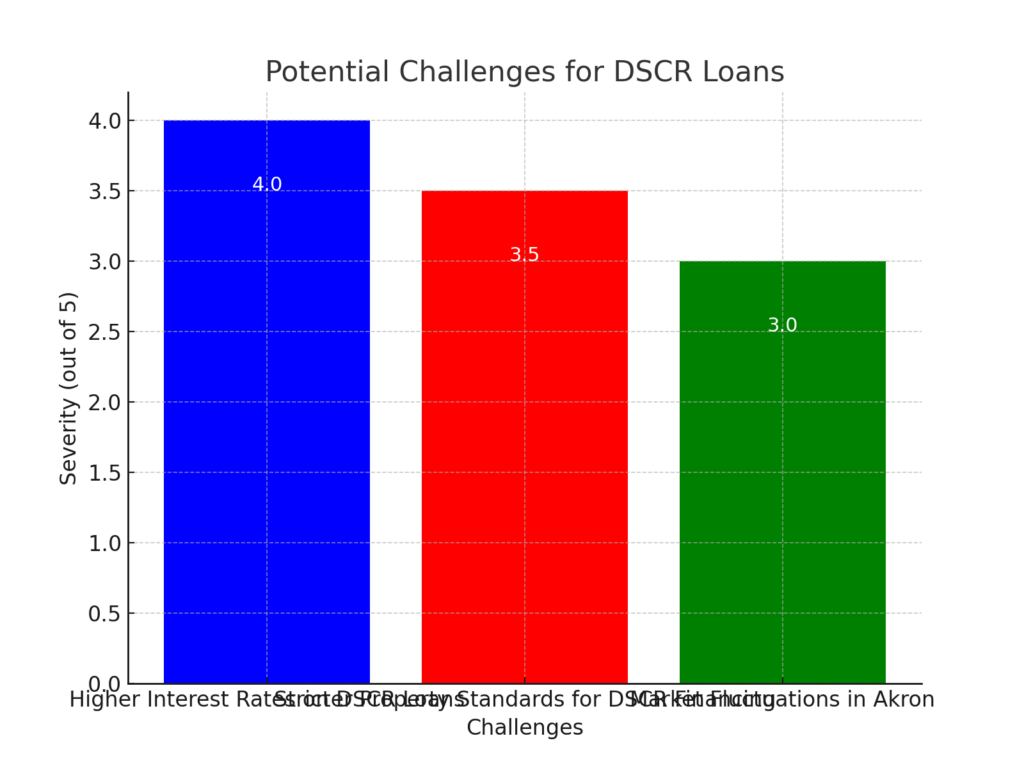

Potential Challenges and How to Overcome Them

Higher Interest Rates on DSCR Loans

DSCR loans may come with slightly higher interest rates compared to traditional mortgages. To offset this, focus on properties with strong income potential and consider making a larger down payment to secure better terms.

Stricter Property Standards for DSCR Financing

Lenders may have stricter standards for properties financed through DSCR loans. Fix problems with the property right away. Get ready to make changes the lender wants. This helps your loan get approved.

Market Fluctuations in Akron

Akron’s real estate market, like any other, can experience fluctuations. Buy different kinds of properties in many parts of Akron. This keeps your money safer if one area has problems.

The Future of DSCR Loans in Akron’s Real Estate Market

As Akron continues to grow and evolve, the demand for rental properties is likely to increase. Akron is getting better, and more people want to live there. This makes DSCR loans a great choice for people buying houses to rent out.

More people are learning about DSCR loans. This makes banks compete to offer better deals. They might create new loans just for Akron’s houses and buildings.

Read Also: California DSCR Loans: Low Rates & Flexible Requirements for Investors

Conclusion: Unlocking Akron’s Real Estate Potential with DSCR Loans

DSCR loans offer a powerful tool for real estate investors looking to capitalize on Akron’s vibrant property market. DSCR loans look at how much money a building can make, not your own paycheck. This helps new and skilled buyers get more houses in Akron.

To succeed with DSCR loans in Akron:

- Study the city’s housing market carefully

- Choose good properties

- Team up with local experts

This smart approach helps you grow your real estate business in Akron, Ohio.

Ready to buy houses in Akron? DSCR loans can help! They work for new buyers and people who already own homes. Start looking into DSCR loans now to grow your Akron real estate business.

FAQs About DSCR Loans in Akron

What credit score do I need for a DSCR loan in Akron?

Most DSCR loans in Akron need a credit score of 620–640 or higher. But some lenders might be more flexible. They care more about how much money the property can make compared to traditional mortgages.

Can I use a DSCR loan for fix-and-flip properties in Akron?

DSCR loans work best for houses you rent out for a long time. They don’t usually fit houses you fix up and sell quickly. But some lenders make special loans that mix DSCR loans with quick money options. These can help if you want to fix and sell houses fast. It’s best to discuss your specific investment strategy with a local Akron lender.

How does Akron’s real estate market compare to other Ohio cities for DSCR loan investments?

Akron offers a unique blend of affordability and growth potential that makes it attractive for DSCR loan investments.

Akron offers great deals for house buyers. Here’s why:

- Many people want to rent homes

- The city is getting better

- Houses cost less than in big cities like Columbus or Cincinnati

This mix helps investors make more money with DSCR loans.

Are there any specific Akron neighborhoods that are particularly suited for DSCR loan investments?

Top Akron spots for DSCR loans:

- Highland Square

- Merriman Valley

- Wallhaven

- Downtown Akron

- Firestone Park

Why these areas shine:

- Lots of renters want to live here

- Close to jobs, schools, and fun places

- Houses often make good money

Smart tips:

- Visit each area yourself

- Check recent house sales

- Talk to local real estate experts

Remember, good areas can change. Always do fresh research before buying.

How might future development plans in Akron affect my DSCR loan investment?

Akron is working to make the city better. This can help house buyers:

- The Downtown Akron Vision plan is fixing up the city center

- These changes might make houses worth more

- More people might want to rent in improved areas

Smart tips:

- Learn about Akron’s plans to fix up different areas

- Think about how these plans could help your houses make money over time

- Use this information when looking at DSCR loans

Keep checking for new city plans. They can change how good your investment is.