DSCR (Debt Service Coverage Ratio) for rental property measures income vs. debt obligations. Calculate: DSCR = Net Operating Income / Total Debt Service. Good DSCR: 1.25+. Factors: rental income, expenses, interest rates. Improve by increasing rent, reducing costs, or refinancing. Essential for investors and lenders.

How to Calculate DSCR for Rental Property: A Comprehensive Guide

Are you a real estate investor looking to expand your portfolio? Or perhaps you’re a lender evaluating the financial health of a potential borrower’s rental property? In either case, understanding how to calculate the Debt Service Coverage Ratio (DSCR) for rental property is crucial. This powerful financial metric can make or break investment decisions and loan approvals. In this guide, we’ll dive deep into the world of DSCR, exploring its significance, calculation methods, and practical applications in the realm of rental property investments.

What is DSCR and Why Does it Matter?

Before we jump into the nitty-gritty of calculations, let’s get a firm grasp on what DSCR actually is. The Debt Service Coverage Ratio is a financial metric used to measure a property’s ability to cover its debt obligations with its net operating income. In simpler terms, it tells us whether a rental property generates enough cash flow to pay its mortgage and other related debt expenses.

But why should you care about the DSCR? Well, it’s a big deal for several reasons:

- Loan Approval: Lenders use the DSCR as a key factor in determining whether to approve a mortgage for a rental property.

- Investment viability: It helps investors assess whether a property will be profitable after accounting for debt payments.

- Risk Assessment: The DSCR provides insight into the financial risk associated with a property investment.

- Performance Indicator: It serves as a benchmark for comparing different investment opportunities.

Now that we’ve established its importance, let’s roll up our sleeves and learn how to calculate this critical ratio.

The DSCR Formula: Breaking it Down

At its core, the DSCR formula is straightforward:

DSCR = Net Operating Income (NOI) / Total Debt Service

It seems simple enough, right? But don’t be fooled—the devil is in the details. To accurately calculate DSCR, we need to understand its components inside and out.

Understanding Net Operating Income (NOI)

Net Operating Income is the lifeblood of your rental property’s financial health. It represents the total income generated by the property minus all reasonable operating expenses. Here’s how to calculate it:

- Start with Gross Potential Income (GPI): This is the total rent you’d collect if the property were 100% occupied at market rates.

- Subtract Vacancy and Credit Losses: Be realistic about potential vacancies and unpaid rent.

- Add Other Income: Include laundry fees, parking fees, or any other income the property generates.

- Subtract Operating Expenses: This includes property taxes, insurance, maintenance, property management fees, utilities (if not paid by tenants), and any other regular costs associated with running the property.

The resulting figure is your NOI. It’s crucial to be as accurate as possible when determining this number, as it forms the foundation of your DSCR calculation.

Decoding Total Debt Service

The Total Debt Service represents all debt payments related to the property over a year. This typically includes:

- Principal and interest payments on the mortgage

- Any secondary loans or lines of credit secured by the property

- Balloon payments (if applicable)

It’s important to note that Total Debt Service doesn’t include operating expenses; those are already accounted for in the NOI calculation.

Step-by-Step Guide to Calculating DSCR

Now that we’ve dissected the components, let’s walk through the process of calculating DSCR for a rental property:

- Calculate the Net Operating Income (NOI):

- Determine Gross Potential Income

- Subtract estimated vacancy and credit losses

- Add any additional income

- Subtract all operating expenses

- Calculate the Total Debt Service:

- Sum up all annual debt payments related to the property

- Divide NOI by Total Debt Service: DSCR = NOI / Total Debt Service

- Interpret the Result:

- A DSCR of 1.0 means the property’s income exactly covers its debt payments

- A DSCR above 1.0 indicates positive cash flow

- A DSCR below 1.0 suggests the property isn’t generating enough income to cover its debt obligations

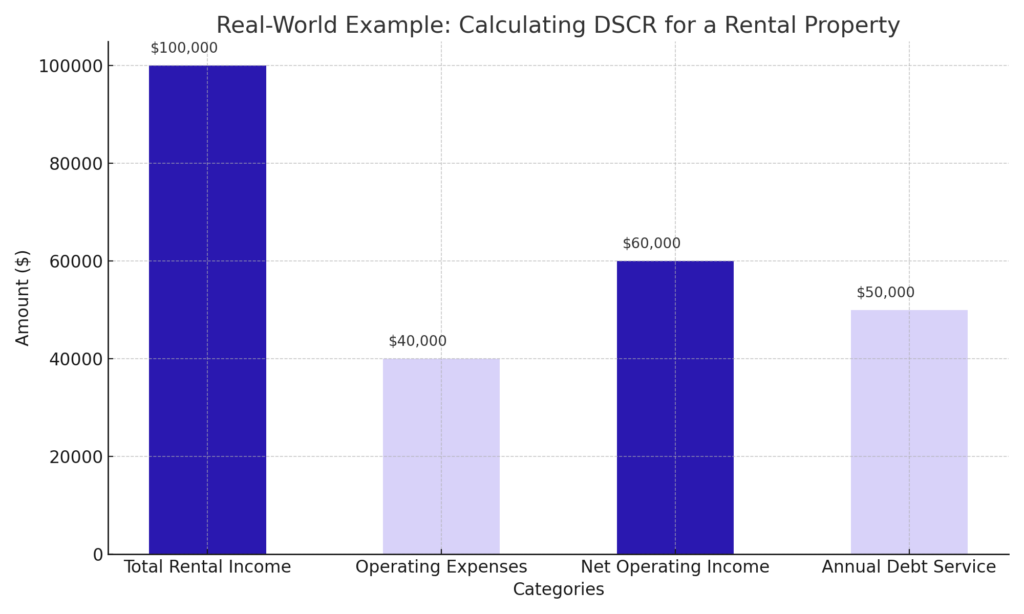

Real-World Example: Calculating DSCR for a Rental Property

Let’s put our knowledge into practice with a hypothetical rental property:

Gross Potential Income: $60,000/year Vacancy and Credit Loss: 5% ($3,000) Other Income: $1,200/year (laundry facilities) Operating Expenses: $15,000/year

Annual Mortgage Payment: $30,000

Step 1: Calculate NOI. NOI = ($60,000 – $3,000 + $1,200) – $15,000 = $43,200

Step 2: Identify Total Debt Service Total Debt Service = $30,000

Step 3: Calculate DSCR: DSCR = $43,200 / $30,000 = 1.44

In this example, the DSCR of 1.44 indicates that the property generates 44% more income than needed to cover its debt obligations—a healthy financial position!

What’s a Good DSCR for Rental Property?

Now that you know how to calculate DSCR, you might be wondering what constitutes a “good” ratio. While this can vary depending on the lender and property type, here are some general guidelines:

- 1.25 or higher: Generally considered strong and likely to be approved by most lenders

- 1.10 to 1.25: Acceptable to many lenders, but may require additional scrutiny

- Below 1.10: May be considered risky by lenders and could result in loan denial or less favorable terms

Remember, these are just guidelines. Some lenders may have stricter requirements, while others might be more flexible, especially for experienced investors or in highly desirable markets.

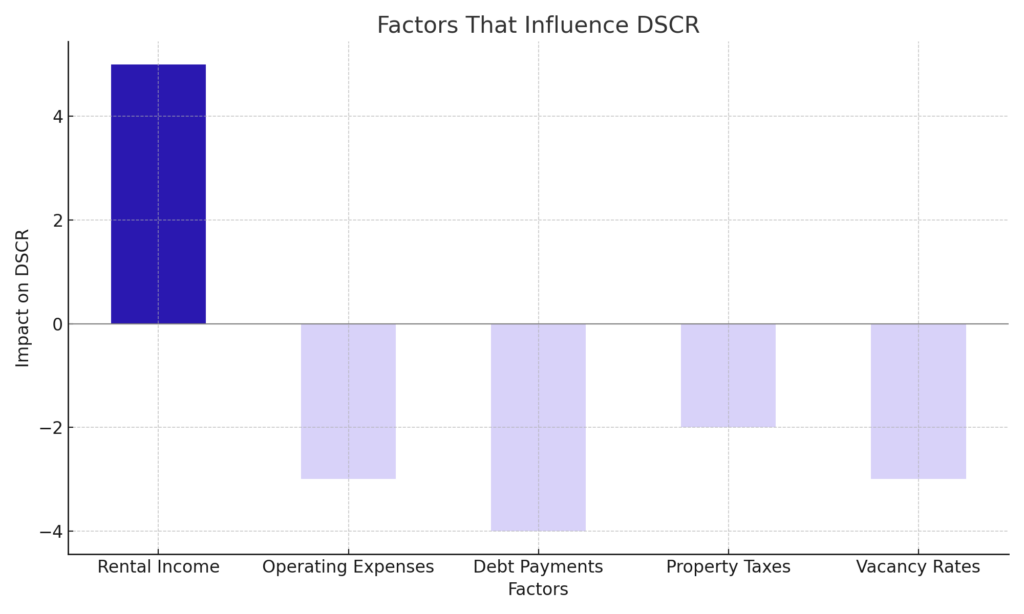

Factors That Influence DSCR

Understanding the factors that can impact your DSCR is crucial for both investors and lenders. Here are some key elements to consider:

1. Rental Income

The most obvious factor is rental income. Higher rents will naturally lead to a better DSCR, assuming expenses don’t increase proportionally. However, it’s essential to use realistic, market-based rent projections rather than overly optimistic figures.

2. Occupancy Rates

Vacancy rates directly affect your NOI. A property in a high-demand area with low vacancy rates will typically have a stronger DSCR than a similar property in a less desirable location.

3. Operating Expenses

Efficient management of operating expenses can significantly impact your DSCR. Regular maintenance, energy-efficient upgrades, and smart property management can help keep costs down and improve your ratio.

4. Interest Rates

Since your mortgage payment is a key component of the Total Debt Service, interest rates play a crucial role in determining DSCR. Lower interest rates generally lead to better DSCR values.

5. Loan Terms

The structure of your loan, including the loan amount, term length, and whether it’s a fixed or variable rate, will affect your debt service and, consequently, your DSCR.

Strategies to Improve Your DSCR

| Strategy | Description |

|---|---|

| Increase Rental Income | Adjust rent to market rates, add amenities, or improve property quality to attract higher-paying tenants. |

| Reduce Operating Expenses | Implement cost-saving measures, negotiate better service contracts, or find more efficient property management. |

| Refinance Debt | Obtain a loan with a lower interest rate or extend the loan term to reduce monthly debt payments. |

| Improve Occupancy Rates | Implement marketing strategies to attract new tenants, retain existing tenants, and reduce vacancy rates. |

| Implement Value-Add Improvements | Renovate or upgrade the property to increase its value and justify higher rents. |

| Increase Ancillary Income | Add revenue streams such as parking fees, vending machines, or laundry facilities. |

| Optimize Property Tax Assessment | Appeal property tax assessments to reduce annual property tax expenses. |

| Review Insurance Policies | Shop for competitive insurance rates or adjust coverage levels to lower premiums. |

| Implement Energy-Efficiency Measures | Invest in energy-efficient systems to lower utility costs. |

| Lease Renewals and Escalations | Negotiate lease renewals with existing tenants at higher rates and include escalation clauses for future rent increases. |

| Diversify Tenant Mix | Attract a mix of tenants to reduce risk and stabilize rental income. |

If you’re looking to boost your DSCR, consider these strategies:

- Increase Rental Income: This could involve raising rents (if market conditions allow), adding value-added services, or improving the property to justify higher rents.

- Reduce Operating Expenses: Look for ways to cut costs without sacrificing property quality or tenant satisfaction. Energy-efficient upgrades or bulk-buying supplies can help.

- Refinance: If interest rates have dropped since you obtained your mortgage, refinancing could lower your debt service and improve your DSCR.

- Pay Down Debt: Making extra payments to reduce your loan principal can lower your debt service over time.

- Increase Down Payment: For new purchases, a larger down payment means a smaller loan, resulting in lower debt service and a better DSCR.

DSCR Loans: A Special Consideration

It’s worth noting that some lenders offer DSCR loans specifically for investment properties. These loans use the property’s DSCR as the primary qualifying factor, often in place of the borrower’s personal income. This can be particularly beneficial for real estate investors looking to scale their portfolios.

DSCR loans typically have different requirements than traditional mortgages:

- Higher DSCR thresholds (often 1.25 or higher)

- Larger down payments (usually 20–25% minimum)

- Higher interest rates compared to owner-occupied properties

- Stricter requirements for property condition and location

While these loans can be more expensive, they offer a pathway to financing for investors who might not qualify based on their personal income alone.

Deeper Dive into Specific Scenarios

Understanding how DSCR calculations apply to different property types and market conditions is crucial for investors and lenders alike. Let’s explore some specific scenarios to broaden our understanding.

DSCR for Different Property Types

While the basic DSCR formula remains consistent, its application can vary significantly across different property types.

Single-Family Homes

- Generally simpler to calculate due to straightforward income and expense structures

- Often have higher vacancy risk (100% vacant or 100% occupied)

- Example DSCR calculation:

- Annual Rent: $24,000

- Operating Expenses: $6,000

- NOI: $18,000

- Annual Debt Service: $15,000

- DSCR = $18,000 / $15,000 = 1.20

Multi-Family Properties

- More stable cash flow due to multiple units

- Economies of scale can lead to lower per-unit operating costs

- Example DSCR calculation (4-unit property):

- Annual Rent: $60,000

- Operating Expenses: $20,000

- NOI: $40,000

- Annual Debt Service: $30,000

- DSCR = $40,000 / $30,000 = 1.33

Commercial Properties

- Often have longer-term leases, providing income stability

- May have more complex expense structures (e.g., triple net leases)

- Example DSCR calculation (small office building):

- Annual Rent: $200,000

- Operating Expenses: $60,000

- NOI: $140,000

- Annual Debt Service: $100,000

- DSCR = $140,000 / $100,000 = 1.40

Mixed-Use Developments

- Combine elements of residential and commercial properties

- Diversified income streams can provide stability

- Requires careful allocation of shared expenses

- Example DSCR calculation (retail + apartments):

- Annual Rent (Retail): $100,000

- Annual Rent (Apartments): $150,000

- Operating Expenses: $75,000

- NOI: $175,000

- Annual Debt Service: $120,000

- DSCR = $175,000 / $120,000 = 1.46

DSCR and Short-Term Rentals

Calculating DSCR for short-term rentals presents unique challenges:

- Fluctuating Occupancy Rates: Unlike long-term rentals, income can vary dramatically by season or even day of the week.

- Higher Operating Costs: Short-term rentals often incur additional expenses for cleaning, furnishings, and property management.

- Platform Fees: Fees from platforms like Airbnb or VRBO need to be factored into income calculations.

To calculate DSCR for a short-term rental:

- Use historical data to estimate average monthly income, accounting for seasonality.

- Be conservative in your occupancy rate projections.

- Factor in all additional costs associated with short-term rental operations.

Example DSCR calculation for a short-term rental:

- Average Monthly Revenue: $4,000

- Annual Revenue: $48,000

- Operating Expenses (including cleaning, management, and platform fees): $20,000

- NOI: $28,000

- Annual Debt Service: $24,000

- DSCR = $28,000 / $24,000 = 1.17

DSCR and Real Estate Market Cycles

Real estate markets are cyclical, and DSCR can fluctuate with these cycles.

- Boom Phase:

- Rising rents can improve DSCR

- Risk of overvaluation and unsustainable debt levels

- Recession:

- Falling rents and increased vacancies can lower DSCR

- Properties with strong DSCR are better positioned to weather downturns

- Recovery:

- Gradual improvement in DSCR as market stabilizes

- Opportunity to acquire properties with potential for DSCR improvement

Investors should consider:

- Stress-testing DSCR calculations under various market scenarios

- Maintaining cash reserves to handle DSCR fluctuations

- Being cautious about taking on excessive debt during boom periods

Practical Applications and Case Studies

DSCR and Loan Approval

Lenders use DSCR as a key metric in assessing loan applications. Here’s a real-world example:

Case Study: Multi-Family Loan Application

- Property: 20-unit apartment complex

- Purchase Price: $2,000,000

- Down Payment: $400,000 (20%)

- Loan Amount: $1,600,000

- Annual NOI: $180,000

- Annual Debt Service: $120,000

- DSCR = $180,000 / $120,000 = 1.50

In this case, the strong DSCR of 1.50 would likely lead to loan approval, as it demonstrates the property’s ability to comfortably cover its debt obligations.

DSCR and Investment decision-making

Investors can use DSCR to compare different investment opportunities.

Scenario: An investor is considering two properties:

Property A:

- Purchase Price: $500,000

- NOI: $40,000

- Annual Debt Service: $30,000

- DSCR = 1.33

Property B:

- Purchase Price: $600,000

- NOI: $55,000

- Annual Debt Service: $35,000

- DSCR = 1.57

While Property B has a higher purchase price, its superior DSCR indicates better cash flow relative to its debt obligations, potentially making it a more attractive investment.

Success Stories and Cautionary Tales

Success Story: The Turnaround Specialist An investor purchased a struggling 50-unit apartment complex with a DSCR of 0.95. Through strategic renovations, improved management, and gradual rent increases, they raised the DSCR to 1.40 over three years. This improvement allowed them to refinance at better terms and extract equity for new investments.

Cautionary Tale: The Overleverage Trap A novice investor acquired several properties in a hot market, each with a DSCR barely above 1.0. When the market cooled and vacancies increased, the properties’ DSCRs dropped below 1.0. Unable to cover debt payments, the investor was forced to sell some properties at a loss to avoid foreclosure.

Read Also: Easy Property Loans in New York: Your 2024 Guide to DSCR Financing

Conclusion

Calculating and understanding DSCR is an essential skill for anyone involved in rental property investments. It provides a clear picture of a property’s financial health and its ability to generate positive cash flow. By mastering the DSCR calculation process and understanding the factors that influence it, you’ll be better equipped to make informed investment decisions, secure financing, and manage your rental property portfolio effectively.

Remember, while DSCR is a powerful tool, it shouldn’t be the only factor in your investment decisions. Always consider the broader market conditions and your long-term investment strategy, and consult with financial professionals when making significant real estate decisions.

FAQs

After exploring the ins and outs of calculating DSCR for rental properties, you might still have some questions. Here are five frequently asked questions to further clarify this important topic:

How often should I recalculate DSCR for my rental property?

It’s a good practice to recalculate your DSCR annually or whenever there are significant changes to your property’s income or expenses. This could include rent increases, major repairs, or changes in your loan terms.

Can DSCR be used for residential properties I live in?

While DSCR is primarily used for investment properties, some lenders may consider it for mixed-use properties where you occupy part of the building. However, traditional debt-to-income ratios are more commonly used for owner-occupied residences.

How does DSCR differ from the cap rate?

DSCR focuses on a property’s ability to cover its debt obligations, while the capitalization rate (cap rate) measures the property’s potential return on investment, regardless of how it’s financed. Both metrics are valuable but serve different purposes in evaluating real estate investments.

What if my calculated DSCR is below 1.0?

A DSCR below 1.0 indicates that the property isn’t generating enough income to cover its debt payments. This could make it difficult to obtain financing and may suggest the need to reevaluate your investment strategy, potentially by increasing income, reducing expenses, or restructuring debt.

Are there any alternatives to DSCR for assessing rental property performance?

While DSCR is widely used, other metrics can provide additional insights into a rental property’s performance. These include cash-on-cash return, return on investment (ROI), and gross rent multiplier (GRM). Using a combination of these metrics can give you a more comprehensive view of your investment’s health.