DSCR (Debt Service Coverage Ratio) measures a borrower’s ability to repay loans by comparing net operating income to debt service. Higher DSCR values allow larger loan amounts. Lenders typically require a DSCR of 1.25 or higher. Key factors affecting DSCR include NOI, interest rates, loan terms, and property value.

What is the Maximum Loan Amount Using DSCR?

Understanding the maximum loan amount using DSCR (Debt Service Coverage Ratio) is crucial for anyone involved in real estate investment or business financing. This metric plays a significant role in determining how much a lender is willing to provide. In this article, we’ll dive deep into the concept of DSCR, its importance, how it’s calculated, and the factors affecting the maximum loan amount.

What is DSCR?

DSCR, or Debt Service Coverage Ratio, is a financial metric used to evaluate a borrower’s ability to repay a loan. It compares the net operating income (NOI) generated by a property or business to the total debt service (principal and interest payments) on the loan.

How is DSCR Calculated?

Calculating DSCR is relatively straightforward:

DSCR=Net Operating Income (NOI)Total Debt Service\text{DSCR} = \frac{\text{Net Operating Income (NOI)}}{\text{Total Debt Service}}DSCR=Total Debt ServiceNet Operating Income (NOI)

For example, if a property generates a NOI of $100,000 annually and has annual debt obligations of $80,000, the DSCR would be:

DSCR=100,00080,000=1.25\text{DSCR} = \frac{100,000}{80,000} = 1.25DSCR=80,000100,000=1.25

Why is DSCR Important?

DSCR is crucial because it indicates the financial health of a business or property in terms of its ability to meet debt obligations. Lenders use DSCR to assess the risk associated with lending money. A higher DSCR suggests a lower risk, while a lower DSCR indicates a higher risk.

What is the Acceptable DSCR?

Typically, lenders look for a DSCR of at least 1.25. This means that the NOI should be 25% higher than the debt service. However, the acceptable DSCR can vary depending on the lender and the type of loan.

Acceptable DSCR Thresholds

Different lenders have varying DSCR thresholds depending on the type of loan and property:

- Commercial Real Estate Loans: Typically require a DSCR of 1.25 or higher.

- Residential Real Estate Loans: May accept a DSCR as low as 1.0 to 1.2.

- Multifamily Properties: Often require a DSCR of 1.2 to 1.4.

- Retail and Office Properties: Usually need a DSCR of 1.3 to 1.5.

Factors Affecting Maximum Loan Amount Using DSCR

| Factor | Description |

|---|---|

| Net Operating Income (NOI) | Higher NOI increases DSCR, allowing for a larger loan amount. |

| Interest Rates | Lower interest rates reduce debt service, improving DSCR and allowing for higher loan amounts. |

| Loan Term | Longer loan terms spread out debt service, positively affecting DSCR and enabling a higher loan amount. |

| Property Value | Higher property values can lead to higher loan amounts as they often generate higher NOI. |

| Lender Requirements | Different lenders have varying requirements and thresholds for DSCR, impacting the maximum loan amount. |

Several factors influence the maximum loan amount that can be obtained using DSCR:

- Net Operating Income (NOI): Higher NOI increases the DSCR, allowing for a larger loan amount.

- Interest Rates: Lower interest rates reduce debt service, improving the DSCR.

- Loan Term: Longer loan terms spread out the debt service, positively affecting the DSCR.

- Property Value: Higher property values can lead to higher loan amounts as they often generate higher NOI.

- Lender Requirements: Different lenders have varying requirements and thresholds for DSCR.

Calculating Maximum Loan Amount Using DSCR

To calculate the maximum loan amount, lenders use the following formula:

Maximum Loan Amount=NOIDSCR×Annual Debt Service Constant\text{Maximum Loan Amount} = \frac{\text{NOI}}{\text{DSCR} \times \text{Annual Debt Service Constant}}Maximum Loan Amount=DSCR×Annual Debt Service ConstantNOI

Example Calculation

Let’s assume:

- NOI: $150,000

- Desired DSCR: 1.25

- Annual Debt Service Constant: 0.08 (based on interest rates and loan terms)

Maximum Loan Amount=150,0001.25×0.08=1,500,000\text{Maximum Loan Amount} = \frac{150,000}{1.25 \times 0.08} = 1,500,000Maximum Loan Amount=1.25×0.08150,000=1,500,000

In this example, the maximum loan amount would be $1,500,000.

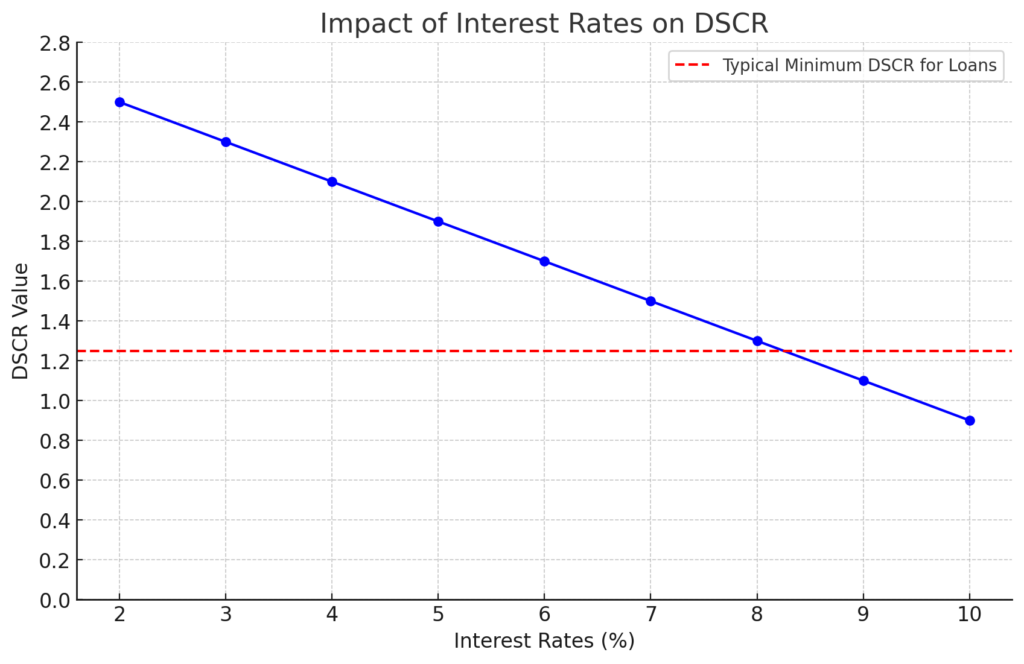

Impact of Interest Rates on DSCR

Interest rates have a significant impact on DSCR. Higher interest rates increase debt service, lowering the DSCR and thus reducing the maximum loan amount. Conversely, lower interest rates improve DSCR and allow for higher loan amounts.

Improving DSCR

To improve DSCR, consider the following strategies:

- Increase NOI: Enhance property management to boost rental income or reduce operating expenses.

- Refinance Debt: Seek better interest rates or extend loan terms to lower annual debt service.

- Invest in High-Value Properties: Properties with higher values typically generate higher NOI.

Real-World Examples

Case Study 1: Commercial Real Estate Deal

A commercial real estate investor was looking to finance a shopping center with a NOI of $500,000. The lender required a DSCR of 1.35. The annual debt service constant was 0.07.

Maximum Loan Amount=500,0001.35×0.07=5,263,158\text{Maximum Loan Amount} = \frac{500,000}{1.35 \times 0.07} = 5,263,158Maximum Loan Amount=1.35×0.07500,000=5,263,158

The investor secured a loan of approximately $5.26 million.

Case Study 2: Multifamily Property Investment

An investor wanted to finance a multifamily property with a NOI of $200,000. The lender required a DSCR of 1.20, and the annual debt service constant was 0.08.

Maximum Loan Amount=200,0001.20×0.08=2,083,333\text{Maximum Loan Amount} = \frac{200,000}{1.20 \times 0.08} = 2,083,333Maximum Loan Amount=1.20×0.08200,000=2,083,333

The investor obtained a loan of about $2.08 million.

×0.08=1,500,000\text{Maximum Loan Amount} = \frac{150,000}{1.25 \times 0.08} = 1,500,000Maximum Loan Amount=1.25×0.08150,000=1,500,000

In this example, the maximum loan amount would be $1,500,000.

Common Mistakes to Avoid

- Overestimating NOI: Be realistic about income projections to avoid overestimating your DSCR.

- Ignoring Expenses: Include all operating expenses in your calculations to get an accurate NOI.

- Not Considering Interest Rate Fluctuations: Account for potential interest rate changes that can affect your DSCR.

Benefits of Using DSCR for Loan Approval

| Benefit | Description |

|---|---|

| Risk Assessment | Provides a clear picture of the borrower’s ability to repay the loan, helping lenders assess the associated risk. |

| Financial Health Indicator | Reflects the financial health and profitability of a property or business, ensuring that it can generate sufficient income to cover debt obligations. |

| Loan Optimization | Helps in determining the optimal loan amount that can be safely borrowed, ensuring that the loan terms are favorable and manageable for the borrower. |

| Lender Confidence | Builds confidence among lenders regarding the borrower’s financial stability, potentially leading to better loan terms and interest rates. |

| Investment Decision | Assists investors in making informed decisions about financing and managing their real estate investments effectively. |

Using DSCR for loan approval offers several benefits:

- Risk Assessment: Provides a clear picture of the borrower’s ability to repay the loan.

- Financial Health Indicator: Reflects the financial health and profitability of a property or business.

- Loan Optimization: Helps in determining the optimal loan amount that can be safely borrowed.

Challenges in Using DSCR

Despite its benefits, using DSCR also comes with challenges:

- Market Fluctuations: Changes in market conditions can affect NOI and, consequently, DSCR.

- Accurate Calculation: Requires precise calculation of NOI and debt service for accuracy.

- Lender Requirements: Varying lender requirements can complicate the process.

Real-Life Applications of DSCR

DSCR is widely used in various financial scenarios, including:

- Commercial Real Estate: Assessing the viability of real estate investments.

- Corporate Financing: Evaluating business loans and corporate bonds.

- Municipal Bonds: Determining the creditworthiness of municipal bond issuers.

Tips for Maintaining a Healthy DSCR

To maintain a healthy DSCR, consider these tips:

- Regular Financial Reviews: Periodically review financial statements to ensure consistent NOI.

- Effective Property Management: Implement effective property management practices to maximize income.

- Debt Management: Keep debt levels manageable and explore refinancing options when beneficial.

Read Also: How to Calculate DSCR in Real Estate: A Beginner’s Guide

Conclusion

Understanding and utilizing DSCR is essential for maximizing loan amounts and ensuring financial stability. By maintaining a healthy DSCR, investors and business owners can secure favorable loan terms and optimize their investment potential.

FAQs

What is a good DSCR for a loan?

A good DSCR for a loan is typically 1.25 or higher, indicating that the NOI is 25% higher than the debt service.

How can I improve my DSCR?

You can improve your DSCR by increasing your NOI, refinancing to get better interest rates, or extending loan terms to reduce annual debt service.

Why is DSCR important for lenders?

DSCR is important for lenders because it helps them assess the risk associated with lending money and ensures that the borrower can meet their debt obligations.

What factors affect DSCR?

Factors affecting DSCR include NOI, interest rates, loan terms, property value, and lender requirements.

Can DSCR fluctuate over time?

Yes, DSCR can fluctuate over time due to changes in NOI, interest rates, and market conditions.