DSCR loans in California offer investment property financing based on rental income potential. Requirements include 620+ credit score, 20-25% down payment, and 1.0+ DSCR. Rates range from 5.5-8% (2024). Benefits: larger loan amounts, easier qualification for multiple properties, flexibility for self-employed investors.

DSCR Loans in California: Your Ultimate Guide to Investment Property Financing

Are you a real estate investor looking to expand your portfolio in the Golden State? If so, you’ve probably heard about DSCR loans in California. These unique financing options are gaining popularity among savvy investors, but many still have questions about how they work and whether they’re the right choice. In this comprehensive guide, we’ll dive deep into the world of DSCR loans, with a special focus on what they mean for California investors.

What is a DSCR Loan?

Before we delve into the specifics of DSCR loans in California, let’s start with the basics. DSCR stands for Debt Service Coverage Ratio, a key metric used by lenders to evaluate the income potential of an investment property. But what exactly is a DSCR loan?

Defining DSCR Loans

A DSCR loan is a type of financing specifically designed for investment properties. Unlike traditional mortgages that primarily consider the borrower’s personal income, DSCR loans focus on the property’s ability to generate rental income. This makes them an attractive option for real estate investors, especially those looking to expand their portfolios without being limited by their personal income.

How DSCR Loans Work

When you apply for a DSCR loan, lenders calculate the Debt Service Coverage Ratio by dividing the property’s net operating income by its annual debt obligations. A ratio of 1.0 or higher indicates that the property generates enough income to cover its debt payments, making it a potentially good investment.

DSCR Loans in California: What You Need to Know

Now that we’ve covered the basics, let’s explore what makes DSCR loans in California unique.

California’s Real Estate Market and DSCR Loans

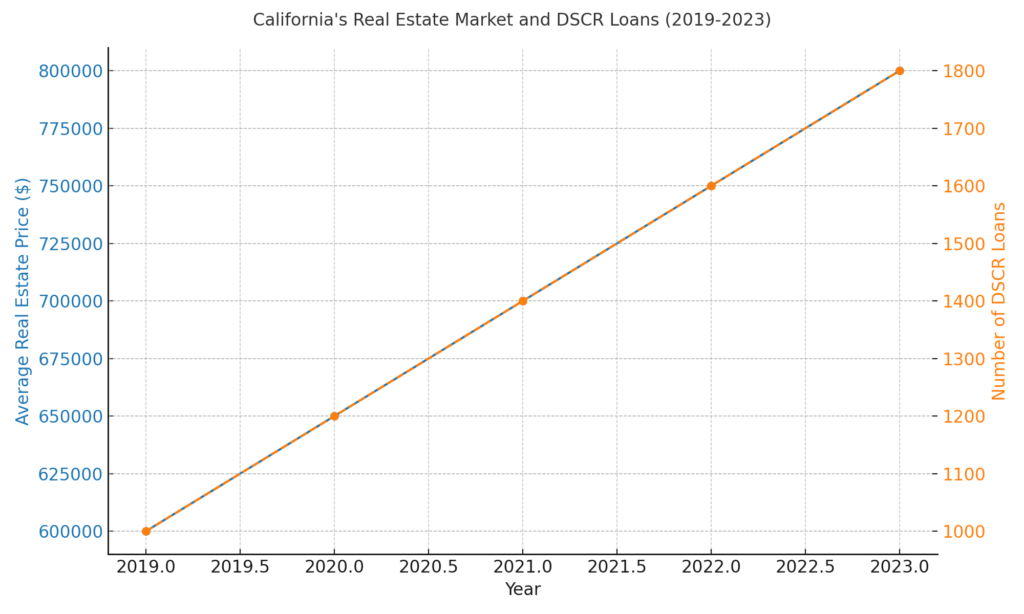

Hypothetical Data

| Year | Average Real Estate Price ($) | Number of DSCR Loans |

|---|---|---|

| 2019 | 600,000 | 1,000 |

| 2020 | 650,000 | 1,200 |

| 2021 | 700,000 | 1,400 |

| 2022 | 750,000 | 1,600 |

| 2023 | 800,000 | 1,800 |

This graph will illustrate the trends in average real estate prices and the number of DSCR loans over a five-year period.

California’s real estate market is known for its high property values and competitive rental markets. This makes DSCR loans particularly appealing to investors in the state. With property prices in cities like San Francisco, Los Angeles, and San Diego often reaching astronomical heights, traditional financing methods may fall short. DSCR loans offer a way for investors to finance properties based on their income potential rather than personal earnings.

DSCR Loan California Requirements

If you’re considering a DSCR loan in California, it’s essential to understand the requirements. While these may vary slightly between lenders, some common criteria include:

| Requirement | Description |

|---|---|

| Minimum DSCR | 1.25 |

| Minimum Credit Score | 680 |

| Loan-to-Value (LTV) Ratio | Up to 75% |

| Property Types | Residential, Commercial, Mixed-use |

| Loan Amount | $100,000 to $5,000,000 |

| Interest Rates | Variable, depending on market conditions and borrower’s profile |

| Loan Term | 5 to 30 years |

| Prepayment Penalty | Typically 1-5 years, varies by lender |

| Documentation Required | Financial statements, tax returns, property appraisal, rental income statements |

| Reserves | 6 to 12 months of principal and interest payments |

- Minimum credit score (typically 620-660)

- Down payment (usually 20-25% of the property value)

- Debt Service Coverage Ratio of at least 1.0 (though some lenders may require higher)

- Property must be an investment property (not owner-occupied)

- Cash reserves (often 6-12 months of mortgage payments)

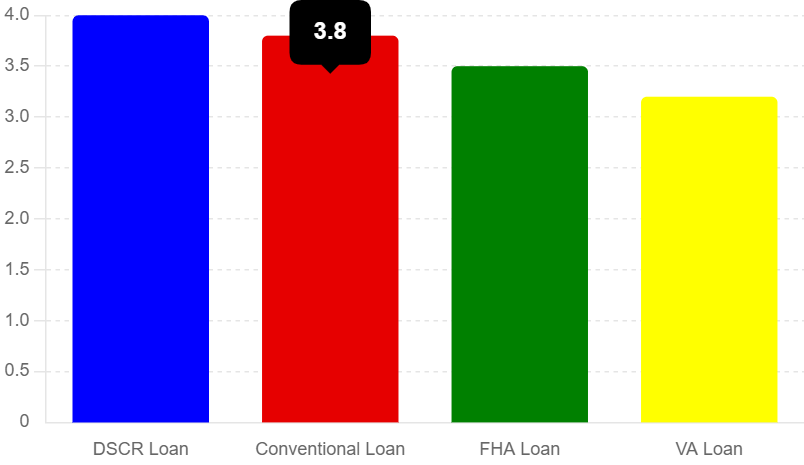

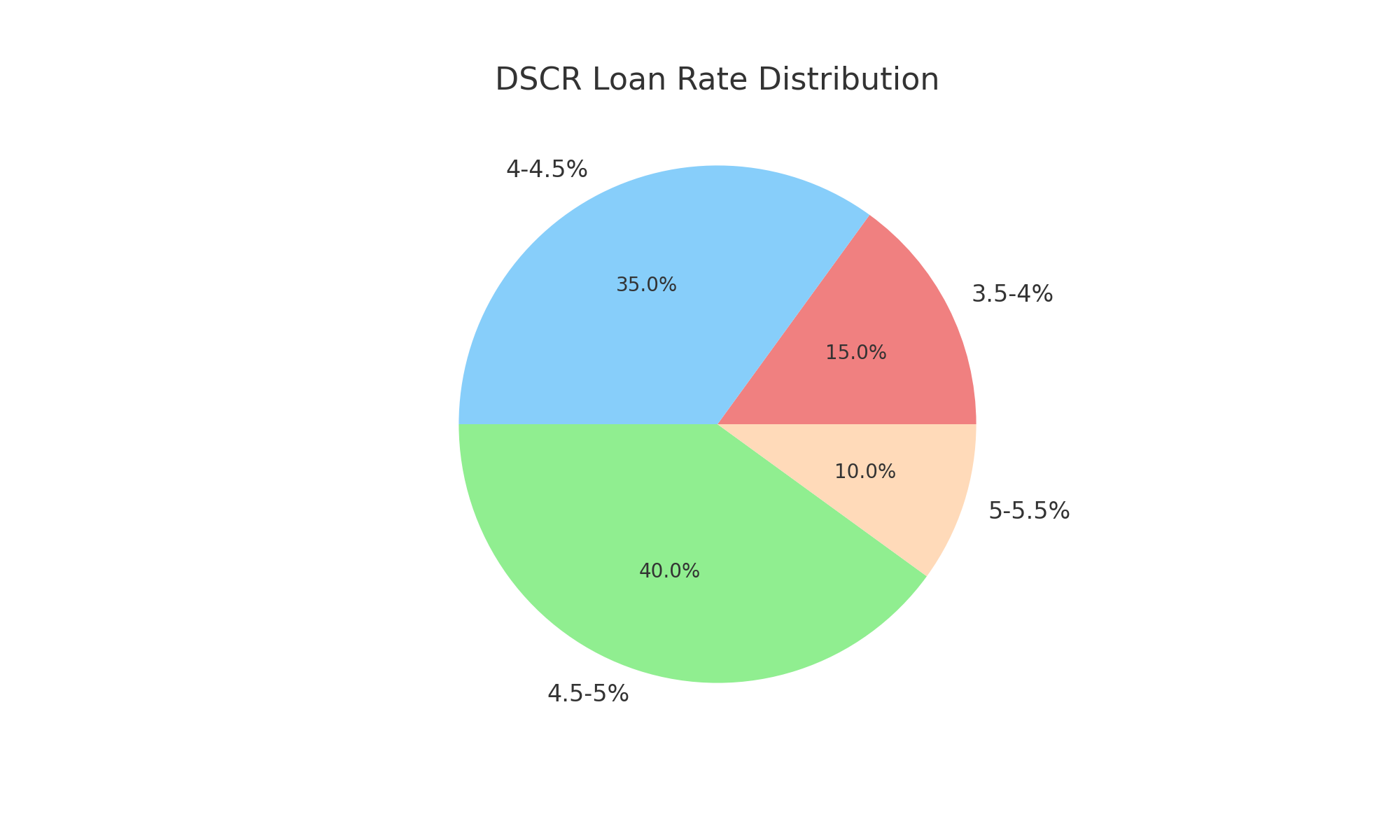

DSCR Loan California Rates

One of the most common questions about DSCR loans in California is regarding interest rates. It’s important to note that DSCR loan rates in California may be slightly higher than traditional mortgage rates. This is because they’re considered higher-risk loans due to their focus on investment properties.

Rates can vary based on factors such as:

- The property’s location within California

- Your credit score

- The loan-to-value ratio

- The property’s DSCR

As of 2024, DSCR loan rates in California typically range from 5.5% to 8%, but it’s always best to shop around and compare offers from multiple lenders.

Advantages of DSCR Loans for California Investors

Now that we’ve covered the basics, let’s explore why DSCR loans are becoming increasingly popular among California real estate investors.

1. Focus on Property Income

One of the biggest advantages of DSCR loans is that they prioritize the property’s income potential over the borrower’s personal income. This can be particularly beneficial in California’s high-cost real estate market, where personal income might not always align with property values.

2. Easier Qualification for Multiple Properties

For investors looking to build a portfolio of rental properties in California, DSCR loans can make it easier to qualify for multiple properties. Since each property is evaluated based on its own income potential, you’re not limited by your personal debt-to-income ratio.

3. Flexibility for Self-Employed Investors

California is home to many entrepreneurs and freelancers. For these self-employed individuals, proving steady income can be challenging when applying for traditional mortgages. DSCR loans offer a more flexible option, as they’re less concerned with personal income documentation.

4. Potential for Larger Loan Amounts

Given California’s high property values, investors often need access to larger loan amounts. DSCR loans can potentially offer higher loan amounts compared to traditional financing, as they’re based on the property’s income potential rather than personal income limits.

Challenges and Considerations for DSCR Loans in California

While DSCR loans offer many benefits, it’s important to consider potential challenges as well.

1. Higher Interest Rates

As mentioned earlier, DSCR loan rates in California are typically higher than traditional mortgage rates. Investors need to carefully consider whether the benefits outweigh the increased cost of borrowing.

2. Larger Down Payments

DSCR loans often require larger down payments compared to some traditional mortgage options. In California’s expensive real estate market, this can mean a significant upfront investment.

3. Strict DSCR Requirements

Lenders typically require a DSCR of at least 1.0, meaning the property must generate enough income to cover its debt obligations. In some competitive California markets, achieving this ratio can be challenging.

4. Property Type Restrictions

Some lenders may have restrictions on the types of properties eligible for DSCR loans. This could limit your options in certain California markets.

Who Should Consider a DSCR Loan in California?

DSCR loans can be an excellent option for certain types of investors in California. You might be a good candidate if:

- You’re looking to invest in rental properties in high-value California markets

- You’re self-employed or have irregular income that makes traditional mortgage qualification difficult

- You want to build a portfolio of investment properties without being limited by your personal income

- You’re confident in the rental income potential of the property you’re considering

How to Apply for a DSCR Loan in California

If you’ve decided that a DSCR loan is right for your California investment property, here’s a general overview of the application process:

- Research DSCR lenders in California

- Gather necessary documentation (property details, rental income projections, etc.)

- Submit your loan application

- Provide any additional requested information

- Wait for the lender’s decision

- If approved, review and sign loan documents

DSCR Loan Programs in California

Several lenders offer DSCR loan programs in California. Some popular options include:

- Angel Oak Mortgage Solutions

- Deephaven Mortgage

- Athas Capital Group

- LendSure Mortgage Corp

It’s important to shop around and compare offers from multiple lenders to find the best terms for your specific situation.

Future of DSCR Loans in California

As California’s real estate market continues to evolve, DSCR loans are likely to play an increasingly important role. With ongoing demand for rental properties in many parts of the state, these loans offer a valuable financing option for investors looking to capitalize on market opportunities.

However, it’s important to stay informed about any changes in lending regulations or market conditions that could impact DSCR loan availability or terms in California.

Read Also: DSCR Loans Akron: Invest with Property Income, Not W-2s

Conclusion

DSCR loans offer a unique and potentially valuable financing option for real estate investors in California. By focusing on a property’s income potential rather than the borrower’s personal income, these loans can open up new opportunities in the state’s competitive real estate market.

However, like any financial decision, it’s crucial to carefully consider the pros and cons of DSCR loans in the context of your individual investment goals and circumstances. By understanding the requirements, benefits, and potential challenges of DSCR loans in California, you’ll be better equipped to make informed decisions about your real estate investments.

Remember, while DSCR loans can be a powerful tool for building your real estate portfolio in California, they’re not right for everyone. Always consult with financial advisors and real estate professionals to ensure you’re making the best choices for your investment strategy.

FAQs

Here are five frequently asked questions about DSCR loans in California:

What is the minimum credit score for a DSCR loan in California?

While requirements can vary by lender, most DSCR loans in California require a minimum credit score of 620 to 660. However, a higher credit score may help you secure better interest rates and terms.

Can I use a DSCR loan for a short-term rental property in California?

Yes, many DSCR loan programs in California allow for short-term rental properties. However, lenders may have specific requirements for calculating potential income from these properties, so be sure to discuss this with your lender.

Are DSCR loans available for multifamily properties in California?

Absolutely! DSCR loans can be an excellent option for financing multifamily properties in California. Many lenders offer DSCR loan programs specifically designed for multifamily investments.

How long does it typically take to close on a DSCR loan in California?

The closing timeline for a DSCR loan in California can vary, but it’s often faster than traditional mortgages. On average, you can expect the process to take 30 to 45 days from application to closing.

Can I refinance my existing California investment property with a DSCR loan?

Yes, many investors use DSCR loans to refinance existing investment properties in California. This can be a good option if you want to tap into your property’s equity or potentially secure better loan terms based on the property’s income potential.