DSCR loans are popular for real estate investors, offering easier qualification as they focus on property income rather than personal income. Pros include no personal income requirements, flexible use of funds, potential for higher loan amounts, and suitability for LLCs and corporations. However, cons include higher interest rates, larger down payments, stricter property requirements, potential higher fees, prepayment penalties, and cash reserve requirements. They are particularly beneficial in states like Florida and Texas, though higher interest rates and property demands are common.

DSCR Loan Pros and Cons

In the world of real estate investment, DSCR (Debt Service Coverage Ratio) loans have become a popular financing option. But what exactly are DSCR loans, and are they the right choice for you? Let’s dive into the pros and cons of DSCR loans to help you make an informed decision.

What is a DSCR Loan?

DSCR loans are a type of financing used primarily by real estate investors to purchase income-generating properties. The Debt Service Coverage Ratio (DSCR) is a measure of the property’s ability to cover its debt obligations with its income. In simpler terms, it’s a way lenders assess whether the property’s income will be sufficient to cover the loan payments.

Pros of DSCR Loans

Here is a table outlining the pros of DSCR loans:

| Pros of DSCR Loans | Description |

|---|---|

| 1. Easier Qualification Process | DSCR loans have a simplified qualification process, focusing primarily on the income generated by the property rather than the borrower’s personal income. |

| 2. No Personal Income Requirements | Borrowers are not required to demonstrate their personal income, making these loans accessible to those with varying personal financial situations. |

| 3. Flexible Use of Funds | The funds from DSCR loans can be used for a variety of purposes, including purchasing, refinancing, or renovating income-producing properties. |

| 4. Potential for Higher Loan Amounts | DSCR loans often allow for higher loan amounts compared to traditional loans, based on the property’s income-generating potential. |

| 5. Suited for LLCs and Corporations | These loans are ideal for businesses, including LLCs and corporations, looking to invest in real estate without tying the loan to an individual’s personal credit. |

| 6. Approval Based on Property Performance | Loan approval is based on the performance of the property, specifically its ability to generate sufficient income to cover the debt service. |

This table provides a clear overview of the advantages of DSCR loans.

1. Easier Qualification Process

One of the biggest advantages of DSCR loans is the relatively easier qualification process compared to traditional loans. Since the loan is based on the property’s income rather than the borrower’s personal income, it can be easier for investors to qualify.

2. No Personal Income Requirements

Unlike conventional loans, DSCR loans do not require the borrower to have a high personal income. This makes them an attractive option for investors who may not have a steady personal income but have profitable investment properties.

3. Flexible Use of Funds

DSCR loans can be used for a variety of purposes, including purchasing rental properties, refinancing existing properties, or even for construction projects. This flexibility makes them a versatile financing option for real estate investors.

4. Potential for Higher Loan Amounts

Because DSCR loans are based on the income generated by the property, investors may be able to secure higher loan amounts compared to traditional financing options. This can be particularly beneficial for those looking to invest in larger or more expensive properties.

5. Suited for LLCs and Corporations

DSCR loans can be issued to LLCs and corporations, providing legal and financial protection for investors. This allows investors to keep their personal assets separate from their investment properties.

6. Approval Based on Property Performance

DSCR loans are approved based on the property’s income-generating potential, making it possible to finance multiple properties without the need to repay one before acquiring another.

Cons of DSCR Loans

Here is a table outlining the cons of DSCR loans:

| Cons of DSCR Loans | Description |

|---|---|

| 1. Higher Interest Rates | DSCR loans typically come with higher interest rates compared to traditional loans, reflecting the increased risk lenders take on. |

| 2. Larger Down Payments Required | Borrowers may need to provide a larger down payment, often ranging from 20% to 30% of the property value, which can be a significant upfront cost. |

| 3. Stricter Property Requirements | Lenders may have stricter requirements for the property, including its condition and income-generating potential, to ensure it meets the standards necessary for loan approval. |

| 4. Potential for Higher Fees | DSCR loans can involve higher fees, including origination fees, processing fees, and appraisal fees, adding to the overall cost of the loan. |

| 5. Prepayment Penalties | Some DSCR loans may include prepayment penalties, which can impose additional costs if the borrower decides to pay off the loan early. |

| 6. Cash Reserve Requirements | Lenders may require borrowers to maintain a cash reserve, ensuring that funds are available for property-related expenses and loan payments in case of income disruptions. |

This table provides a clear overview of the disadvantages of DSCR loans.

1. Higher Interest Rates

One of the downsides of DSCR loans is that they often come with higher interest rates compared to conventional loans. This is because they are considered riskier for lenders due to the reliance on the property’s income.

2. Larger Down Payments Required

DSCR loans typically require larger down payments, which can be a barrier for some investors. It’s important to have substantial capital available to meet these requirements.

3. Stricter Property Requirements

Lenders offering DSCR loans often have stricter requirements for the property itself. This can include higher standards for the property’s condition, location, and income potential.

4. Potential for Higher Fees

DSCR loans can come with higher fees and closing costs. It’s essential to factor in these additional expenses when considering this type of financing.

5. Prepayment Penalties

Some DSCR loans may include prepayment penalties, which can be costly if you decide to pay off the loan early.

6. Cash Reserve Requirements

Lenders may require investors to have several months of cash reserves, which can be a challenge for those without significant liquid assets.

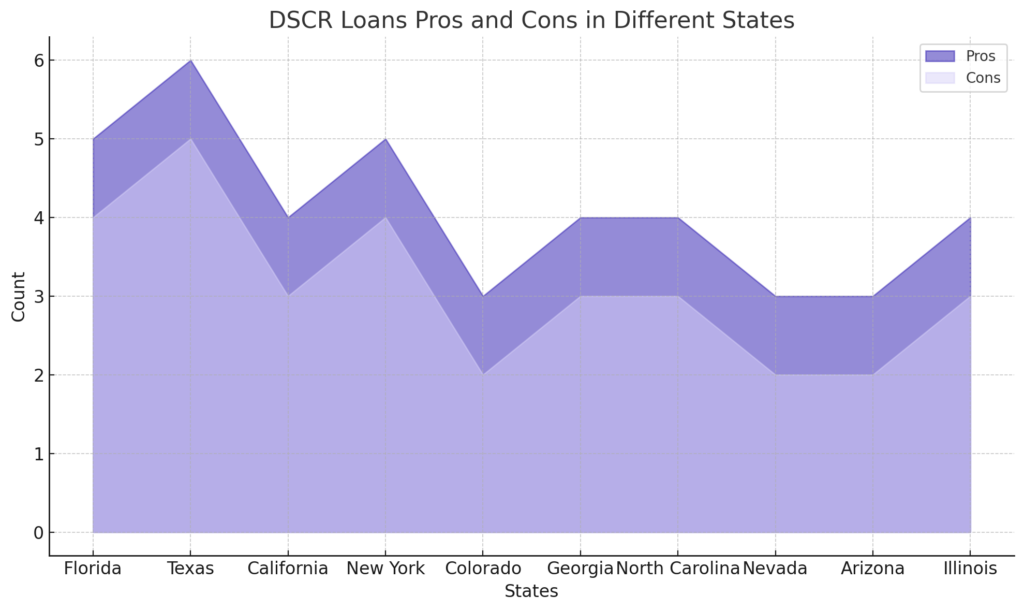

DSCR Loans Pros and Cons in Different States

DSCR Loan Florida Pros and Cons

Florida is a popular state for real estate investment, and DSCR loans can be particularly beneficial here due to the high demand for rental properties. However, investors should be aware of the higher interest rates and property requirements.

DSCR Loan Texas Pros and Cons

Texas offers a diverse real estate market, making DSCR loans a viable option. The state’s booming economy and population growth provide excellent opportunities for rental income. However, investors should be prepared for the competitive market and potential for higher down payments.

DSCR Loan Florida Pros and Cons

Florida is a hotspot for real estate investment due to its thriving tourism industry and favorable tax policies. DSCR loans in Florida are popular among investors who focus on vacation rentals and residential properties. Lenders in Florida typically look for a DSCR of 1.25 or higher, ensuring that the property generates sufficient income to cover the loan payments.

DSCR Loan Texas Pros and Cons

Texas is known for its robust economy and diverse real estate market. Investors in Texas often use DSCR loans to finance multifamily properties and commercial real estate. Texas lenders usually require a DSCR of at least 1.20, making it a favorable market for those looking to invest in high-yield properties.

DSCR Loan California Pros and Cons

California’s real estate market is one of the most dynamic in the country, with high demand for both residential and commercial properties. Due to the high property values, lenders in California often set a higher DSCR threshold, typically around 1.35 or more. This ensures that the properties are generating ample income to cover the mortgage payments and other associated costs.

DSCR Loan New York Pros and Cons

New York offers a diverse real estate landscape, from urban apartments to suburban homes and commercial buildings. DSCR loans in New York are attractive to investors looking to capitalize on the rental market. Lenders in this state usually require a DSCR of at least 1.30, given the competitive and high-value nature of the market.

DSCR Loan Colorado Pros and Cons

Colorado has seen a significant increase in real estate investments, especially in cities like Denver and Boulder. The state’s strong rental market makes DSCR loans a viable option for investors. Lenders in Colorado typically look for a DSCR of around 1.25, balancing the state’s growing real estate opportunities with the need for financial stability.

DSCR Loan Georgia Pros and Cons

Georgia’s real estate market, particularly in Atlanta, offers substantial investment opportunities. DSCR loans are popular among investors focusing on rental properties and commercial spaces. Lenders in Georgia usually require a DSCR of 1.20 or higher, making it accessible for investors aiming for steady cash flow and growth.

North Carolina Pros and Cons

North Carolina, with its booming tech and healthcare sectors, is a promising state for real estate investments. The demand for rental properties is high, making DSCR loans an attractive option. Lenders in North Carolina often require a DSCR of at least 1.25, ensuring the properties are profitable and capable of covering the loan costs.

DSCR Loan Nevada Pros and Cons

Nevada’s real estate market, especially in Las Vegas, is known for its potential high returns. DSCR loans in Nevada cater to investors targeting rental properties and commercial investments. Lenders typically look for a DSCR of around 1.30, reflecting the state’s vibrant and sometimes volatile market.

DSCR Loan Arizona Pros and Cons

Arizona offers a growing real estate market with a strong rental demand, particularly in cities like Phoenix and Scottsdale. Investors using DSCR loans in Arizona benefit from the state’s economic growth and population influx. Lenders in Arizona usually require a DSCR of 1.25, ensuring the investment properties generate sufficient income.

DSCR Loan Illinois Pros and Cons

Illinois, particularly Chicago, provides diverse real estate investment opportunities. DSCR loans are popular among investors in both residential and commercial sectors. Lenders in Illinois often require a DSCR of at least 1.30, considering the high value and competitive nature of the market.

Comparing DSCR Loans to Other Financing Options

DSCR Loan vs. Conventional Loan

When comparing DSCR loans to conventional loans, the primary difference lies in the qualification process. Conventional loans require a strong personal income and credit history, while DSCR loans focus on the property’s income. This makes DSCR loans more accessible to some investors but comes with higher interest rates and down payment requirements.

DSCR Loan for Primary Residence

DSCR loans are generally not used for primary residences. They are designed for investment properties that generate income, making them unsuitable for personal homes.

DSCR Loan Programs and Requirements

DSCR Loan Program Down Payment

The down payment requirement for DSCR loans can vary but typically ranges from 20% to 30% of the property’s value. This higher down payment is due to the increased risk associated with these loans.

DSCR Loan Interest Rates Today

Interest rates for DSCR loans can fluctuate based on market conditions and the lender’s policies. Generally, they are higher than conventional loan rates due to the increased risk.

DSCR Loan Application Process

How Much Down for a DSCR Loan

The down payment for a DSCR loan can be significant. Investors should plan for a down payment of at least 20%, though it can be higher depending on the lender and the property’s specifics.

DSCR Loan Qualifications

Qualifying for a DSCR loan involves demonstrating that the property’s income can cover the debt obligations. Lenders will assess the property’s rental income, operating expenses, and overall financial health.

Special Considerations for DSCR Loans

DSCR Construction Loan

DSCR loans can be used for construction projects, but these loans often come with additional requirements and higher interest rates. Investors should carefully evaluate the potential returns before opting for a DSCR construction loan.

DSCR Loan for Airbnb

Using a DSCR loan for short-term rental properties like Airbnb can be a lucrative investment. However, lenders may have specific requirements or restrictions for properties used for short-term rentals.

Long-Term Rental Loans and DSCR Loans

Long-Term Rental Loans

DSCR loans are particularly well-suited for long-term rental properties. The steady rental income can help ensure that the debt service coverage ratio remains favorable, making it easier to manage the loan.

DSCR Loan Refinance

Refinancing a DSCR loan can be an option for investors looking to take advantage of better interest rates or to access equity in the property. It’s important to weigh the costs and benefits of refinancing.

Read Also: DSCR Loan No Down Payment: Risks and Rewards Explained

Conclusion

In conclusion, DSCR loans offer a unique financing option for real estate investors. They provide easier qualification processes and flexible use of funds but come with higher interest rates and down payment requirements. Understanding the pros and cons of DSCR loans can help you determine if they are the right choice for your investment strategy.

FAQs

What is a DSCR loan and how does it work?

A DSCR loan is a type of financing based on the property’s income rather than the borrower’s personal income. Lenders assess the property’s ability to cover its debt obligations with its income.

Are DSCR loans good?

DSCR loans can be a good option for real estate investors who have income-generating properties but may not have a strong personal income or credit history.

How much down for a DSCR loan?

Down payment requirements for DSCR loans typically range from 20% to 30% of the property’s value.

Can you get a DSCR loan with no money down?

It’s generally difficult to get a DSCR loan with no money down due to the higher risk associated with these loans. Most lenders require a substantial down payment.

What is a good DSCR?

A good DSCR is typically above 1.25. This means the property’s income is 1.25 times greater than its debt obligations, indicating a healthy margin to cover loan payments.