Financial ratios DSCR and ICR assess debt risk. Calculate DSCR using EBITDA for total debt coverage (aim for >1.25); crucial in capital-intensive industries. ICR uses EBIT for interest coverage (target >2), common in lower-capital sectors. Both guide lending decisions and financial health analysis.

Debt Service Coverage Ratio (DSCR) and Interest Coverage Ratio (ICR):

| Ratio | Focus | Calculation | Use Case |

|---|---|---|---|

| DSCR | Total debt obligations | EBITDA | Capital-intensive industries |

| ICR | Interest payments | EBIT | Lower capital needs industries |

Key takeaways:

DSCR (Debt Service Coverage Ratio) and ICR (Interest Coverage Ratio) are both financial metrics used to assess a company’s ability to meet its debt obligations, but they focus on different aspects of debt servicing.

What is the Difference Between DSCR and ICR?

Introduction

Lenders and investors use key financial ratios to check a company’s financial health and ability to repay debts. Two key ratios in this context are the Debt Service Coverage Ratio (DSCR) and the Interest Coverage Ratio (ICR). Knowing how these ratios differ helps you make smarter money choices. In this article, we will explore what DSCR and ICR are, how they are calculated, and their respective importance in financial analysis.

What is DSCR?

Definition The Debt Service Coverage Ratio (DSCR) measures a company’s ability to service its debt with its operating income. It is a key indicator for lenders to assess the risk associated with lending to a business.

How to Calculate DSCR

To find DSCR, use this formula:

DSCR = Net Operating Income ÷ Total Debt Service

This means:

- Calculate your Net Operating Income

- Add up all your debt payments

- Divide the income by the debt payments

The result shows how well you can cover your debts.

- Net Operating Income (NOI)NOI is the money a business makes from its main work. It doesn’t include:

- Taxes

- Interest payments

- Add up all the money the business earns

- Subtract the costs of running the business

- Don’t take out taxes or interest

- Total Debt Service: This includes all principal and interest payments on outstanding debt for a given period.

Importance: A DSCR greater than 1 indicates that a company generates sufficient income to cover its debt obligations. A ratio below 1 suggests that the company might struggle to meet its debt payments, indicating higher risk for lenders.

Example: Company A has an EBITDA of $1,000,000, lease payments of $50,000, interest expenses of $200,000, and principal repayments of $300,000.

DSCR=1,000,000+50,000200,000+300,000=1,050,000500,000=2.1DSCR=200,000+300,0001,000,000+50,000=500,0001,050,000=2.1

With a DSCR of 2.1, Company A demonstrates a strong ability to service its debt obligations.

What is ICR?

Definition: Interest Coverage Ratio (ICR)

ICR shows how easily a company can pay the interest on its debts. To find ICR:

- Calculate the company’s earnings before interest and taxes (EBIT)

- Divide EBIT by the total interest the company owes

This ratio tells you how many times over a company can pay its interest costs. A higher ICR means the company can handle its debt interest more easily. It is used to assess how easily a company can meet its interest obligations.

How to Calculate ICR?

To find ICR, use this formula:

ICR = EBIT ÷ Interest Expense

This means:

- Calculate your Earnings Before Interest and Taxes (EBIT)

- Divide EBIT by the total interest you own

The result shows how well you can cover your interest payments. A higher number is better.

- Understanding ICR Key parts: EBIT (Earnings Before Interest and Taxes): How much money a company make before paying interest and taxes? It shows how well the business runs

- Interest Expense: All the interest the company must pay on its debts. Usually counted for one year

- Why ICR matters: ICR above 1: Good sign. The company can pay its interest.ICR below 1: Warning sign. The company might struggle to pay interest. Higher ICR: Company looks safer to lenders.Lower ICR: Company might seem risky to lenders. A strong ICR means a company can handle its debts well.

Example: Company B has an EBIT of $800,000 and an interest expense of $150,000.

ICR=800,000150,000=5.33ICR=150,000800,000=5.33

With an ICR of 5.33, Company B demonstrates a strong ability to cover its interest obligations.

Key Differences Between DSCR and ICR

| Feature | DSCR (Debt Service Coverage Ratio) | ICR (Interest Coverage Ratio) |

|---|---|---|

| Full Name | Debt Service Coverage Ratio | Interest Coverage Ratio |

| What It Measures | Ability to cover total debt obligations | Ability to pay interest on debt |

| Formula | (EBITDA + Lease Payments) / (Interest + Principal Payments) | EBIT / expense) |

| Components | EBITDA, lease payments, interest, and principal | EBIT, interest expense |

| Scope | Comprehensive (includes interest and principal payments) | Focused (includes interest payments only) |

| Time Frame | Long-term debt servicing ability | Short-term interest payment ability |

| Preferred By | Real estate and capital-intensive industries | Industries with lower capital needs |

| Risk Assessment | Overall long-term debt risk | Immediate interest payment risk |

| Ideal Ratio | Generally, above 1.25 | Generally, above 2 |

| Affected By | Cash flow, total debt obligations | Operating income, interest rates |

| Lender Focus | Total debt repayment capacity | Ability to cover interest costs |

Scope of Coverage

- DSCR vs ICR: DSCR (Debt Service Coverage Ratio):

- Look at the big picture. Includes both main loan payments and interest. It shows if a company can pay all its debt costs

- Focuses on one key part, Only looks at interest payments. It shows if a company can pay the cost of borrowing money

- DSCR checks if you can pay everything you oweICR checks if you can pay the extra costs of having loans

Income Measure

- DSCR: Uses Net Operating Income, reflecting the income from core business operations.

- ICR: Earnings Before Interest and Taxes (EBIT), which includes a company’s overall profitability.

Risk Assessment

- health and helpsDSCR vs ICR: What They Tell UsDSCR (Debt Service Coverage Ratio): Gives a big-picture view of money health.

- ICR (Interest Coverage Ratio):

- Tell us about your financial health right now. It shows if a company can pay loan interest easily. It helps judge if a company can handle its current debts

- DSCR looks at long-term money strength. ICR focuses on short-term ability to pay interest

When to Use DSCR vs. ICR

Lenders and Investors

- DSCR (Debt Service Coverage Ratio):

- It is best to check if a business can pay all its debtsUseful when looking at long-term loansIt helps decide if a company can handle large loans over time

- It is good to see if a company can pay its interest costs. Useful for short-term money checks. It is important when a company owes a lot of interest

- Use DSCR to judge overall debt-paying power. Use ICR to check how easily a company pays interest

- DSCR for big, long-term loans

- ICR for quick checks on interest-paying ability

Business Planning

- How Companies Use DSCR and ICR

- DSCR (Debt Service Coverage Ratio):

- It helps companies plan their money better. It shows if they can pay all parts of their loans. Used to make sure they can pay both the main loan amounts and interest

- It helps companies watch their money day-to-day. If they can easily pay the interest on loans. Used to check if they’re making enough profit to cover loan costs

- DSCR looks at total loan paymentsICR focuses just on interest payments

- Make smart choices about borrowing money. Keep their finances healthy. Plan for future expenses

Real-World Examples

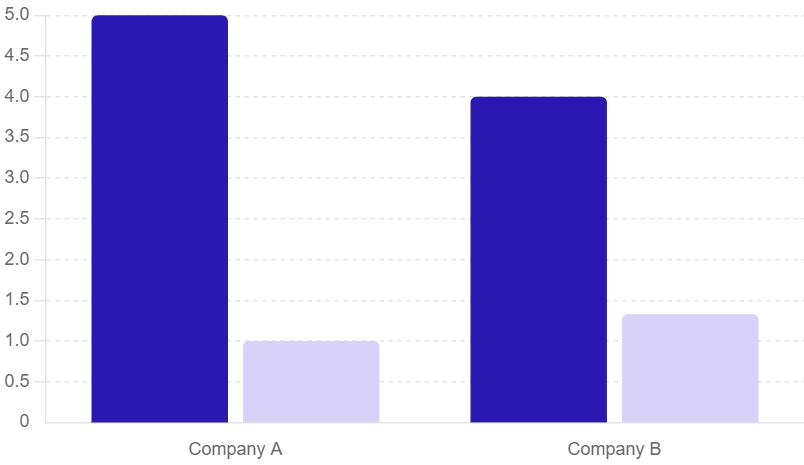

Example 1: Company with High ICR but Low DSCR

Company A has:

- EBIT of $1 million

- Interest Expense of $200,000

- Principal Repayments of $800,000

Calculating the ratios:

- ICR: 1,000,000200,000=5\frac{1,000,000}{200,000} = 5200,0001,000,000=5

- DSCR: 1,000,000200,000+800,000=1\frac{1,000,000}{200,000 + 800,000} = 1200,000+800,0001,000,000=1

In this case, Company A has a high ICR of 5, indicating a strong capacity to cover interest payments, but a DSCR of 1, suggesting it can only cover its total debt service obligations.

Example 2: Company with Balanced Ratios

Company B has:

- EBIT of $2 million

- Interest Expense of $500,000

- Principal Repayments of $1 million

Calculating the ratios:

- ICR: 2,000,000500,000=4\frac{2,000,000}{500,000} = 4500,0002,000,000=4

- DSCR: 2,000,000500,000+1,000,000=1.33\frac{2,000,000}{500,000 + 1,000,000} = 1.33500,000+1,000,0002,000,000=1.33

Company B has a balanced approach, with an ICR of 4 and a DSCR of 1.33, indicating a healthy ability to meet both interest and principal repayments.

How do lenders use DSCR and ICR differently?

Lenders look at the DSCR and ICR to check a borrower’s financial health. They use these ratios in different ways.

Debt Service Coverage Ratio (DSCR)

- How Lenders Use DSCR

- Big Picture View:

- DSCR shows if a borrower can pay all loan costs. Checks both the main loan amount and interest. Very useful for big loans like in real estate

- Good DSCR (usually above 1.25) means:

- borrower can likely pay the loan. lender might offer better deal

- Lower interest rates. More time to pay back the loan

- DSCR helps lenders see the whole money picture. Good DSCR can lead to better loan terms. Lenders use it a lot for big, long-term loans

- Big Picture View:

- How Lenders Use DSCR to Manage Risk

- Checking Risk:

- Lenders use DSCR to see how risky a loan might be. Low DSCR means higher risk. If DSCR is low, lenders might:

- Ask for more security (like property)Make loan rules stricter

- Lenders change what they expect for DSCRThey know that different businesses have different risks. For example:

- A store might need a different DSCR than a factory. A new business might need a higher DSCR than an old one

- Lenders use DSCR to see how risky a loan might be. Low DSCR means higher risk. If DSCR is low, lenders might:

- DSCR helps lenders decide how safe a loan is. Low DSCR might mean tougher loan terms. Lenders. look at what type of business it is when using DSCR

- Checking Risk:

Interest Coverage Ratio (ICR)

- How Lenders Use ICR

- Checking Interest Payments:

- ICR shows how easily a company can pay loan interest. It tells how many times over a company can pay its interest. Helps lenders judge short-term money health

- high ICR means the company has extra money to pay interest. This makes lenders feel safer about getting paidIt helps spot companies that might miss interest payments

- ICR only looks at interest, not the whole loan amount. It doesn’t tell if a company can pay back the full loan. Lenders need other information too for the big picture

- Great for checking interest-only loans. It helps when looking at companies that owe a lot of interest. It’s good for quick checks on a company’s financial health

- ICR focuses on paying interest, not the whole loan. High ICR means less risk for lenders. Lenders use ICR for quick money health checks

- Checking Interest Payments:

Which industries rely more on DSCR than ICR?

Hypothetical Dataset

| Industry | Average DSCR | Average ICR |

|---|---|---|

| Real Estate | 1.8 | 3.2 |

| Utilities | 2.5 | 4.0 |

| Manufacturing | 1.6 | 2.8 |

| Retail | 1.2 | 3.0 |

| Technology | 2.0 | 5.5 |

| Financial Services | 1.4 | 3.6 |

Certain industries tend to rely more on the Debt Service Coverage Ratio (DSCR) than the Interest Coverage Ratio (ICR) when assessing a company’s ability to service its debt.

Capital-Intensive Industries

Some businesses need a lot of money to start.

- Factories

- Mining companies

- Construction firms

These companies:

- Often borrow more money

- Have tighter budgets for paying loans

They use DSCR more because:

- It shows if they can pay all loan costs

- This includes both the main loan amount and interest

Example: A construction company might:

- Borrow lots of money to buy big machines

- Aim for a DSCR between 1.0 and 1.5

- This means they make just enough money to pay their loans

Why this matters:

- Shows they can pay their debts

- But don’t have much extra money left over

Key point: In these industries, DSCR helps show if a company can handle its big loans.

Real Estate and Project Finance

Real estate and big project deals use DSCR a lot. Here’s why:

- DSCR is Important Because:

- It looks at when loan payments are due

- It checks if there’s enough money to pay big bills

- How It’s Used:

- For new building projects

- To see if the project will make enough money to pay loans

- What It Checks:

- Can the project cover all loan costs?

- This means both the main loan amount and interest

- Why It’s Useful:

- Real estate often has big, long-term loans

- Projects need to show they can pay back money over many years

Example: When building a new mall:

- Lenders use DSCR to check if the mall will make enough money

- They want to know it can pay back the loan for years to come

Key Point: DSCR helps show if big, long-term projects can pay their loans over time.

Reasons for Relying on DSCR

- Shows the Whole Picture:

- DSCR checks if a company can pay all loan costs

- This includes both the main loan amount and interest

- Gives a full view of how well a company handles debts

- Lenders Like It:

- Banks often want to see a good DSCR before giving a loan

- It helps them feel safer about getting their money back

- It shows the company can likely pay its debts

- Good for Big Debts:

- Some businesses have really big loans to pay

- Like factories or real estate companies

- They use DSCR to make sure they can pay these big bills

Summary: DSCR is used more in businesses that:

- Need lots of money to start (like building factories)

- Have big loans to pay back (like real estate projects)

- Work on long-term projects

These businesses use DSCR because:

- It shows they can pay all parts of their loans

- This makes lenders feel safer giving them money

Key Point: DSCR helps show the full picture of paying back big, long-term loans.

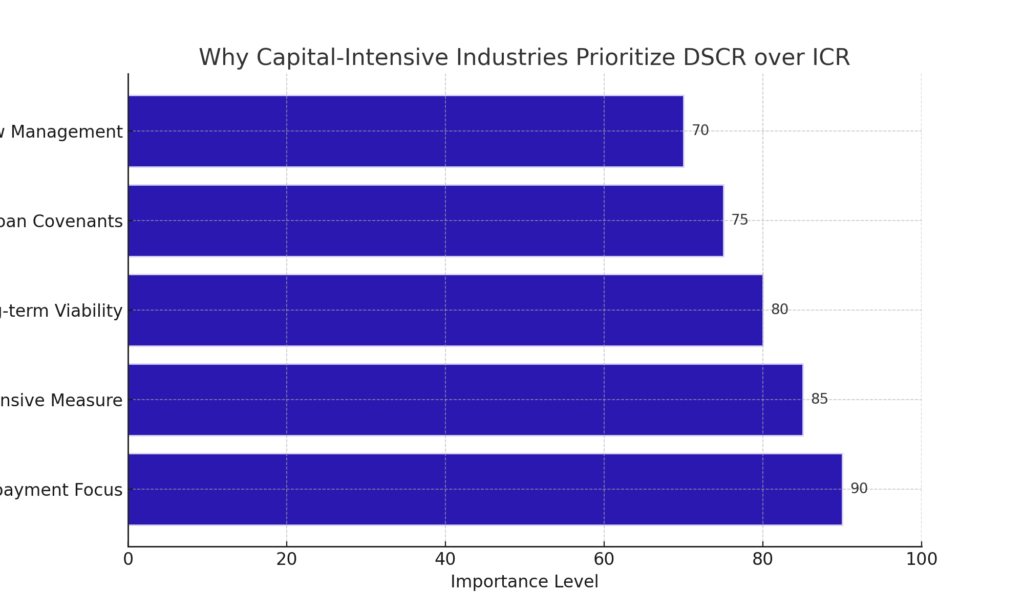

Why do capital-intensive industries prioritize DSCR over ICR?

Capital-intensive industries prioritize the Debt Service Coverage Ratio (DSCR) over the Interest Coverage Ratio (ICR) for a few key reasons:

Principal Repayments are Significant

Some businesses need lots of money to start.

- Factories

- Mining companies

- Construction firms

These companies often include the following:

- Borrow big amounts of money

- Use it to buy land, buildings, and big machines

This means:

- They have to pay back large loans

- Both the main amount and interest

DSCR is important because:

- It looks at all loan payments

- It shows if the company can pay everything back

Why this matters:

- Paying back the main loan amount can be really expensive

- It’s a big part of what the company owes

DSCR helps by:

- Checking if the company makes enough money

- To pay all parts of its loans

Key point: For big industries with large loans, DSCR gives a full picture of their ability to pay debts.

Debt Levels are Higher

Capital-intensive firms tend to operate with higher leverage compared to other sectors. This is because they require significant upfront capital expenditures to fund their operations.

With higher debt levels, the principal portion of debt service becomes more material. Focusing on DSCR ensures that the company is generating sufficient cash flow to cover both the interest and principal components of its debt obligations.

Lender Requirements

Lenders in capital-intensive industries often require a minimum DSCR threshold when approving loans. This helps mitigate the risk of default by ensuring that the borrower can meet its total debt service requirements.

Lenders may be less focused on ICR alone since it only considers interest payments. In industries with meaningful principal repayments, DSCR provides a more complete picture of the company’s ability to repay its debt.

Can a company have a high ICR but a low DSCR?

Yes, a company can have a high Interest Coverage Ratio (ICR) while having a low Debt Service Coverage Ratio (DSCR). This situation can arise due to the different components that each ratio considers.

Key Differences in Calculations

- ICR Calculation:

- The ICR measures a company’s ability to cover its interest expenses using its earnings before interest and taxes (EBIT). The formula is:

- EBIT: Money the company makes before paying interest and taxes

- Interest Expense: Money the company owes for borrowing

- The company makes much more money than it owes in interest

- It can easily pay the extra costs of borrowing money

- If ICR is 5, the company makes 5 times more than it owes in interest

- This is very good!

- It shows the company can handle its debts well

- Makes lenders feel safe about lending money

- DSCR Calculation:

- The DSCR assesses the ability to cover both interest and principal payments. It is calculated as:

- EBITDA: Money the company makes before certain costs

- Lease Payments: Money paid for using things the company doesn’t own

- Interest Expense: Extra cost for borrowing money

- Principal Repayments: Paying back the main loan amount

- The company might have trouble paying all its debts

- This includes both interest and the main loan amount

- If DSCR is below 1, the company doesn’t make enough to cover all debt costs

- This is worrying!

- Shows if a company can pay all parts of its loans

- Helps lenders decide if giving a loan is safe

Scenario Explanation

A company could have high EBIT relative to its interest expenses, resulting in a high ICR, but if it has significant principal repayments due, the DSCR could be low. For example:

- Company A has:

- EBIT of $1 million

- Interest Expense of $200,000

- Principal Repayments of $800,000

Calculating the ratios:

- ICR:ICR=1,000,000200,000=5ICR=200,0001,000,000=5

- DSCR (assuming EBITDA equals EBIT for simplicity): DSCR=1,000,000200,000+800,000=1,000,0001,000,000=1 DSCR=200,000+800,0001,000,000=1,000,0001,000,000=1

In this case,

Company A’s ICR and DSCR

Let’s look at Company A:

- ICR (Interest Coverage Ratio):

- Company A’s ICR is 5

- This is high and good

- It means they can pay their interest 5 times over

- Shows they easily cover interest payments

- DSCR (Debt Service Coverage Ratio):

- Company A’s DSCR is 1

- This is low and risky

- It means they just barely cover all debt payments

- It shows they struggle to pay the full loan amount

What this tells us:

- Paying just the interest is easy for Company A

- Paying the whole loan (interest plus main amount) is hard

Why it matters:

- High ICR: Looks good for short-term interest payments

- Low DSCR: Shows risk for long-term total debt payments

Key point: Company A can handle interest well but might have trouble with total loan payments.

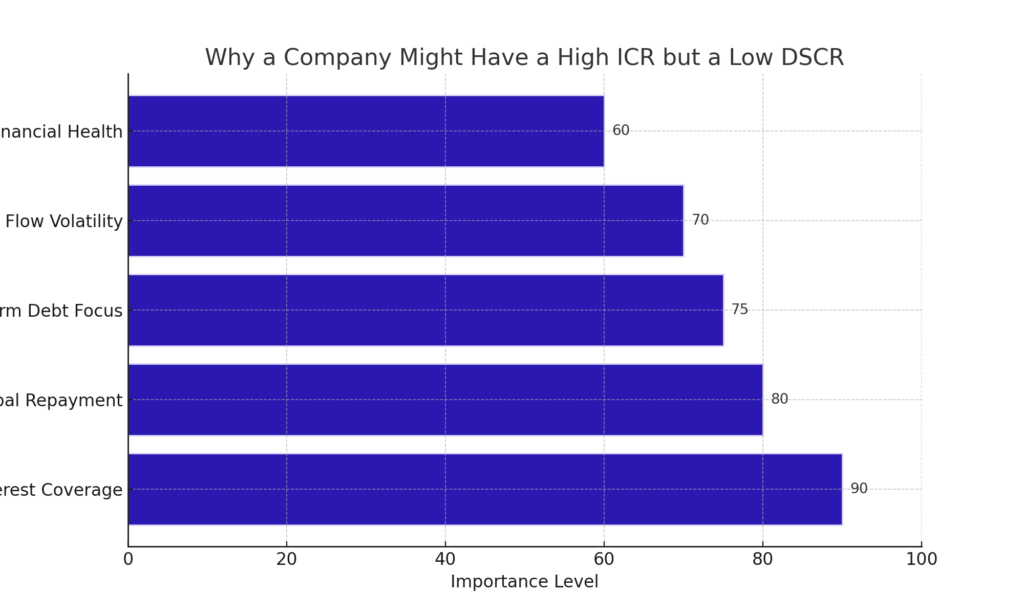

What factors can cause a company to have a high ICR but a low DSCR?

A company can have a high interest coverage ratio (ICR) while having a low debt service coverage ratio (DSCR) due to several factors that affect each ratio differently. Here are the key factors that can lead to this situation:

1. High Interest Expense Relative to Principal Repayments

Why a Company Might Pay Interest Easily but Struggle with Total Debt

Let’s break it down:

- The Company’s Loan Situation:

- Owes a lot of money

- Pays high interest

- Doesn’t pay much on the main loan amount yet

- What This Means for ICR (Interest Coverage Ratio):

- ICR looks good (high number)

- company earns enough to pay interest easily

- Example: Earns $100,000, owes $20,000 in interest (ICR = 5)

- What This Means for DSCR (Debt Service Coverage Ratio):

- DSCR looks bad (low number)

- When adding main loan payments, it’s too much

- Example: Earns $100,000, owes $20,000 interest + $90,000 main payment (DSCR = 0.91)

- The Problem:

- company can handle interest now

- But total payments (interest plus the main loan) are too high

- There is not enough money left to pay everything

Key Point: A company might look good at paying interest but still struggle with its total loan payments. This shows why looking at both ICR and DSCR is important.

2. High Operating Income (EBIT) but Low Cash Flow

Why a Company Might Look Profitable but Struggle with Cash

Let’s break it down:

- The Company’s Money Situation:

- Makes good money on paper (high EBIT)

- But has less real cash coming in (low EBITDA)

- What This Means for ICR (Interest Coverage Ratio):

- ICR looks good (high number)

- Based on earnings before costs like interest and taxes

- Example: EBIT is $100,000, interest is $20,000 (ICR = 5)

- What This Means for DSCR (Debt Service Coverage Ratio):

- DSCR looks bad (low number)

- Based on actual cash flow, which is lower

- Example: Cash flow is $80,000; total debt payment is $100,000 (DSCR = 0.8)

- Why the Difference:

- ICR doesn’t count some costs that use up cash:

- Money tied up in inventory or unpaid bills

- Taxes

- Costs that don’t use cash, like wear and tear on equipment

- DSCR looks at real cash available, which is often less

- ICR doesn’t count some costs that use up cash:

Key Point: A company can look good at making money but still have trouble paying its debts. This happens when profits don’t turn into cash quickly enough.

3. Capital Expenditures and Non-Operating Expenses

Heavy capital expenditures or non-operating expenses can reduce the cash available for debt. Here’s a simplified version with improved readability:

Why Growing Companies Might Struggle with Debt Payments

Let’s break it down:

- Company’s Spending Situation:

- Spending a lot on growth (like new machines or buildings)

- Or has high costs not related to main business

- What This Means for ICR (Interest Coverage Ratio):

- ICR still looks good (high number)

- company earns enough to pay interest

- Example: Earns $100,000, owes $20,000 in interest (ICR = 5)

- What This Means for DSCR (Debt Service Coverage Ratio):

- DSCR looks bad (low number)

- There is not enough cash left for all debt payments

- Example: After growth spending, only $70,000 left for $100,000 total debt payment (DSCR = 0.7)

- The Problem:

- Money goes to growth instead of debt

- Can pay interest, but not enough for total loan payments

- Growth spending uses up cash needed for loans

Key Point: A growing company might easily pay interest but struggle with total debt. This happens when they spend a lot on expansion, leaving less for loan payments.

4. Debt Structure and Terms

How Loan Terms Can Trick You About a Company’s Money Health

Let’s break it down:

- Special Loan Setup:

- Company only pays interest for a while

- No payments on the main loan amount at first

- What This Means Early On:

- ICR looks great (high number)

- Company easily pays just the interest

- Example: Earns $100,000, pays $20,000 interest (ICR = 5)

- What Happens Later:

- Main loan payments start

- DSCR suddenly drops (becomes a low number)

- Example: Now owes $20,000 in interest plus $80,000 in the main payment, but still earns $100,000 (DSCR = 1)

- The Problem:

- Company looks healthy at first

- But isn’t ready for bigger payments later

- I didn’t save enough cash for full loan costs

Key Point: Tricky loan terms can make a company look good at handling debt early on. But when full payments start, they might struggle if they don’t plan ahead.

5. Economic Conditions and Market Fluctuations

How Tough Times Can Hide Money Problems

Let’s break it down:

- What Happens in Bad Times:

- economyEconomy slows down or market gets tough

- Company sells less

- But still has to pay for things like rent and workers

- Effect on ICR (Interest Coverage Ratio):

- ICR might still look okay

- Based on past earnings, which were good

- earnings wereExample: Last year’s earnings $100,000, interest $20,000 (ICR = 5)

- Effect on DSCR (Debt Service Coverage Ratio):

- DSCR drops (becomes a low number)

- Less cash coming in now to pay debts

- Example: Current cash flow $70,000, total debt payment $100,000 (DSCR = 0.7)

- The Hidden Problem:

- ICR looks at past success

- DSCR shows current struggle

- Company can’t cut some costs even when sales drop

Key Point: When times get tough, a company might look okay based on old numbers (ICR). But current cash problems (shown by DSCR) can tell the real story. This is why it’s important to look at both the past and present when checking a company’s financial health.

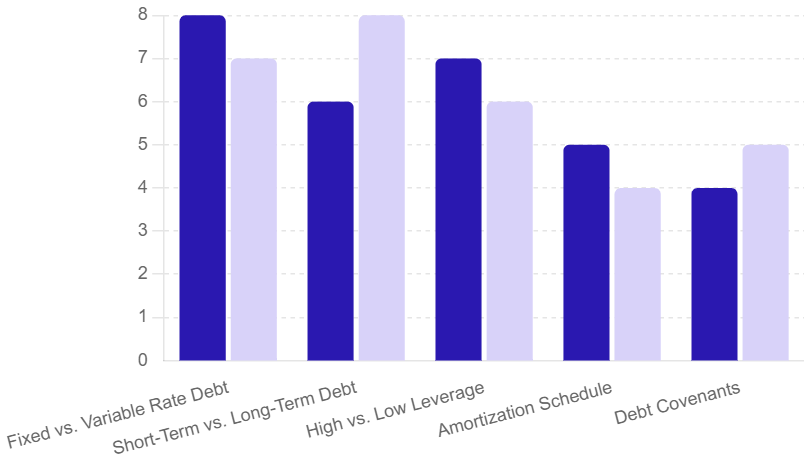

How does the structure of debt impact the ICR and DSCR?

The structure of a company’s debt significantly impacts both the Interest Coverage Ratio (ICR) and the Debt Service Coverage Ratio (DSCR). Here’s how different aspects of debt structure can influence these ratios:

1. Types of Debt

- Fixed vs. Changing Interest Rates: Fixed Interest:

- Interest stays the same

- Good for planning (ICR stays steady)

- But if main loan payments are large, might hurt cash flow (lower DSCR)

- Interest can go up or down

- Harder to plan (ICR can change)

- Can be good or bad for cash flow, depending on rates

- Short-Term vs. Long-Term Loans: Short-Term Loans:

- Pay back quickly

- Frequent payments

- Can use up cash fast (might lower DSCR)

- Pay back over a long time

- Smaller, spread-out payments

- Easier on cash flow (can help DSCR)

- But must manage interest well

Key Points:

- Fixed rates help predict costs but might strain cash if payments are large.

- Changing rates are less predictable but might be cheaper sometimes

- Short-term loans use cash quickly; long-term loans spread out the cost

- Each type affects ICR and DSCR differently

Companies need to choose loan types carefully based on their cash flow and future plans.

2. Leverage Levels

- Companies with Lots of Debt (High Leverage):

- a lot compared to what they ownPay high interestIf they make good money,

- ICR might look good (can cover interest)

- DSCR might look bad (struggle to pay total debt)

- Owes $1 million, makes $200,000

- Interest is $80,000 (ICR = 2.5, looks okay)

- total payment is $180,000 (DSCR = 1.1, very tight)

- a lot compared to what they ownPay high interestIf they make good money,

- Companies with Less Debt (Low Leverage):

- less compared to what they ownPay less interestMight have:

- Lower ICR (less interest to cover)But better DSCR (easier to pay total debt)

- Owes $300,000, makes $200,000

- Interest is $24,000 (ICR = 8.3, very good)

- total payment is $60,000 (DSCR = 3.3, very comfortable)

- less compared to what they ownPay less interestMight have:

Key Points:

- More debt can make ICR look good but DSCR looks bad

- Less debt might lower ICR but can make DSCR stronger

- It’s important to balance debt with ability to pay

Companies need to manage how much they borrow to stay healthy financially.

3. Amortization Schedule

- How Loan Payment Schedules Affect a Company’s Ability to Pay: Let’s look at two types of loan payment plans:

- Front-Loaded Payments (Pay More Early):

- Big payments at the startSmaller payments laterHow it affects the company:

- DSCR might be low at first (hard to pay big amounts)ICR could be okay if they can handle the interest

- $1 million loan over 5 yearsYear 1 payment: $300,000Year 5 payment: $100,000

- Small payments at the start. Bigger payments later, How it affects the company:

- DSCR looks good at first (easy to pay small amounts)ICR stays steady if interest is manageable

- $1 million loan over 5 yearsYear 1 payment: $100,000Year 5 payment: $300,000

- Big payments at the startSmaller payments laterHow it affects the company:

- Front-loaded plans are tough at first but get easierBack-loaded plans are easy at first but get harderCompanies need to match payment plans to their expected cash flowThe right plan depends on when the company expects to make more money

- Front-Loaded Payments (Pay More Early):

4. Covenants and Restrictions

- Debt Covenants: Some debt agreements include covenants that may restrict a company’s operational flexibility, affecting its ability to generate cash flow. This can impact the DSCR negatively if cash flow is constrained, even if the ICR remains high due to strong earnings.

5. Cash Flow Variability

- Operational Cash Flow: Companies with variable cash flows may find it challenging to maintain a consistent DSCR. If a company has high EBIT but inconsistent cash flows due to seasonality or economic cycles, it may show a high ICR while struggling with DSCR during lean periods.

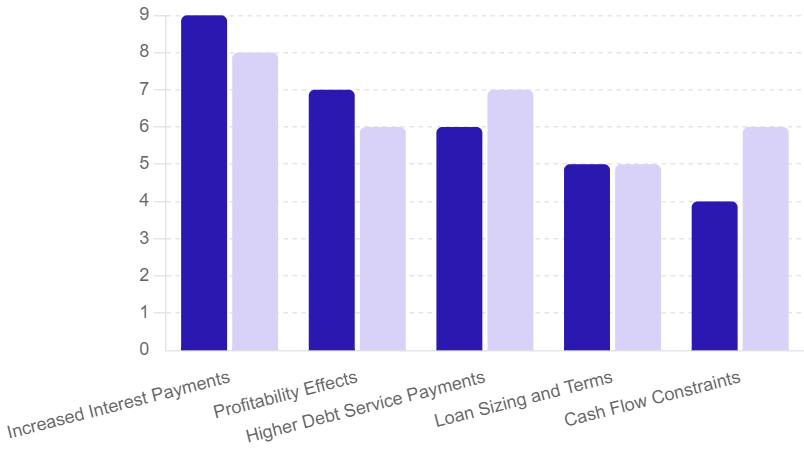

How do changes in interest rates affect ICR and DSCR?

Changes in interest rates can have significant effects on both the Interest Coverage Ratio (ICR) and the Debt Service Coverage Ratio (DSCR). Here’s how these ratios are impacted:

Impact on Interest Coverage Ratio (ICR)

- Increased Interest Payments:

- How Rising Interest Rates Affect a Company’s Ability to Pay: Let’s break it down:

- What Happens When Interest Rates Go Up?

- Borrowing money costs moreCompanies pay more interest on loans

- ICR = EBIT ÷ Interest ExpenseEBIT: Money earned before interest and taxesInterest Expense: Cost of borrowing money

- EBIT = $100,000Interest Expense = $20,000ICR = 100,000 ÷ 20,000 = 5

- EBIT stays at $100,000Interest Expense goes up to $25,000New ICR = 100,000 ÷ 25,000 = 4

- ICR goes down (from 5 to 4) company can still pay interest, but it’s harderLess money left after paying interest

- What Happens When Interest Rates Go Up?

- Profitability Effects:

- Higher interest rates can also affect a company’s profitability, especially if the company is highly leveraged. If rising rates lead to reduced sales or higher operational costs, EBIT may decrease, further lowering the ICR.

Impact on Debt Service Coverage Ratio (DSCR)

- Higher Debt Service Payments:

- The DSCR considers both interest and principal repayments. As interest rates rise, the annual debt service (which includes both interest and principal) increases.The formula for DSCR is:

- DSCR=EBITDA+Lease PaymentsInterest Expense + Principal RepaymentsDSCR = Interest Expense + Principal RepaymentsEBITDA+Lease Payments

- If EBITDA does not increase proportionately, the DSCR will decline, indicating that the company may struggle to meet its total debt obligations.

- Loan Size and Terms:

- Lenders often adjust loan amounts based on current interest rates to maintain the required DSCR. For example, if interest rates rise, lenders may reduce the maximum loan amount to ensure that the debt service remains manageable, which can further impact a company’s ability to finance growth or operations.

- Cash Flow Constraints:

- Increased debt service obligations can strain cash flows, particularly for companies with variable income. This can lead to a lower DSCR, indicating potential difficulties in meeting both interest and principal payments.

Example Scenario

For instance, if a company has a net operating income (NOI) of $600,000 and a required DSCR of 1.25, its maximum allowable debt service would be $480,000. If interest rates rise, causing the annual debt service to increase to $546,631, the DSCR would drop from 1.25 to 1.10, indicating that the company is less able to cover its obligations comfortably [1].

How to Improve DSCR and ICR

Increase Operating Income

Boosting Net Operating Income (NOI) or EBIT through revenue growth and cost management can improve both DSCR and ICR.

Debt Restructuring

Refinancing high-interest debt or extending loan terms can reduce interest and principal payments, improving DSCR and ICR.

Lease Payments Management

Effectively managing lease payments can help maintain a healthy DSCR, particularly for companies with significant leasing obligations.

Read Also: Minimum DSCR for Bank Loan: Requirements, Calculation, and Improvement Strategies

Conclusion

Both the DSCR and the ICR are vital financial metrics that provide valuable insights into a company’s debt servicing ability. While DSCR gives a comprehensive picture of the overall capacity to meet debt obligations, ICR focuses on the ability to cover interest expenses. Understanding the differences between these ratios can help businesses, lenders, and investors make more informed financial decisions.

FAQs

Q: Can a company have a high ICR but a low DSCR?

A: Yes, it is possible. A company might have sufficient earnings to cover interest expenses (high ICR) but not enough to cover principal repayments, leading to a low DSCR.

Q: Which ratio is more important for long-term loans?

A: DSCR is generally more important for long-term loans as it assesses the ability to cover total debt service, including principal repayments.

Q: How often should these ratios be calculated?

A: These ratios should be calculated regularly, at least quarterly, to monitor the financial health and debt servicing capability of a company.