DSCR loans in Michigan fund real estate investments based on property income, not personal finances. Ideal for building rental portfolios, they offer flexibility for investors in cities like Detroit and Grand Rapids. Learn how DSCR loans can boost your Michigan real estate success.

DSCR Loans in Michigan: Your Gateway to Real Estate Investment Success

Are you eyeing the vibrant real estate market in Michigan, but feel overwhelmed by traditional financing options? Look no further! DSCR loans in Michigan might just be the game-changer you’ve been searching for. DSCR loans offer great chances for everyone in Michigan real estate. Whether you’ve bought many properties or you’re just starting, these loans can help you succeed in the Great Lakes State.

Discover the power of DSCR loans in Michigan’s real estate market. This guide explains how these loans work and why investors love them. We’ll walk you through the basics and important details. By the end, you’ll have the knowledge to make smart investment choices. Get ready to unlock new opportunities in Michigan’s property market with DSCR loans.

What is a DSCR Loan?

Before we delve into the specifics of DSCR loans in Michigan, let’s start with the basics. DSCR stands for Debt Service Coverage Ratio. It’s a type of loan that’s primarily used for investment properties, particularly rental homes. DSCR loans are different from regular mortgages. They care more about how much money the property can make, not how much you earn.

How Does a DSCR Loan Work?

The fundamental principle behind DSCR loans is simple yet powerful. Lenders look at the ratio between the property’s potential income and its debt obligations. This ratio shows if the property will make enough money to pay for the mortgage and other costs.

Here’s a quick breakdown:

- Property Income: The expected rental income from the property.

- Debt Obligations: The total mortgage payment, including principal, interest, taxes, and insurance (PITI).

The DSCR is calculated by dividing the property’s income by its debt obligations. A ratio of 1.0 or higher indicates that the property generates enough income to cover its debts, making it an attractive proposition for lenders.

Why Choose a DSCR Loan in Michigan?

Michigan’s real estate market offers many chances. You can invest in busy cities like Detroit and Grand Rapids, or in pretty towns by the lakes. DSCR loans can be an excellent fit for investors looking to tap into this diverse market. Here’s why:

- Flexibility: DSCR loans often have more flexible requirements compared to conventional loans, making them accessible to a wider range of investors.

- Focus on Property Performance: Since these loans prioritize the property’s income potential, they can be ideal for investors with multiple properties or those just starting their real estate journey.

- Streamlined Process: DSCR loans typically require less documentation related to personal income, potentially speeding up the approval process.

- Higher Loan Limits: In many cases, DSCR loans offer higher loan amounts compared to traditional financing options, allowing investors to target higher-value properties.

- Diverse Property Types: Whether you’re interested in single-family homes, multi-unit buildings, or even short-term rentals, DSCR loans can accommodate various property types.

Michigan’s real estate market presents unique opportunities that make DSCR loans particularly attractive. Let’s dive deeper into why these loans are gaining popularity in the Great Lakes State:

Economic Indicators and Real Estate Trends

Michigan’s economy has been on an upward trajectory, with key indicators pointing towards a robust real estate market:

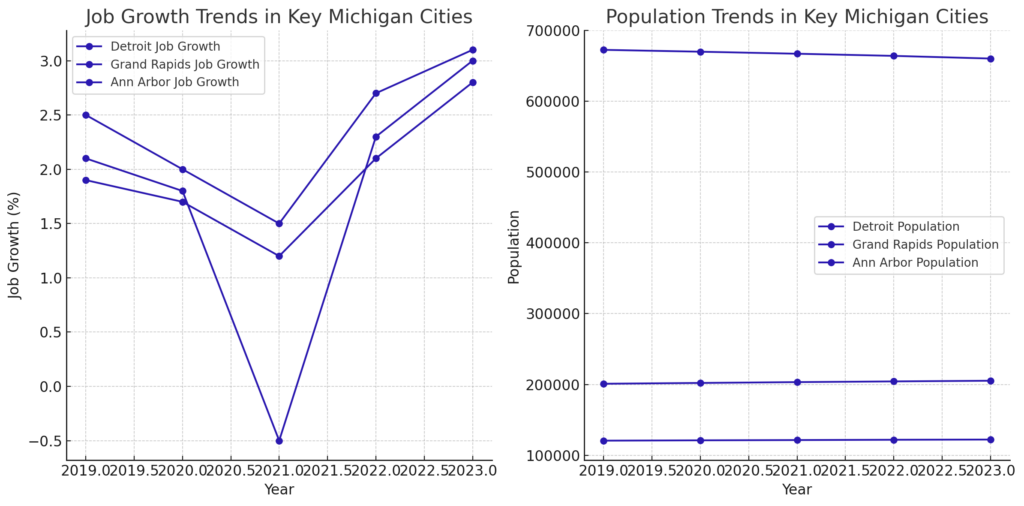

- Job Growth: The state has seen steady job growth in recent years, particularly in sectors like technology and advanced manufacturing. This influx of workers drives demand for rental properties.

- Population Shifts: While some areas have experienced population decline, cities like Grand Rapids and Ann Arbor are seeing growth, creating hotspots for real estate investment.

- Affordability: Compared to coastal markets, Michigan offers relatively affordable real estate, allowing investors to enter the market with lower capital requirements.

DSCR Loan Michigan Requirements: What You Need to Know

DSCR loans have many benefits. But you need to know the special rules for getting one in Michigan. These may vary slightly depending on the lender, but here are some general guidelines:

Credit Score

Most lenders in Michigan require a minimum credit score of 620-640 for DSCR loans. However, some may have higher requirements, especially for more favorable terms.

Down Payment

Typically, you can expect to need a down payment of 20-25% for a DSCR loan in Michigan. Some lenders might offer options with lower down payments, but these often come with higher interest rates.

DSCR Ratio

The minimum DSCR ratio can vary, but many lenders look for a ratio of at least 1.25. This means the property should generate 25% more income than its debt obligations.

Property Type

While DSCR loans can be used for various property types, they’re most commonly applied to residential properties with 1-4 units. Some lenders may also consider multi-family properties or commercial real estate.

Loan-to-Value (LTV) Ratio

The maximum LTV ratio for DSCR loans in Michigan typically ranges from 75-80%, depending on the lender and property type.

Understanding these requirements can help you prepare your application and increase your chances of approval. Remember, each lender may have slightly different criteria, so it’s always wise to shop around and compare options.

Impact of Property Types on DSCR Requirements

| Property Type | Minimum DSCR | Typical Loan Terms | Interest Rates | Down Payment |

|---|---|---|---|---|

| Single-Family Rental | 1.20 | 30 years, fixed rate | 3.5% – 4.5% | 20% – 25% |

| Multi-Family Rental | 1.25 | 25-30 years, fixed or variable rate | 4.0% – 5.0% | 25% – 30% |

| Commercial Property | 1.30 | 20-25 years, fixed or variable rate | 4.5% – 6.0% | 25% – 35% |

| Industrial Property | 1.35 | 20-25 years, fixed or variable rate | 4.5% – 6.0% | 25% – 35% |

| Mixed-Use Property | 1.25 | 20-30 years, fixed or variable rate | 4.0% – 5.5% | 25% – 30% |

Different property types can significantly affect your DSCR loan terms and requirements:

- Single-Family Homes: Often the easiest to finance, with lenders typically requiring a DSCR of 1.25 or higher.

- Multi-Family Properties: Can offer higher potential returns but may require a higher DSCR, often 1.3 or above, due to increased management complexity.

- Short-Term Rentals: Growing in popularity, especially in tourist areas like Traverse City. Lenders may require higher DSCRs (1.5+) due to income volatility.

- Commercial Properties: DSCR requirements can be stricter, often 1.4 or higher, reflecting the increased risk and complexity of commercial real estate.

DSCR Loan vs. Conventional Loan: What’s the Difference?

You might ask how DSCR loans compare to regular loans when looking to finance your Michigan investment property. Let’s break down the key differences:

Income Verification

- DSCR Loan: Focuses primarily on the property’s potential rental income.

- Conventional Loan: Requires extensive personal income verification, including tax returns and pay stubs.

Credit Requirements

- DSCR Loan: Generally more lenient, with minimum scores often in the 620-640 range.

- Conventional Loan: Typically requires higher credit scores, often 680 or above for investment properties.

Debt-to-Income Ratio

- DSCR Loan: Not typically considered, as the focus is on the property’s income.

- Conventional Loan: Strict DTI requirements, usually below 43% for most borrowers.

Loan Terms

- DSCR Loan: Often offers more flexible terms, including interest-only options and longer amortization periods.

- Conventional Loan: Generally more standardized terms, typically 15 or 30-year fixed-rate mortgages.

Property Limitations

- DSCR Loan: Can be used for a wide range of investment properties, including short-term rentals.

- Conventional Loan: May have restrictions on the number of properties financed or exclude certain property types.

Case Study: Successful DSCR Loan Investment in Detroit

Let’s look at a real-world example of how a DSCR loan helped an investor capitalize on Detroit’s revitalization:

Sarah, a real estate investor, identified an opportunity in Detroit’s Midtown neighborhood. She found a 4-unit apartment building priced at $400,000, requiring significant renovation.

The Numbers:

- Purchase Price: $400,000

- Renovation Costs: $100,000

- Total Investment: $500,000

- DSCR Loan Amount: $400,000 (80% LTV)

- Down Payment: $100,000

After renovation, the property’s projected monthly rental income was $6,000. The monthly mortgage payment, including taxes and insurance, was $3,500, resulting in a DSCR of 1.71 ($6,000 / $3,500).

This strong DSCR allowed Sarah to secure favorable loan terms, including an interest rate of 6.5% on a 30-year fixed mortgage. Two years after the purchase, the property’s value has increased to $650,000, and it maintains a consistent occupancy rate of 95%.

This case study shows how DSCR loans help investors grab new chances. They even work in areas that are just starting to improve.

How to Apply for a DSCR Loan in Michigan

Ready to take the plunge and apply for a DSCR loan in Michigan? Here’s a step-by-step guide to help you navigate the process:

- Research Lenders: Look for lenders in Michigan that offer DSCR loans. This may include banks, credit unions, and private lenders.

- Gather Documentation: While DSCR loans require less personal financial documentation, you’ll still need to provide:

- Property details and projected rental income

- Personal identification and contact information

- Credit report authorization

- Calculate Your DSCR: Use the projected rental income and estimated mortgage payments to calculate your property’s DSCR.

- Submit Your Application: Once you’ve chosen a lender, submit your application along with all required documentation.

- Property Appraisal: The lender will typically require an appraisal to verify the property’s value and rental potential.

- Underwriting: The lender will review your application, verify information, and make a decision.

- Closing: If approved, you’ll move forward to closing, where you’ll sign the final documents and receive your loan.

DSCR Loan Interest Rates in Michigan

Interest rates for DSCR loans in Michigan can vary widely depending on several factors. Generally, you can expect rates to be slightly higher than those for conventional mortgages. This is because DSCR loans are considered higher risk due to their focus on investment properties.

Factors that can influence your DSCR loan rate include:

- Your credit score

- The property’s DSCR

- Loan-to-value ratio

- Property type and location

- Loan term and structure (e.g., fixed-rate vs. adjustable-rate)

As of 2024, DSCR loan rates in Michigan typically range from 5.5% to 8.5%. However, it’s important to note that rates can fluctuate based on market conditions and individual lender policies.

Michigan’s Real Estate Market: Why It’s Attractive for DSCR Loans

Michigan’s real estate market offers unique opportunities that make it particularly well-suited for DSCR loans:

Diverse Market Segments

Michigan offers many types of investments. You can buy in growing cities like Detroit or steady towns like Ann Arbor and Grand Rapids. This variety lets you pick properties that fit your plans and how much risk you want to take.

Affordable Entry Points

Compared to some other states, Michigan often offers more affordable entry points for real estate investors. This can make it easier to meet the down payment requirements for DSCR loans.

Strong Rental Demand

Many Michigan cities have strong rental markets, driven by factors such as universities, growing job markets, and shifting housing preferences. This robust rental demand can help ensure a healthy DSCR for your investment properties.

Potential for Appreciation

Many places in Michigan have seen property values go up over time. While we can’t promise this will always happen, it shows these areas might grow more in the future.

Tips for Success with DSCR Loans in Michigan

To make the most of your DSCR loan in Michigan, consider these tips:

- Do Your Market Research: Thoroughly investigate local rental markets to ensure your property can generate sufficient income.

- Build Relationships with Local Lenders: Many Michigan-based lenders have a deep understanding of the local market and may offer more tailored DSCR loan products.

- Consider Property Management: Professional management can help ensure consistent rental income, which is crucial for maintaining a healthy DSCR.

- Plan for Vacancies: When calculating your DSCR, factor in potential vacancy periods to avoid overestimating your rental income.

- Stay Informed About Local Regulations: Michigan’s rental laws and regulations can impact your property’s profitability. Stay up-to-date to avoid potential issues.

- Explore Different Property Types: Michigan offers opportunities in various property types, from single-family homes to multi-unit buildings. Diversifying can help spread risk.

- Network with Other Investors: Join local real estate investment groups to learn from experienced investors and stay informed about market trends.

Alternative Financing Options in Michigan

While DSCR loans offer many benefits, they’re not the only option for financing investment properties in Michigan. Here are some alternatives to consider:

Conventional Mortgages

Conventional mortgages might work well for you if:

- You plan to buy just a few investment properties

- You have good personal finances

- You want to buy a home to live in

FHA Loans

For those planning to live in one unit of a multi-unit property, FHA loans can offer lower down payment options.

Hard Money Loans

These short-term loans can be useful for fix-and-flip projects or as bridge financing. Michigan has several reputable hard money lenders.

Private Money Lenders

Michigan has many private lenders. These lenders often have easier rules than big banks. They work well with investors who have done this before.

Portfolio Loans

Some Michigan banks offer portfolio loans, which they keep on their own books rather than selling to secondary markets. These can offer more flexibility in terms and qualifying criteria.

Taking the Next Step with DSCR Loans in Michigan

Now that you’ve gained a comprehensive understanding of DSCR loans and their potential in Michigan’s real estate market, it’s time to take action. Here’s how you can move forward:

- Assess Your Investment Goals: Determine what type of property and location in Michigan aligns with your investment strategy.

- Calculate Potential DSCR: Use online calculators or speak with a financial advisor to estimate the DSCR for properties you’re considering.

- Contact DSCR Lenders: Reach out to multiple lenders specializing in DSCR loans in Michigan. Compare their terms, rates, and requirements.

- Get Pre-Approved: A pre-approval will give you a clear picture of your borrowing capacity and strengthen your position when making offers.

- Start Your Property Search: With your financing lined up, begin actively searching for investment properties that meet your criteria.

Don’t let this opportunity pass you by. Michigan’s real estate market is ripe with potential, and DSCR loans offer a powerful tool to help you capitalize on it. Contact a DSCR loan specialist today to explore your options and take the first step towards building your real estate portfolio in the Great Lakes State.

Remember, every successful real estate investor started with a single property. Your journey to financial growth through Michigan real estate begins with that crucial first step. Reach out to a DSCR lender now and start turning your investment dreams into reality.

The Future of DSCR Loans in Michigan

As Michigan’s real estate market continues to evolve, DSCR loans are likely to play an increasingly important role. Here are some trends to watch:

- Growing Popularity: As more investors become aware of DSCR loans, we may see increased competition among lenders, potentially leading to more favorable terms.

- Technological Advancements: Improved property valuation and income prediction tools may streamline the DSCR loan process even further.

- Adaptation to Market Changes: DSCR loan products may evolve to better accommodate emerging trends in Michigan’s real estate market, such as the growth of short-term rentals.

- Increased Regulation: As DSCR loans become more prevalent, we may see more specific regulations aimed at this type of financing.

- Integration with Other Financial Products: We might see DSCR loans bundled with other services, such as property management or insurance, to create comprehensive investment packages.

Pros and Cons of DSCR Loans in Michigan

Like any financial product, DSCR loans come with their own set of advantages and disadvantages. Let’s weigh them up:

Pros:

- Easier Qualification: Less emphasis on personal income makes it easier for some investors to qualify.

- Scalability: Allows investors to finance multiple properties without being limited by personal income.

- Faster Approval: Streamlined process can lead to quicker loan approvals.

- Flexibility: Can be used for various property types, including short-term rentals.

- No Limit on Financed Properties: Unlike some conventional loans, there’s typically no cap on the number of properties you can finance.

Cons:

- Higher Interest Rates: Rates are often higher than those for conventional mortgages.

- Larger Down Payments: Typically require 20-25% down, which can be substantial for higher-value properties.

- Stricter Property Requirements: The property must demonstrate sufficient rental income potential.

- Potential for Higher Fees: Some DSCR loans may come with additional fees or closing costs.

- Less Suitable for Owner-Occupied Properties: DSCR loans are designed for investment properties, not primary residences.

Conclusion

DSCR loans in Michigan are a great tool for real estate investors. They focus on how much money a property can make, not just your personal finances. This opens doors for both new and experienced investors.

These loans have their own rules, but they offer the freedom to grow your real estate business in Michigan. They can help you build a successful group of properties. But remember, like all investments, you need to:

- Do your homework

- Understand the good and bad points

- Talk to money experts before deciding

You might want to buy:

- A rental in busy Detroit

- A vacation home in beautiful Traverse City

- An apartment building in growing Grand Rapids

DSCR loans can help you do this. Learn how these loans work and use them well. This knowledge will help you make smart choices and possibly earn big in Michigan’s exciting property market.

FAQs

Here are five frequently asked questions about DSCR loans in Michigan:

How does a DSCR loan differ from a conventional mortgage?

A DSCR loan primarily focuses on the property’s ability to generate income, rather than the borrower’s personal income. This makes it easier for investors to qualify, especially when financing multiple properties.

What’s the minimum credit score needed for a DSCR loan in Michigan?

While requirements can vary by lender, most DSCR loans in Michigan require a minimum credit score of 620-640. However, a higher credit score can often secure better terms and rates.

Can I use a DSCR loan for a short-term rental property in Michigan?

Yes, many DSCR loan programs in Michigan allow for short-term rental properties. However, lenders may have specific requirements for calculating potential income from these properties.

Are there prepayment penalties on DSCR loans in Michigan?

Some DSCR loans may have prepayment penalties, especially in the first few years of the loan. It’s important to discuss this with your lender and carefully review the loan terms before committing.

How long does the DSCR loan approval process typically take in Michigan?

The approval process for a DSCR loan in Michigan can often be faster than for conventional loans, typically taking 2-4 weeks. However, this can vary depending on the lender and the complexity of the property and application.