DSCR loans with no down payment offer flexibility and potential benefits for real estate investors. These loans focus on the property’s income potential rather than the borrower’s personal income or credit score. Benefits include increased investment capital, easier market entry, and leveraging properties for higher returns. Securing a DSCR loan with no down payment requires strong lender relationships, good credit scores, real estate experience, and a solid business plan. However, most DSCR loans still require a down payment, typically around 20%. Creative financing options and regional programs can help minimize down payment requirements.

DSCR Loan No Down Payment: A Comprehensive Guide for Investors

Investing in real estate can be a lucrative venture, but securing the right financing is crucial. For many investors, DSCR (Debt Service Coverage Ratio) loans are an attractive option due to their flexibility and the potential for no down payment. This guide will explore everything you need to know about DSCR loans with no down payment, covering various aspects from qualifications to specific regional options like Florida and Texas.

Why Choose a DSCR Loan?

DSCR loans are popular among real estate investors because they focus on the property’s income potential rather than the borrower’s personal income or credit score. This makes them particularly attractive for those with non-traditional income streams or less-than-perfect credit histories.

Benefits of DSCR Loans No Down Payment

Securing a DSCR loan with no down payment offers several advantages:

- Increased Investment Capital: With no down payment required, you can allocate your capital towards other investment opportunities or property improvements.

- Easier Entry into the Market: For new investors, the ability to secure financing without a significant initial investment can facilitate easier entry into the real estate market.

- Leverage: Leveraging a property with no down payment can amplify your returns, especially if the property’s value appreciates over time.

Case Study: Maximizing Returns with DSCR Loans

Investor Profile: Jane Doe, a seasoned real estate investor in Florida.

Scenario: Jane secured a DSCR loan with a 10% down payment for a multi-family property in a high-demand area. The property’s rental income was robust enough to cover the mortgage and operational costs, resulting in a DSCR of 1.35.

Outcome: Within two years, the property appreciated by 15%, increasing the equity and overall return on investment. Jane’s ability to invest with a low down payment allowed her to allocate funds to renovate the property, further increasing its value and rental income.

Visual Aid: An infographic showing the timeline of property value appreciation and equity growth under a DSCR loan.

Success Story: Maximizing Returns in Texas

John, an experienced investor in Austin, Texas, utilized a DSCR loan to purchase a multifamily property with only a 10% down payment. The property’s strong rental income allowed him to leverage the investment significantly. Over two years, the property appreciated by 15%, increasing his equity and overall return on investment. John’s story highlights how effective DSCR loans can be for real estate investment strategies.

Can You Get a DSCR Loan with No Down Payment?

There are no DSCR loan programs that allow you to avoid a down payment entirely. The largest and most competitive institutional investors that buy DSCR loans allow a maximum 80% Loan-to-Value (LTV) ratio, which means you would be responsible for a 20% down payment on a purchase using a DSCR loan.

How to Get a DSCR Loan with No Down Payment

Securing a DSCR loan with no down payment requires careful planning and strategy. Here’s a step-by-step guide to increase your chances of success.

1. Build Strong Relationships with Lenders

Networking with multiple lenders specializing in DSCR loans can open doors to more flexible financing options.

2. Improve Your Credit Score

While DSCR loans focus on the property’s income, a higher credit score can still improve your chances of favorable terms.

3. Demonstrate Real Estate Experience

Lenders are more likely to offer no down payment options to experienced investors with a proven track record.

4. Present a Solid Business Plan

A well-crafted business plan showcasing the property’s potential can convince lenders to offer more flexible terms.

5. Consider Creative Financing Options

Explore alternatives like seller financing or partnering with other investors to achieve your no down payment goal.

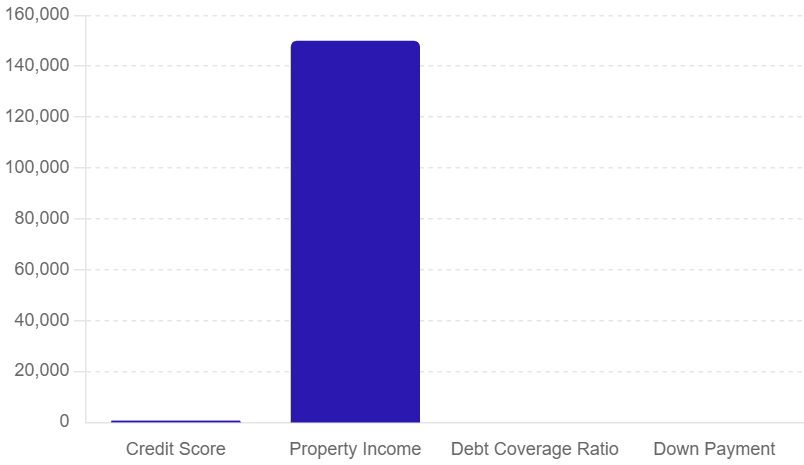

DSCR Loan Qualifications

To qualify for a DSCR loan, the primary consideration is the property’s income-generating potential. Lenders typically look for:

- Adequate DSCR: A minimum DSCR of 1.2 is often required, though some lenders may have different thresholds.

- Property Type: The property must be a rental property, generating consistent rental income.

- Condition of the Property: The property should be in good condition and meet the lender’s requirements for habitability.

The Correlation Between Down Payment and Default Rate

Housing economists, institutional lenders, and rental property investors generally agree that a 70% LTV (30% down payment) is an ideal target. The primary reason no down payment loans are unavailable is due to the risk of negative equity. At 0% down payment, you start with 0% equity in the home, increasing the risk of default if property values decline.

Example of Negative Equity

- Purchase Price: $200,000

- Loan Amount: $200,000

- Market Value After 10% Downturn: $180,000

- Equity: -$20,000

- Closing Costs to Sell: $15,000

- Cash from Borrower at Settlement: $35,000

In such a scenario, many borrowers decide to walk away and let the lender foreclose on the house.

No Down Payment Loans in a Rising Market

In a rising market, a no down payment loan can perform well and quickly move from 100% LTV at origination to a safer CLTV (current loan to value).

Example of Positive Equity

- Purchase Price: $200,000

- Loan Amount: $200,000

- Market Value After 10% Appreciation: $220,000

- Equity: $20,000

- Closing Costs to Sell: $15,000

- Cash to Borrower at Settlement: $5,000

How to Calculate Home Equity

When taking on high LTV debt, it’s important to understand how your amortization schedule affects the rate at which you accumulate equity if your home value does not appreciate.

- 30-Year Amortization: Provides $10,765.13 of equity by the end of year 5 for a $200,000 property.

- 15-Year Amortization: Provides $43,808.16 of equity over the same timeline but with a higher monthly payment.

DSCR Loan No Down Payment in Florida

Florida is a popular market for real estate investors. Securing a DSCR loan with no down payment in this state can be advantageous. Several lenders in Florida specialize in DSCR loans and may offer no down payment options for properties in high-demand areas.

DSCR Loan No Down Payment in Texas

Texas also offers a robust real estate market, and many lenders provide DSCR loans with no down payment. Investors should focus on properties in growing markets and work with local lenders familiar with the Texas real estate landscape.

No Credit Check DSCR Loans

For investors with poor or limited credit histories, no credit check DSCR loans can be a viable option. These loans focus solely on the property’s income potential, making them accessible to a wider range of investors.

DSCR Loan Down Payment Requirements

While some DSCR loans offer no down payment options, others may require a low down payment. Understanding the various down payment requirements can help you better prepare:

- Standard Down Payment: Typically, DSCR loans require a down payment of 10-20%.

- Low Down Payment Options: Some lenders offer low down payment options, starting as low as 5-10%.

- Down Payment Assistance: Certain programs and regional initiatives provide down payment assistance, making it easier to meet lender requirements.

Creative Strategies for Minimizing Down Payments on DSCR Loans

This table summarizing creative strategies for minimizing down payments on DSCR (Debt Service Coverage Ratio) loans:

| Strategy | Description |

|---|---|

| 1. Seller Financing as a Down Payment Alternative | Negotiate with the seller to provide financing for part of the down payment. This can reduce the initial cash outlay required from the borrower. |

| 2. Leveraging Home Equity | Use the equity in an existing property as collateral for the down payment. This can be done through a home equity loan or line of credit. |

| 3. Exploring DSCR Loan Down Payment Assistance Programs | Research and apply for programs that offer down payment assistance specifically for DSCR loans. These programs can provide grants or low-interest loans to cover the down payment. |

| 4. Considering a DSCR Loan with a Low Down Payment | Look for DSCR loan options that require a lower down payment. Some lenders offer products with reduced down payment requirements, making it easier to secure financing. |

While true no down payment DSCR loans may be challenging to find, there are several strategies investors can employ to minimize their out-of-pocket expenses.

1. Seller Financing as a Down Payment Alternative

Negotiating with the property seller to finance a portion of the purchase price can effectively reduce or eliminate the need for a traditional down payment.

2. Leveraging Home Equity

Investors with existing properties can tap into their home equity to cover the down payment on a new DSCR loan.

3. Exploring DSCR Loan Down Payment Assistance Programs

Some lenders and local governments offer assistance programs specifically designed to help investors with down payments on investment properties.

4. Considering a DSCR Loan with a Low Down Payment

If a true no down payment option isn’t available, look for DSCR loans offering low down payment requirements, such as 10% down DSCR loan programs.

Minimum Down Payment for Multi-Family Properties

Investors looking to purchase multi-family properties may find that DSCR loans offer flexible down payment options. The minimum down payment can vary based on the property’s size, location, and income potential, but it’s often lower than traditional loans.

DSCR Loan Programs

Various DSCR loan programs cater to different investor needs. These programs can offer benefits such as interest-only payments, no credit check requirements, and flexible down payment options.

Investment Loans for Rental Property

DSCR loans are ideal for investors seeking to purchase rental properties. They provide the necessary capital while focusing on the property’s ability to generate rental income.

Read Also: DSCR Loan Pros and Cons: Everything You Need to Know

Conclusion

Securing a DSCR loan with no down payment can significantly enhance your real estate investment strategy. By understanding the qualifications, regional options, and various loan programs available, you can make informed decisions that maximize your investment potential. Whether you’re investing in Florida, Texas, or other markets, DSCR loans offer a flexible and accessible financing solution.

FAQs

Are there DSCR loans available in Florida with no down payment?

Yes, several lenders in Florida offer DSCR loans with no down payment, particularly for properties in high-demand areas.

What are the down payment requirements for DSCR loans?

Down payment requirements for DSCR loans can vary. While some loans offer no down payment options, others may require a standard down payment of 10-20%, with low down payment options available from some lenders.